Max India Limited (or “the Company”) is a multi-business corporate in the healthcare sector. It was until recently actively managing stakes in:

- Max Healthcare (49.7%), which was a JV with South African company Life Healthcare – The Hospital Business.

- Max Bupa Health Insurance (51%), which was a 51:49 JV with Bupa Finance Plc. UK – The Insurance Business

- Complete ownership (100%) of Antara Senior Living

Since end of calendar year 2018, the Company has engaged itself in the sale of its assets as well as spin offs of other businesses in order to create more value in the existing businesses, reduce leverage in the current business & venture into new businesses.

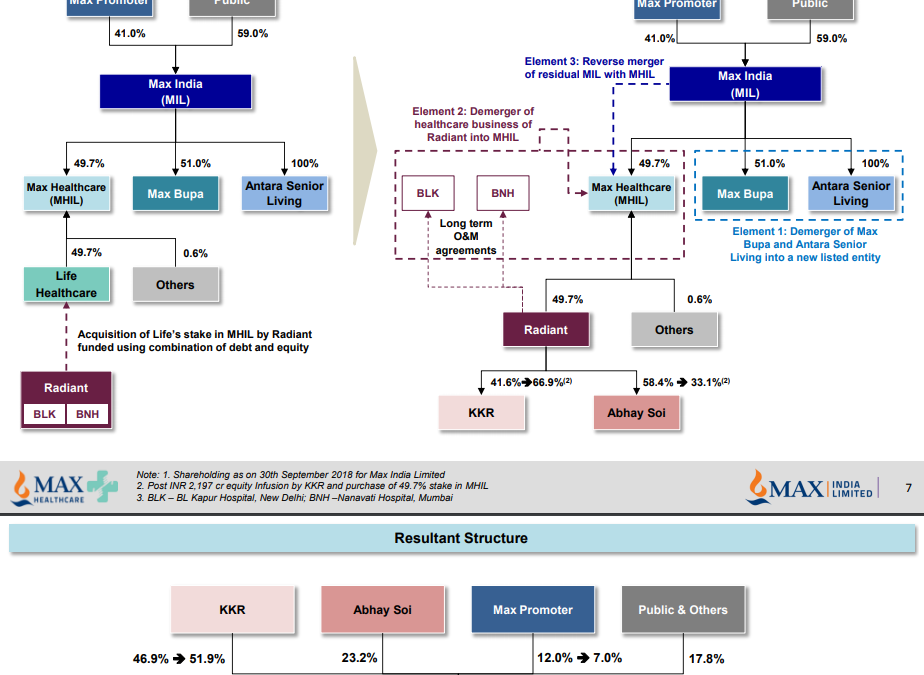

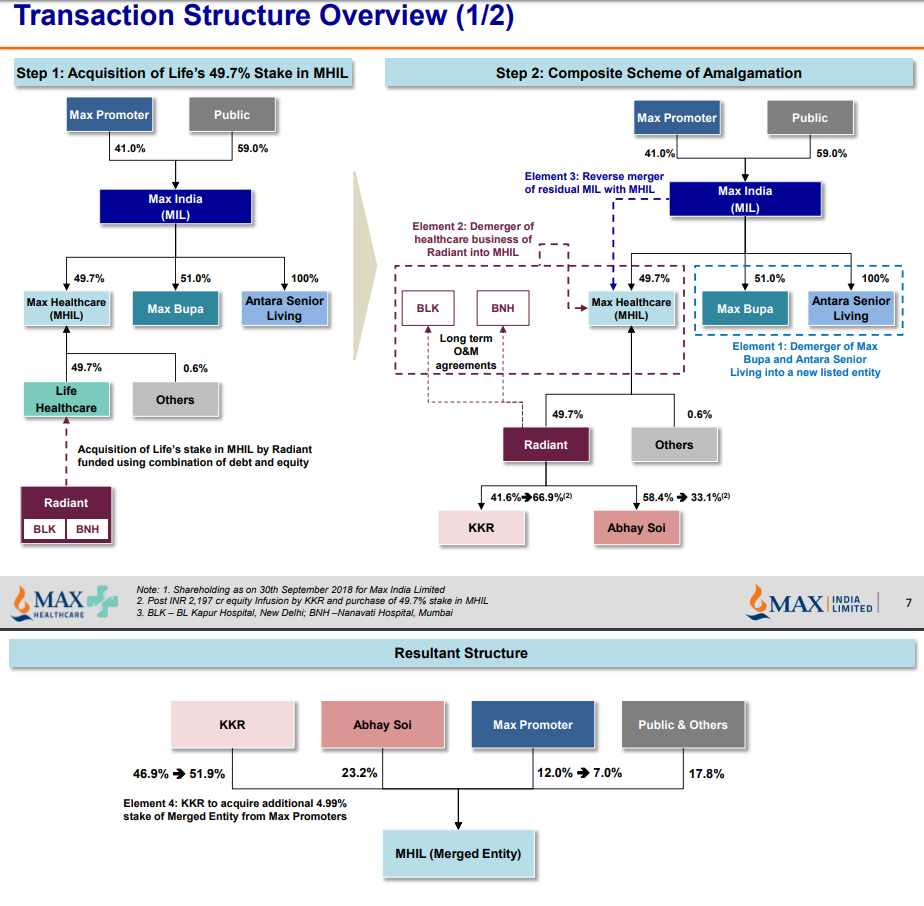

Merger of Max Healthcare with Radiant Life Care & KKR:

In December 2019, the Company announced that Radiant Life Care & KKR will acquire a majority stake in Max Healthcare. In order to do so, Radiant Life Care & KKR acquired the 49.7% of Max Healthcare. This will be followed by a demerger of Radiant’s healthcare assets (BLK & BNH) into Max Healthcare which will finally result in KKR & Radiant acquiring a majority stake in Max Healthcare.

In the resultant structure KKR will have a 51.9% stake, Abhay Soi the promoter of Radiant will have 23.2% stake, the promoter of Max, Analjit Singh will have a 7% stake & the remaining 17.8% will be held by the public & others.

KKR & Abhay Soi will be co-promoters of the merged entity.

Sale of entire stake in Max Bupa:

In February 2019 Max India announced that it sold its entire 51% stake in Max Bupa Health Insurance to True North, an India centric fund with a combined corpus of $2 Billion. The transaction which is subject to approval from shareholders of Max India is expected to be completed by 2020 & will lead to a cash inflow of Rs.511 crores, which the management claims will be used towards investing in existing & new business opportunities.

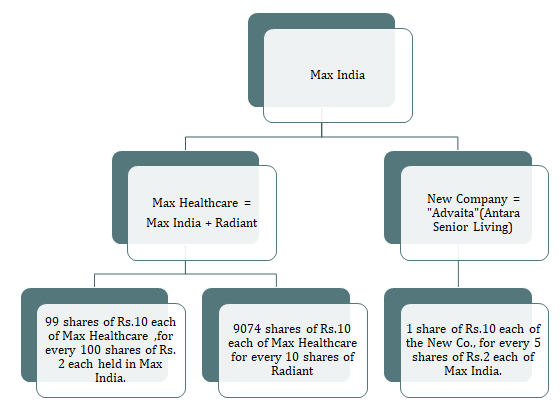

Demerger of Antara Senior Living:

`Max India, will also demerge the Senior Living business & this new entity which will be called “Advaita Allied Health Services”. Besides managing the Senior Living business, the “Advaita” or the New Max India will manage a corpus of Rs.500 crores which it will receive from the sale of its health insurance business. The Management has said that the cash reserves will be used for venturing into a 1-2 new business areas as well as for allowing existing shareholders an exit opportunity by way of capital reduction.

Sale of Pharmax:

On 27 June 2019, the company divested its entire 85% stake in Pharmax Corporation to its wholly owned subsidiary Max Ventures Ltd. for Rs.61.2 crores.

The Max India deal with Radiant will result in a new entity called Max healthcare & the demerger of Antara Senior Living will also result in a new entity “Advaita”. The shareholders of Max India will be allotted the new shares in the following manner:

Radiant is a well-recognized brand & operates 2 hospitals Mumbai & Delhi. It took over & restructured BL Kapur hospital in Delhi & Nanavati Hospital in Mumbai, both brand names with a long legacy & located in the heart of the cities.

The merger of Max with Radiant seems to be a good fit & the company aims to cash on synergies in the new operation. The resultant entity after the merger, Max Healthcare, will be one of the top 3 hospital chains in India. The merger will strengthen the brand in the NCR & Mumbai. The NCR market capturing the highest proportion of India’s foreign medical tourists.

Apart from this the merged entities will benefit from patient flow across networks, retaining & attracting doctor talent as well as better cost management. The Management along with Radiant feel aim to aid future growth by utilizing idle capacity by undertaking brownfield projects in NCR & Mumbai to with a potential of increasing the operating beds by an additional 2650 beds.

The funds from the sale of the Company’s stake in Max Bupa will be used by the new entity for furthering the Senior Living business & expand it to New Chandigarh & Noida.

It has entered into an agreement with a Chandigarh based developer for 650 units in 2 phases, wherein Antara will invest Rs.20 crore as secured loan & an additional Rs.26 crore investment, the developer will contribute the land & organize debt for development of the project & Antara to get 17% of the collection fee. In Noida the Company had entered into a similar arrangement with a developer but the developer backed out due to funding issues. Now the Company has full control of the project, however it may need to guarantee the debt which could be Rs.100 crores. Units in both projects will be priced from Rs.75 lakhs to Rs.1.5 crore.

The Company also plans to use the funds from the sale, to enter 1-2 new business areas which will be related to the Company’s current focus’ of Life Insurance, Real estate, Senior Care & lifestyle. The funds will also give the provide existing shareholders the opportunity to exit through a capital reduction process.

The founder of Max Group, Mr. Analjit Singh, reduced his share in Max healthcare from an initial 12% to 7%, the balance being taken over by KKR in order to gain majority in Max Healthcare. The funds received from the transaction will be used to refinance debt & repay loans raised through pledged shares.

Conclusion:

One should buy/hold their stake in Max India ltd., the merger with Radiant, a company with a trusted brand name & a favorable past of operating hospitals in NCR & Mumbai. The merger will not only cement the brand name further but also provide synergies as mentioned before. Apart from this, Radiant being backed by KKR a global investment firm with an AUM of $200 billion ensures that the new entity might find it easier to raise capital in the future.