India offers huge potential growth opportunities to global companies like Procter & Gamble (P&G) and Colgate-Palmolive being one of the fastest-growing consumer markets. According to Deloitte, factors which drive India’s growth are:

- Young demographic profile

- Rise in India’s middle class

- Rising income level of the Indian middle class

By 2020, Deloitte expects India to be the world’s largest middle class consumer market. India’s total consumer spend could reach $13 trillion by 2030.

Also Read: Future Prospects of Indian Economy

Colgate Palmolive – Leader in Oral Care Market in India

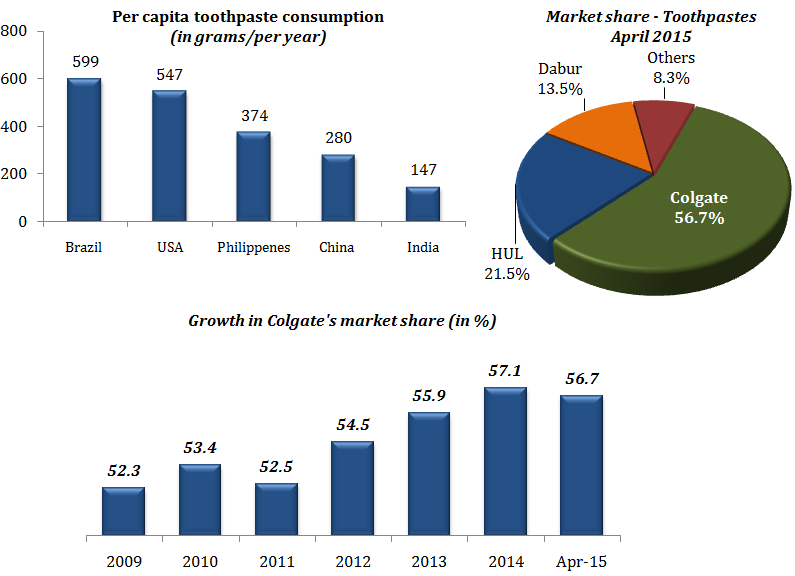

Colgate is the market leader in the oral care segment, holding 56.7 % market share in toothpaste and 42.4 % in toothbrush (as of January 23, 2015). Colgate’s growth in the Indian market is attributable to several premium products like Colgate Visible White and the company’s constant endeavor to launch new products tailored for the Indian market.

In order to build leadership position in the oral care market in India, Colgate Palmolive India has neglected its personal products and household care brands giving other companies like Hindustan Unilever, Dabur etc an opportunity to kill its market share in those categories.

(click to enlarge)

| Oral Care | Personal Care | ||

| Tooth Paste | Colgate TotalColgate Visible WhiteColgate Sensitive-Pro-ReliefColgate Max FreshColgate Kids ToothPasteColgate Active SaltColgate Maximum Cavity Protection plus Sugar Acid Neutralizer | Body Wash | Palmolive Aroma Shower Gel – RelaxPalmolive Thermal Spa – Firming & Massage |

| Tooth Brushes | Colgate 360Colgate SensitiveColgate Slim Soft CharcoalColgate Extra-Clean Gum CareColgate Zig ZagColgate Kids 2+ | Liquid Hand Wash | Palmolive Naturals Liquid Hand Wash – Family Health |

| Tooth Powder | Colgate Toothpowder | Skin Care | Palmolive Charmis Cream |

| Whitening Products | Colgate Visible White | Hair Care | Halo Shampoo |

| Kid’s | Colgate Kids ToothPaste | Home Care | |

| Mouthwash | Colgate Plax | Axion Dish Washing Paste | |

Financial Performance

| Particulars (in Rs. Cr.) | 2014 | 2013 | 2012 |

| Income from operations | 3,578.81 | 3,163.81 | 2,693.23 |

| OPBDIT | 664.01 | 656.81 | 578.52 |

| PAT | 539.87 | 496.75 | 446.47 |

| EPS | 126.78 | 96.68 | 32.83 |

| Equity Share Capital | 13.60 | 13.60 | 13.60 |

| Total Shareholders’ funds | 599.88 | 489.59 | 435.39 |

| Total Debt | – | – | – |

| OPBDIT / Operating Income (In %) | 18.55 | 20.76 | 21.48 |

| PAT/Operating Income (In %) | 15.09 | 15.70 | 16.58 |

| Return on capital employed (In %) | 110.69 | 134.15 | 132.87 |

| Return on Shareholders’ funds (In %) | 90.00 | 101.46 | 102.54 |

| OPBDIT/Interest & Finance Charges | NA | NA | NA |

| Current Ratio | 0.78 | 1.01 | 1.09 |

Stock Performance

Over the last 5 years, Colgate Palmolive has delivered 178.19 % shareholder return (from Rs. 723.50 in April 2010 to Rs. 2012.70 in April 2015).

Procter & Gamble – Entry in India

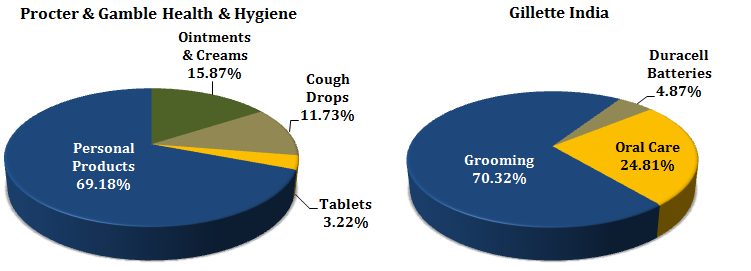

P&G entered India in 1988 and operates two listed entities – Gillette India Limited and Procter & Gamble Hygiene & Health Care Limited & one wholly owned subsidiary (Procter & Gamble Home Products Limited).

[1] Procter & Gamble Health & Hygiene – Healthcare (Vicks), Feminine Hygiene (Whisper) and Personal Care (Old Spice);

[2] Gillette India – Razors & other shaving products, Oral-B dental products and Duracell batteries;

[3] Procter & Gamble Home Products – Ariel and Tide detergents.

(click to enlarge)

In the oral care segment, P&G has launched the Oral-B brand both in toothbrush and toothpaste category, but has not launched its leading toothpaste brand, “Crest,” in India. The Company faces strong competition from Colgate because of its robust distribution network (approx 5 million outlets), which makes it difficult for P&G to capture a sizeable share of the oral care market.

P&G is trying hard to increase its presence in India. The Company has increase its distribution network to 1.3 million retail outlets in the last couple of years. The Company is engaged aggressively in product innovation and brand promotion to increase its sales in India.

Financial Performance of Procter & Gamble Hygiene & Healthcare

| Particulars (in Rs. Cr.) | 2014 | 2013 | 2012 |

| Income from operations | 2,050.94 | 1,686.78 | 1,297.41 |

| OPBDIT | 420.69 | 250.56 | 200.21 |

| PAT | 302.02 | 203.22 | 181.29 |

| EPS | 93.04 | 62.61 | 55.85 |

| Equity Share Capital | 32.46 | 32.46 | 32.46 |

| Total Shareholders’ funds | 1,002.90 | 805.32 | 697.04 |

| Total Debt | – | – | – |

| OPBDIT / Operating Income (In %) | 20.51 | 14.85 | 15.43 |

| PAT/Operating Income (In %) | 14.73 | 12.05 | 13.97 |

| Return on capital employed (In %) | 46.43 | 35.53 | 31.99 |

| Return on Shareholders’ funds (In %) | 30.11 | 25.23 | 26.00 |

| OPBDIT/Interest & Finance Charges | NA | NA | NA |

| Current Ratio | 2.32 | 2.40 | 2.17 |

Stock Performance

Over the last 5 years, Procter & Gamble Health & Hygiene has delivered 228.52 % shareholder returns (from Rs. 2104.35 in April 2010 to Rs. 6913.20 in April 2015).

Financial Performance of Gillette India

| Particulars (in Rs. Cr.) | 2014 | 2013 | 2012 |

| Income from operations | 1,749.79 | 1,437.72 | 1,232.90 |

| OPBDIT | 114.00 | 169.59 | 140.90 |

| PAT | 51.42 | 87.16 | 75.73 |

| EPS | 15.78 | 26.75 | 23.24 |

| Equity Share Capital | 32.59 | 32.59 | 32.59 |

| Total Shareholders’ funds | 643.46 | 649.23 | 619.26 |

| Total Debt | – | – | – |

| OPBDIT / Operating Income (In %) | 4.70 | 9.25 | 8.69 |

| PAT/Operating Income (In %) | 2.88 | 5.91 | 5.97 |

| Return on capital employed (In %) | 12.59 | 21.29 | 18.88 |

| Return on Shareholders’ funds (In %) | 7.99 | 13.42 | 12.22 |

| OPBDIT/Interest & Finance Charges | NA | NA | NA |

| Current Ratio | 2.00 | 2.26 | 2.01 |

Stock Performance

Over the last 5 years, Gillette India has delivered 200.03 % shareholder returns (from Rs. 1504.45 in April 2010 to Rs. 4513.75 in April 2015).

Conclusion

Both Colgate-Palmolive and Procter & Gamble are in a good position to take advantage of the rise in India’s middle class income to drive their global businesses forward. Colgate is in a better position out of the two companies because of its first mover advantage in the oral care segment where it has the lion’s share.

Kindly suggest if it is the right time to buy these stocks. It looks like the Price has already gone up.

Look at my last 2 posts. I wrote in detail about this aspect.

nice article sir!

I always enjoy reading and learning.

Can you please write about identifying monopolistic and moated Companies with your picks for india?

In reply to ENRIQUE.

Thanks for you comment. I will write about that soon. You may also want to read these:

http://194.195.112.90/safe-large-cap-stock-selection-criteria/

http://194.195.112.90/long-term-investment-stocks-making-5-stock-portfolio/