Hindustan Unilever Limited (“HUL” or the “Company”) has its presence in five segments.

- Soaps and Detergents segments comprises categories of Soaps, Detergents and Household Care,

- Personal Products segment includes categories of Skin Care, Hair Care, Oral Care, Colour Cosmetics and Deodorants.

- Beverages segment covers Tea and Coffee.

- Packaged foods segment includes Culinary and Bakery Products, Frozen Desserts and Ice cream.

- Others include Water business (Pureit).

The Company has maintained an average dividend yield of 1.75 % over the last 5 financial years.

WHAT’S DRIVING THE STOCK

Diversified Brand Portfolio

| Soaps | Dove, Lifebuoy, Lux and Liril, Vim |

| Detergents | Surf, Comfort, Wheel, Rin |

| Skin Care | Fair & Lovely, Pond, Lakme, Dove |

| Hair Care | Dove, TRESemme, Clinic Plus, Sunsilk, Toni&Guy |

| Oral Care | Closeup, Pepsodent |

| Deodorant | Axe, Dove |

| Tea | Taj Mahal, Red Label, 3 Roses |

| Coffee | Bru |

| Packaged Food | Knorr, Annapurna, Modern, Kissan, Kwality Walls and Magnum |

| Water | Pureit |

Dominant Position in Soaps & Detergents

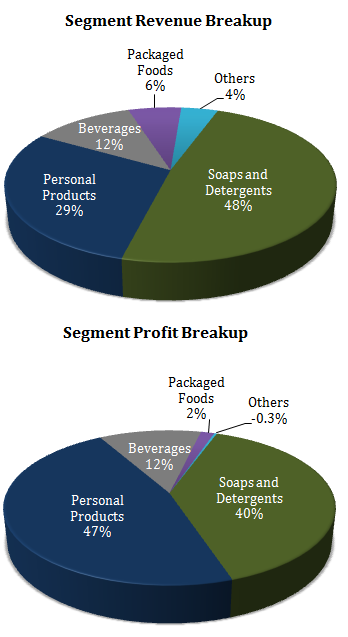

Soaps & detergents segment contributes ~48% to the overall revenue. The Company’s strong brands in soaps (Lifebuoy, Lux, Liril, Rexona) and detergents (Wheel, Surf Excel, Surf, Vim) have helped the company maintain its dominant position in both segments (~40% in detergents and ~45% in soaps) over the years, despite intense competition. HUL is continuously investing in maintaining its market share by launching the liquid format of soaps, viz. hand wash and body wash.

Strong Brand Portfolio in Personal Care Products

The Company has strong brand portfolio and presence across all categories of personal care segments (hair care, oral care, skin care, men’s grooming, and cosmetics). Personal care segment contributes ~47% to EBIT. HUL brands caters to all segment of consumers –

Premium – Pond’s, Axe, Dove, Close Up;

Popular – Vaseline, Sunsilk, Pepsodent;

Mass – Fair & Lovely, Clinic Plus.

Premiumisation – Revenue Driver for Beverages

HUL is the second largest branded tea company in India with brands like Lipton, Taj Mahal, and Red Label. The Company is also growing in the branded coffee business with its brand ‘Bru’. Growing green tea and coffee culture in the country and shift of consumers to premium flavored teas and tea bags are expected to generate steady revenue for company’s beverages portfolio.

Entry into Ayurveda Play – Indulekha

HUL has bought hair care brand Indulekha from Kerala-based Mosons Group for ₹ 330 Cr. to have its presence in the growing ayurvedic segment. The acquisition of Indulekha brings to HUL a premium brand around ayurveda that will complement its existing portfolio and strengthen its presence in the hair-care category.

Several local players such as Dabur, Emami, Himalaya, Ayushakti, Kama Ayurvedic and Baba Ramdev’s Patanjali have already entered this segment as consumers are opting out of chemical-based products in the personal care segment.

WHAT’S DRAGGING THE STOCK

The Threat of Patanjali Ayurved

Patanjali Ayurved is the newest entrant in the FMCG sector with over 350 products including biscuits, noodles, juices, toothpaste, shampoo, hair oils, skin cream products etc. Patanjali has made an entry with a bang and has in very quick time crossed Rs. 2000 Cr in revenue. As per a report published by IIFL, Patanjali could report revenue in excess of Rs. 20,000 Cr by FY 2020.

This could certainly have disruptive effect on Britannia and other FMCG companies. Patanjali is on a sales push and is planning to make its products available at 2 Million stores by end of 2016 from the current ~ 200,000 stores (that’s a 10 times growth). Further, Patanjali was found and is headed by the immensely popular yoga guru Baba Ramdev, which gives its products a strong brand recall and great advantage in marketing.

Struggling Oral Care Segment

HUL is struggling to increase its market share in the oral care business which faces high competition from players like Colgate, Dabur India and Procter & Gamble. In FY 2015, HUL lost its market share, with Dabur eating into its share and Colgate consolidating its leadership position.

Note – Colgate-Palmolive gained market share in 2015 at 56.7 % as against 55.9 % in 2014, Dabur also gained market share in 2015 to 13.4 % from 12 % in the previous year while HUL’s market share declined to 21.5 % from 22.8 % in 2014.

Loss Making Water Purifier Business

In India, a very small percentage of population uses water purifiers. HUL therefore has to first educate the consumers, getting them to appreciate the benefits of safe water, and then adopting Pureit. HUL faces huge competition from various water purifier providers like Aquaguard, Kent, Tata Swach. The Company reported a loss in this segment in FY 2015.

High pricing in the range of Rs. 1500 to Rs. 21990, also make the product less affordable for major section of the society.

Counterfeit Consumer Goods

According to KPMG Report – Sell Smart, July 2015 – fake consumer goods are growing faster than the overall consumer products market. Counterfeit and smuggled products now account for more than a fifth of the FMCG market in India.

Lack of awareness among consumers and incapability to differentiate between genuine and fake goods act as a major risk for the FMCG companies.

Threat of New Entrants

Over the last decade, the Indian FMCG industry has been dominated by few established players such as Colgate, Britannia, Procter & Gamble (P&G), Marico and Dabur. In the FMCG space there is always a threat of a new entrant who may want to expand their portfolio of offerings.

Also see: Blue Chip Stocks in India