On 18th December, 2018, IDFC Bank Ltd. and Capital First Ltd. announced the completion of merger and the merged entity will be called IDFC First Bank (“IDFC First” or the “Bank”).

Current Price (10th June, 2019) – Rs. 42.10

Market Cap – Rs. 20,180.24 Cr.

Promoter – (IDFC Financial Holding Company Limited) – 40% stake.

IDFC First Bank now offer a wider array of retail and wholesale banking products, services and digital innovations, to a greater number of customer segments. It serves 7.2 million customers through its 206 bank branches, 140 ATMs, 454 rural business correspondent centers across the country’s urban and rural geographies.

On a combined basis, IDFC First Bank has on-book loan assets of 110,400 Cr., for the quarter ended March 31, 2019. The retail loan book now contribute 37% to the overall loan book.

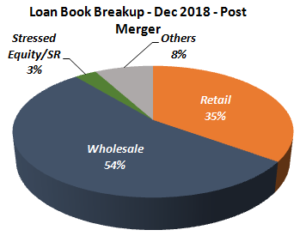

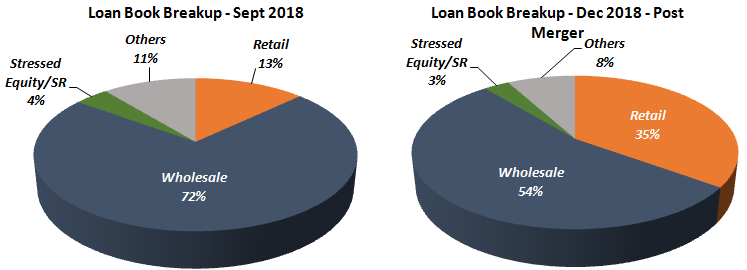

Before Merger, the credit book continues to be largely driven by corporate portfolio which formed 72% of the total book.

| Loan Book (Rs. Cr.) | Mar-18 | Dec-18* | Mar-19* |

| Retail Assets | 7,043 | 36,236 | 40,812 |

| Rural | 3,218 | 4,704 | 5,185 |

| SME | 1,794 | 13,574 | 15,767 |

| Consumer | 2,031 | 17,957 | 19,860 |

| Wholesale Assets | 54,911 | 56,809 | 53,649 |

| Corporate | 27,039 | 34,098 | 32,190 |

| Infrastructure | 26,828 | 22,710 | 21,459 |

| Priority Sector Lending | 8,980 | 8,575 | 12,924 |

| Stressed Equity and SRs | 3,162 | 3,040 | 3,016 |

| Total Loan Assets | 73,052 | 1,04,660 | 1,10,400 |

* Post merger with Capital First

Pro-Forma Financials (Q2 FY 19) before the merger

| Capital First | IDFC Bank | IDFC First Bank | |

| Loan Asset (on-Book) | Rs. 27,351 Cr | Rs. 75,337 Cr. | Rs. 102,688 |

| % of Retail Loan Assets | 89% | 13% | 33% |

| Total Borrowing + Deposits | Rs. 24,550 Cr | Rs. 101,232 | Rs. 125,782 |

| CASA | – | Rs. 6,426 Cr | Rs. 6,426 Cr |

| Net worth | Rs. 2,928 Cr | Rs. 14,776 Cr | Rs. 17,704Cr |

| NII | Rs. 615 Cr | Rs. 451 Cr | Rs. 1,066 Cr |

| Total Income | Rs. 695 Cr | Rs. 571 Cr | Rs. 1,266 Cr |

| Opex | Rs. 327 Cr | Rs. 552 Cr | Rs. 879 Cr |

| Provisions | Rs. 210 Cr | Rs. 601Cr | Rs. 811 Cr |

| PAT | Rs. 105 Cr | Rs. -370 Cr* | Rs. -265 Cr |

*The Bank took one-time provisions relating to stressed infrastructure loans. Without such one-time charge off, the PAT for H1 FY19 would be Rs. 81 Cr.

Financial Performance

| Particulars | Jun-18 | Sep-18 | Dec-18 | Mar-19 | FY19 |

| Net Interest Income

(In Rs. Cr.) |

490 | 451 | 1,145 | 1,113 | 3,199 |

| Other Income (In Rs. Cr.) | 103 | 118 | 301 | 334 | 856 |

| Operating Profit

(In Rs. Cr.) |

146 | 17 | 305 | 299 | 768 |

| PAT (In Rs. Cr.) | 182 | (370) | (1,538) | (218) | (1,944) |

Q4 FY 2019 Highlights:

- Net Interest Income for the quarter ended on 31 March 2019 was Rs. 1,113 Cr.

- Net Interest Margin for the quarter ended on 31 March 2019 was at 3.03%

- The Gross and Net NPA of the Bank as of 31 March 2019 stood at 2.43% and 1.27% as compared to 3.31% and 1.69% as of 31st March 2018 and as compared to 1.97% and 0.95% as of 31st December 2018.

- Total capital adequacy ratio as per Basel III guidelines, was at 15.5%

Peer Comparison

| PRIVATE SECTOR BANKS | |||||

| Name | Last Price | Market Cap. | NPA | P/E | P/B |

| HDFC Bank | 2,435.90 | 663,793.50 | 0.40% | 31.49 | 5.01 |

| Kotak Mahindra | 1,488.00 | 284,046.91 | 0.70% | 39.43 | 5.63 |

| ICICI Bank | 414.05 | 267,018.01 | 2.06% | 79.32 | 2.34 |

| Axis Bank | 811.10 | 208,694.58 | 2.06% | 44.61 | 3.25 |

| IndusInd Bank | 1,541.00 | 92,917.43 | 1.21% | 28.15 | 3.96 |

| Bandhan Bank | 559.60 | 66,764.92 | 0.58% | 34.21 | 5.89 |

| Yes Bank | 133.55 | 30,941.73 | 1.86% | 18.00 | 1.20 |

| RBL Bank | 663.45 | 28,343.34 | 0.69% | 32.70 | 3.76 |

| Federal Bank | 105.00 | 20,845.97 | 1.48% | 16.75 | 1.70 |

| City Union Bank | 215.25 | 15,810.13 | 1.81% | 23.15 | 4.45 |

| Karur Vysya | 77.90 | 6,226.63 | 4.98% | 29.51 | 0.99 |

| DCB Bank | 237.00 | 7,339.95 | 0.65% | 22.55 | 2.56 |

| Karnataka Bank | 105.00 | 2,967.38 | 2.95% | 0.54 | 6.22 |

| South Ind Bk | 13.55 | 2,452.12 | 3.45% | 9.89 | 0.47 |

| Average | 29.31 | 3.39 | |||

| IDFC First Bank | 42.25 | 20,204.15 | 1.27% | – | 1.21 |

*Price & Market Cap – 10 June, 2019 and NPA figures on 31st March 2019.

WHAT’S DRIVING THE STOCK?

Robust Loan Growth

Before merger, IDFC First Bank has grown its credit almost entirely on the back of the corporate sector, which constitutes ~72% of its outstanding credit. The main rationale of IDFC Bank merger with Capital First is to increase the share of retail loan book. As of Q2 FY2019, Capital First has 89% of retail loan assets.

Retail Assets as a % of the total Funded Assets has improved substantially from 13% to 35% post the merger.

Management Guidance –

- The Bank plans to grow the retail asset book from Rs. 36,236 Cr to over Rs. 100,000 Cr

- The Bank plans to increase the retail book composition to more than 70% in the next 5-6 years.

- Being a high yielding segment, it will support NIM, going ahead.

Improvement in CASA ratio

As of March 31, 2019, the total deposits of the Bank stood at Rs. 70,479 Cr., up 14% from Rs. 61,914 Cr. in December 2018. Out of total deposits, low cost Current Account Savings Accounts Deposits (CASA) was at Rs. 9,114 Cr, contributing 12.9% to the total deposits. The Bank aims to increase the CASA Ratio on a continuous basis year on year and strive to reach 30% CASA ratio within the next 5-6 years.

Strong Management Guidance – the Bank plans to reach the following goals in the next 5-6 years of operation:

- Loan Book – To reach Rs. 180,000 Cr.

- % Retail Exposure – 70% of the total loan book

- Net Interest Margin – To reach ~5.5%

- RoA% – To reach 1.4 – 1.6%

- RoE% – To reach 13 – 15%

Asset Quality – As of March 2019, IDFC First NPAs stood at 1.3%. Before the merger, IDFC Bank did provisions of nearly Rs 601.38 Cr. in Q2 FY 2019. In addition, the Bank as part of the clean-up, sold an additional Rs 2,400 Cr. of stressed assets (comprising exposure to several borrowers, including DS Group) to Edelweiss Asset Reconstruction Company for Rs 622.6 Cr.

WHAT’S DRAGGING THE STOCK?

Intense competition, threat of new entrants – Many of the services that were traditionally performed by the banks are now being performed by other players such as depositories, NBFCs and brokerage houses which have intensified competition in the banking industry.

Fintechs Disrupting Financial Service Market through innovative solutions across wide range of services such as payments, lending, data analytics, wealth management.

Hi Rajat,

Thanks for this comprehensive analysis. So what’s your recommendation for IDFC First Bank? Buy, Sell, Hold? And where does IDFC figure in all this? Thanks and warm regards.