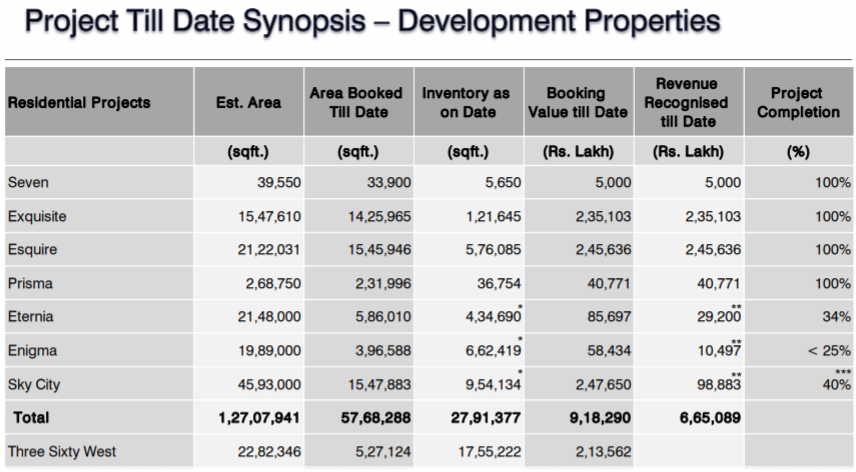

The Company’s existing inventory in the ongoing residential projects (excluding Three sixty West) is around 2.79 million square feet (projects in western and central suburbs) and another 6.68 million square feet of residential projects in the pipeline, all in the western suburb.

Oberoi Realty is also executing two mixed-use developments at Borivali (1.73 million square feet) and Worli (1.70 million square feet).

The operating assets – the offices (Commerz and Commerz II Phase I), retail (Oberoi Mall) and the hospitality asset (The Westin) are already generating revenue of more than Rs 300 Cr. The Company is adding another 238-room Ritz Carlton hotel in Worli, which is expected to be operational by end of 2019.

| 9M FY 2019 | Revenue (Rs. Cr.) | EBITDA (Rs. Cr.) | Occupancy Rate |

| Oberoi Mall | 111.84 | 106.13 | 97.00% |

| Commerz | 31.23 | 30.29 | 77.99% |

| Commerz – Phase 1 | 57.76 | 51.56 | 63.52% |

| The Westin Mumbai Garden City | 99.87 | 35.01 | 81.83% |

| Total | 300.70 | 222.99 |

Financial Position

| Particulars | FY14 | FY15 | FY16 | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 798.45 | 922.67 | 1,416.01 | 1,113.62 | 1,265.40 |

| Growth | – | 15.56% | 53.47% | -21.36% | 13.63% |

| EBITDA (In Rs. Cr.) | 434.77 | 513.79 | 676.31 | 569.76 | 675.26 |

| EBITDA Margin | 54.45% | 55.69% | 47.76% | 51.16% | 53.36% |

| EBIT (In Rs. Cr.) | 407.62 | 473.50 | 627.31 | 520.26 | 626.19 |

| EBIT Margin | 51.05% | 51.32% | 44.30% | 46.72% | 49.49% |

| PBT (In Rs. Cr.) | 464.38 | 489.22 | 663.24 | 562.30 | 645.91 |

| PAT (In Rs. Cr.) | 311.06 | 317.12 | 435.56 | 378.59 | 458.80 |

| PAT Margin | 38.96% | 34.37% | 30.76% | 34.00% | 36.26% |

| EPS (In Rs.) | 9.48 | 9.66 | 12.84 | 11.15 | 12.62 |

| EPS Growth Rate | – | 2% | 33% | -13% | 13.2% |

| Historic P/E (Closing Price of 31st March) | 22.78 | 29.43 | 18.81 | 33.04 | 40.44 |

| CURRENT P/E (based on price of 2nd April – Rs. 547.20 and EPS TTM –Rs. 22.92) | 23.87 | ||||

| Shareholder funds (In Rs. Cr.) | 4,396.39 | 4,634.29 | 5,341.13 | 5,725.96 | 6,092.37 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 76.06 | 838.06 | 456.51 | 868.65 | 944.50 |

| Cash (In Rs. Cr.) | 499.74 | 293.68 | 311.87 | 345.79 | 116.72 |

| D/E | 0.02 | 0.18 | 0.09 | 0.15 | 0.16 |

| Interest Coverage | 1402.48 | 291.93 | 99.02 | 102.29 | 98.43 |

| ROCE | 9.11% | 8.65% | 10.82% | 7.89% | 8.90% |

| ROE | 7.08% | 10.56% | 12.42% | 9.82% | 10.60% |

Quarterly Performance

| Quarterly Results | Q3 FY 2018 | Q2 FY 2019 | Q3 FY 2019 | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 356.20 | 592.11 | 528.62 | -10.72% | 48.41% |

| EBITDA (In Rs. Cr.) | 196.78 | 323.51 | 208.26 | -35.62% | 5.83% |

| EBITDA Margin | 55.24% | 54.64% | 39.40% | ||

| PAT (In Rs. Cr.) | 120.19 | 213.83 | 137.93 | -35.50% | 14.76% |

| PAT Margin | 33.74% | 36.11% | 26.09% | ||

| EPS (Rs.) | 3.54 | 5.88 | 3.79 | -35.54% | 7.06% |

Q3 FY 2018 Highlights:

- The Company’s sales volumes declined 3.0% YoY to 1.47 lsf in Q3FY19 due to tepid sales at Goregaon projects (31,555 sq ft) and no sales at Worli project.

- Oberoi Realty commenced bookings for a fifth tower at Sky City and received a good response to the project in Q3FY19.

- On the new launches front, the Company has postponed the launch of the Goregaon Phase-III near the festive season in Q2 FY20E whereas the Thane project would be probably launched in Q3FY20E. It could also launch Maxima project in FY20E.

WHAT’S DRIVING THE STOCK?

Diversified Product Portfolio

Oberoi Realty has a diversified product portfolio comprising residential projects and income generating annuity assets such as offices, large format retail and luxury hotel. The Company also has good mix of residential/ annuity assets in the pipeline.

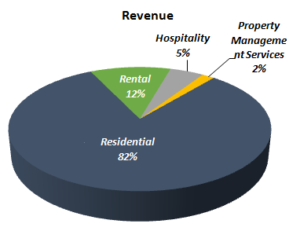

Diversified Revenue Streams

On an overall basis, residential projects contributed 82% of revenue during 9M FY2019, while lease rentals and hospitality contributed another 12% and 5% respectively. The lease and hospitality business is a relatively stable business with high monthly rentals and healthy occupancy. Currently, the Company has four operational assets — Oberoi Mall, Commerz, Westin Hotel and the Commerz Phase I. The occupancy ratio of its Oberoi Mall and Westin Hotel were 97% and 82% respectively, while it was 78% for Commerz.

Rental & Hospitality Portfolio

Oberoi Realty reported strong revenue growth in its rental & hospitality portfolio. Oberoi Mall saw revenues jump 38.9% YoY to Rs. 38.9 Cr. as average realisation increased from Rs. 170 psf per month in Q3FY18 to Rs. 242 psf per month in Q3FY19.

In addition, the Company has planned two mixed-use developments at Borivali (Gross Leasable Area (GLA): 1.73 msf) and Worli (GLA: 1.70 msf). Oberoi Realty has already incurred capex of Rs. 40-50 Cr.

- At Borivali, the Company will develop 1.2 msf mall, 0.3-0.4 msf hotel and the remainder as office space.

- At Worli, it will develop 0.9-1.0 msf mall, 80-90 room hotel while rest of the area would be for office space.

These assets, which would be developed at an expenditure of Rs. 800 Cr. each, are expected to be operational in the next four to five years.

| Operational trend in Oberoi Realty’s Rental And Hospitality Portfolio | |||||

| Particulars | Q3 FY 2018 | Q4 FY 2018 | Q1 FY 2019 | Q2 FY 2019 | Q3 FY 2019 |

| Oberoi Mall (Retail Property) | |||||

| Operating Revenue (Rs. Cr.) | 28 | 29 | 35.4 | 37.5 | 38.9 |

| EBITDA margin (%) | 95 | 96.5 | 94 | 95.1 | 95.5 |

| Occupancy (%) | 99.4 | 99.4 | 97.3 | 96.9 | 96.9 |

| Realisation (Rs./sqft/month) | 170 | 176 | 220 | 233 | 242 |

| Commerz I (Commercial Space) | |||||

| Operating Revenue (Rs. Cr.) | 11.1 | 11.1 | 10.7 | 10.1 | 10.4 |

| EBITDA margin (%) | 99 | 109.2 | 98.3 | 97.8 | 94.8 |

| Occupancy (%) | 82.1 | 82.1 | 78.5 | 77.7 | 77.7 |

| Realisation (Rs./sqft/month) | 141 | 142 | 143 | 136 | 140 |

| Commerz II Phase I (Commercial Space) | |||||

| Operating Revenue (Rs. Cr.) | 11.4 | 12.7 | 16.6 | 18.5 | 22.6 |

| EBITDA margin (%) | 81.5 | 84.5 | 87.5 | 89 | 90.8 |

| Occupancy (%) | 44.7 | 47.5 | 63.4 | 63.4 | 63.7 |

| Realisation (Rs./sqft/month) | 117 | 123 | 120 | 134 | 141 |

| The Westin Mumbai Garden City (Hospitality) | |||||

| Operating Revenue (Rs. Cr.) | 35.4 | 34 | 30.9 | 32.1 | 36.9 |

| EBITDA margin (%) | 36.1 | 28.2 | 34.5 | 33.2 | 37.1 |

| Average Room Rate (Rs.) | 9,401 | 9,093 | 8,366 | 8,715 | 9,712 |

| Occupancy (%) | 80 | 83.6 | 84.3 | 81.1 | 80.2 |

| Revenue per available room (Rs.) | 7,582 | 7,615 | 7,052 | 7,055 | 7,775 |

Strong Financials

The Company reported 15% increase in its consolidated net profit at Rs 137.93 Cr. for the quarter ended December as compared to Rs 120.19 Cr. in the year-ago period. Total income rose 48% to Rs 528.62 Cr. in Q3 FY 2019 compared to Rs 356.20 Cr. in the corresponding period of the previous year. This was primarily driven by real estate business which jumped 53% yoy to Rs. 490.19 Cr. in Q3 FY 2019

Strong Balance Sheet – The Company has maintained optimal capital structure with prudent use of leverage.

WHAT’S DRAGGING THE STOCK?

- Delays in project approvals may lead to postponement of launches.

- Oberoi Realty has a high share of premium residential projects with longish sales cycle. Economic slowdown/stock market corrections are negatively correlated to sales. This may impact cashflows.

- In Q3 FY 2019, the Company’s sales volume declined 3.0% YoY to 1.47 lakh sq ft in Q3FY19 due to tepid sales at Goregaon projects (31,555 sq ft) and no sales at Worli project.

- In Q3 FY2019, the operating margins of the Company fall sharply to 35.6% from 54.64% in Q2 FY 2019 and 55.24% in Q3 FY 2018.

Competitive Intensity – The top real estate players in the western markets are Oberoi, Godrej, Sunteck and Kolte Patil.