INVESTMENT THESIS

Revised and from date of Original Publication: 16 July 2023 for news on Special Dividend

- ASTER DM has a unique business model with a presence in India’s growing healthcare industry and an established business with strong returns. Aster DM Healthcare has shifted its focus purely to India in the future, and we remain optimistic about the opportunities available in India in the healthcare industry.

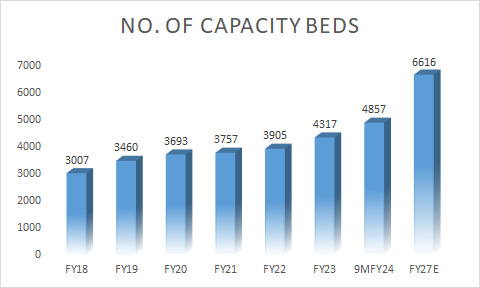

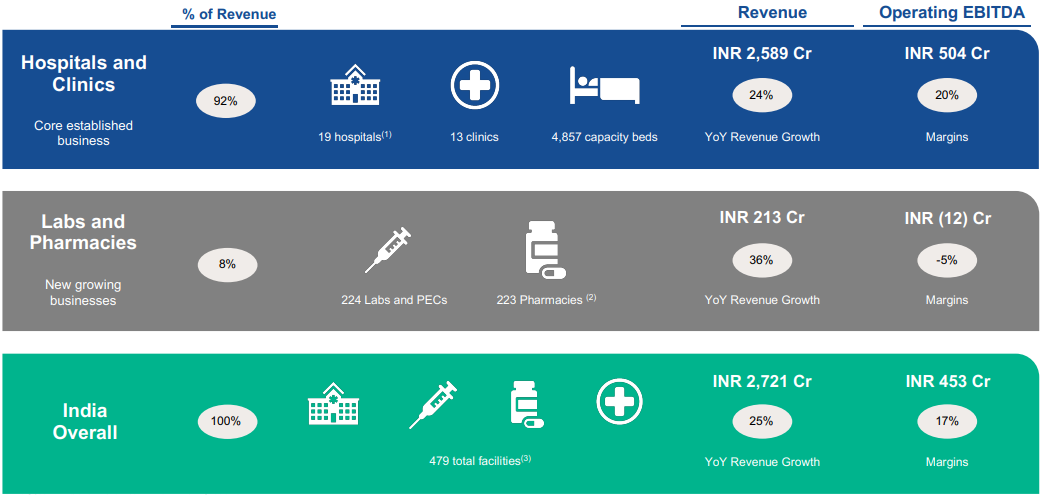

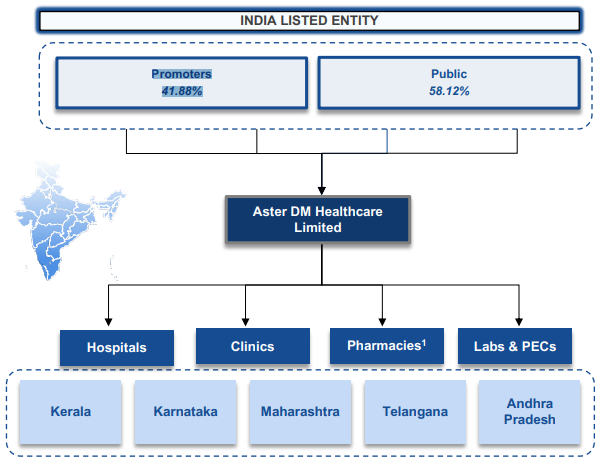

- Aster healthcare services deals primary with quaternary care models, including clinics, hospitals, mobile health, telehealth, and home care services. The company has a diversified portfolio of healthcare facilities, consisting of 19 hospitals (bed capacity 4857), 13 clinics, 223 retail pharmacies, and 224 labs and patient experience centers (PEC).

-

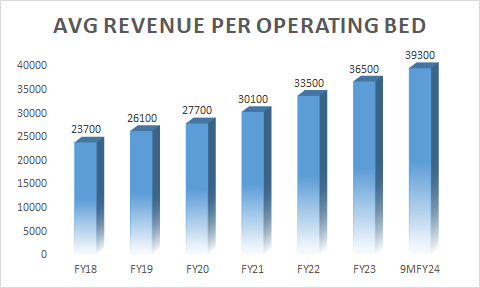

ASTER intends to expand its bed capacity by 1759 in the Kerala and Karnataka regions over the next 3-4 years. The company announced a capex of Rs. 1000 crore to support this growth, which we believe will be pivotal for fostering the company’s growth trajectory.The company plans to acquire these beds through a mix of owned, leased, and operations and maintenance (O&M) models. Currently, the company boasts an occupancy rate of 70%, Avg Revenue Per Operating Bed (ARPOB) of Rs. 39300, and an operating profit margin (OPM) of 17%. By implementing an asset-light model, which involves leasing land instead of buying it, the company aims to improve its margin by 200-300 basis points.

- With investment strategies in place and a team of excellent doctors with a common vision of providing quality healthcare service, we believe that Aster DM is well poised for sustainable growth. Additionally, a Proper capital allocation strategy will be a key to scaling up India operations.

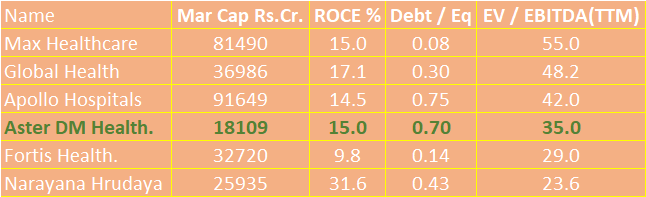

VALUATION (As of 15-04-2024)

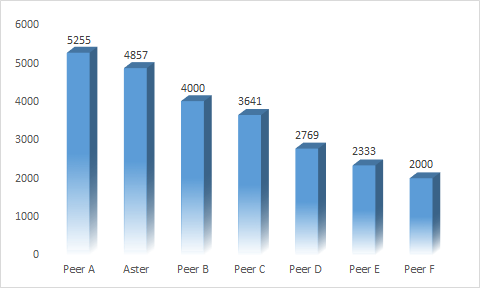

After adjusting for the GCC stake, the India business is trading at 30x EV/EBITDA on TTM, which is a 60%-20% discount compared to listed peers. Timely closure of GCC divestment and utilization of proceeds will be key monitorable in the near term.

ABOUT THE COMPANY

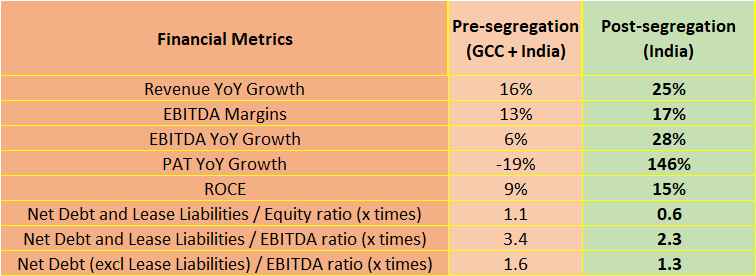

Aster DM Healthcare Limited is a prominent private healthcare service provider operating in GCC (Gulf Cooperation Council) and India. Recently, the board has approved the sale of its GCC stake at an 11.9x multiple on the EV/EBITDA basis. This move is expected to unlock significant value for the shareholders. The sale transaction is expected to be completed by Q4FY24

ABOUT THE STAKE SALE

- GCC Business will be acquired by Alpha GCC Holdings Limited, a company incorporated in Dubai International Financial Centre (“Aster GCC”) at an Enterprise Value of INR13,540cr

- At the closing of the Transaction, Fajr Capital & its consortium members will own ~65% and a Promoter entity1 will own the remaining ~35% stake in the GCC Business through Aster GCC

- Post-closing of the transaction, the board has announced a dividend of INR 110 –120 to the shareholders of the Company and will retain the remaining transaction proceeds to pursue growth opportunities and to keep as reserves.

Now in the market, there is no consensus on whether the sale of the GCC business which was supposed to be a cash cow for the company was a legitimate move. Nonetheless, we feel this could be a game-changer move for Aster to unlock significant value.

Here is why we feel stake sale could unlock the value chain!

Following the stake sale or post-segregation, the company managed to increase its ROCE by 600 basis points. We are optimistic that there is still potential for growth in margins, and we predict that revenue could experience a CAGR of 25% over the next 4-5 years.

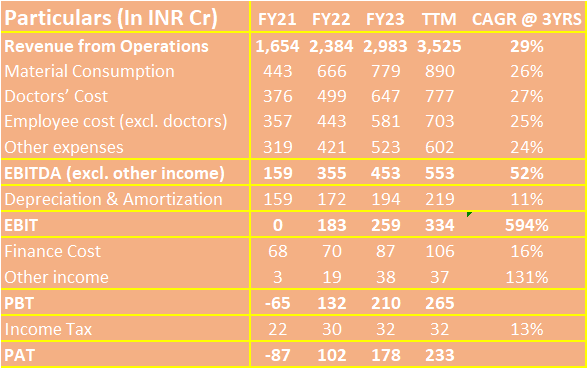

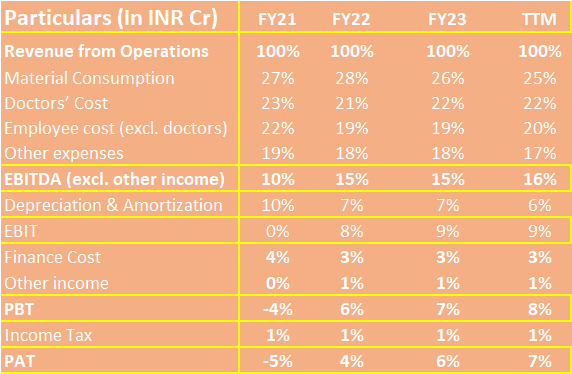

FINANCIALS OF ASTER DM INDIA

At present, Aster Dm India is achieving a revenue growth rate of 29% on a TTM basis, amounting to Rs 3,525 crore. We anticipate a 25% increase in revenue, which, combined with substantial operating leverage, will result in significant profitability gains from the current levels.

Avg Revenue Per Operating Bed (ARPOB)

Based on management guidance, to increase the total number of capacity beds to 6,616 coupled with enhancement in Avg Revenue Per Operating Bed (ARPOB) to match the industry average of Rs50000. Assuming an occupancy rate of 70%, we expect a ramp-up growth in the top line which further supports our thesis of a 25% CAGR for the top line.

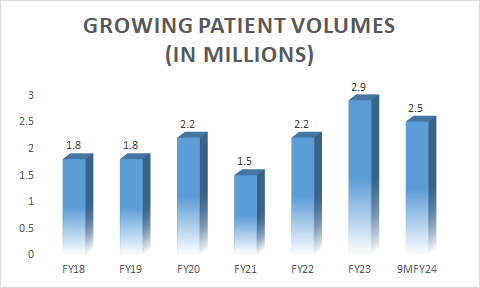

Sustained improvement in Business performance over the past few years.

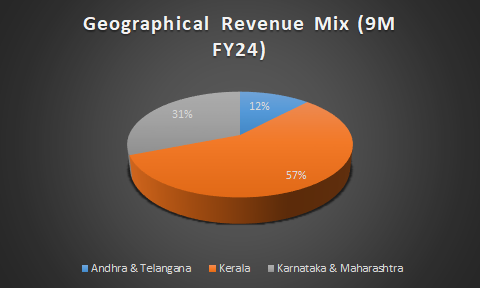

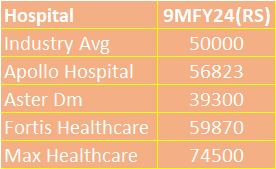

PEER COMPARISON ( dominant positioning in the South India region)

2nd largest network in South India with significant capacity beds in southern states

For 9MFY24, Aster India has delivered strong performance in its core hospital business while rapidly growing the other new businesses.

SHAREHOLDING PATTERN

Business Leadership: Dr. Azad Moopen will continue in his role as the Founder & Chairman and oversee both India and GCC businesses, while Ms. Alisha Moopen will be promoted to the position of Managing Director and Group CEO of GCC business. Dr. Nitish Shetty will continue as the CEO of Aster’s business in India.