[1] Selling an asset ‘only’ because it is doing badly – Mutual fund holders and share holders are different when it comes to the time it takes for each category to give up on investments. Typically a fund holder will compare his returns with overall stock market returns every 2-3 years. A retail investor in the stock market is even worse. Predictably he will sell a stock on the below basis:

| Sharp correction of > 10%, within a day in the price of the asset. | Sell immediately |

| Slow correction of 40-50%, spread over 8-12 months in the price of the asset. | Sell slowly and somewhat reluctantly |

The reason for selling should not be driven by the retail price of the underlying asset but by its value. Unless things have changed substantially for your asset at a fundamental level – hold on to it. One of our subscribers wrote to me in 2013 asking if he should sell certain equity mutual funds he had been holding for 5 years since 2008. He was not happy with the 12% return he had made in the 5 year period. I suggested that he hold on. After all equities performed really badly in those 5 years. In my view he was lucky to have made any positive return. Fast forward to 2015, he is making an 85% overall return. It’s just the nature of his underlying investment class – stocks, that’s what they do!

[2] Buying an asset only because it is doing well – A successful investor once said:

The dumbest reason to buy a stock is because it is rising.

This is equally applicable to gold, property and to all other asset classes. In the years between 2005 – 2008, everyone was buying stocks. Between 2008 – 2011, the focus changed towards buying real estate. 2011-2014 witnessed an equally irrational behavior in gold. These days’ equities are back again. I am convinced that once the Sensex reaches 60,000, the number of people who write in to me with their expert stock tips will increase by anything between 6-16 times. Hopefully I would have sold my stocks by then.

[3] Holding on to bad investments – Rolf Dobelli in his book, ‘The Art of Thinking Clearly’ brilliantly explained the ‘sunk cost fallacy’ – a lot of people sit through a bad film only because they had paid Rs. 300 for the ticket. They overlook the fact that the money is gone whether they watch the entire film or not. Why suffer more because you made a mistake in past?

Your past investments often become the primary reason for you to carry on in a lost cause. Many people do not sell their investments purely because they had bought it at a higher price. This is irrational. The fact that you made a bad financial decision is no reason to persist with it forever. The next time you wonder why your portfolio is not making money when the entire market is moving up, take a deep breath and sell the crap you purchased at absurd prices and are now holding on to.

[4] Investing your money based on a relatives advice – Without any hesitation I can say that 80% people do this wrong. This may be a very personal view, possibly based on my years of experience working as a lawyer that you should never hire a lawyer or a doctor who is known to you. Same applies for investment advisors. Instead go for independence, competence and honesty.

- Independence– the person you choose should not be affected by the outcome of his decision. If he is, it is most likely that his decisions will be neither independent nor any good. This works both ways. In the very first year in which I started my independent business I made a rule. I will never accept any family portfolio nor do any consulting for them, free or otherwise. As a client, make sure that you always have the ability to ask tough questions of your advisors. You may turn an advisor, lawyer or doctor into a friend but it usually will not work the other way around, not for very long anyways.

- Competence – I have seen far too many people looking for someone in their circle of friends and family to save an extra 5-10%. That may be a good idea when buying a shirt or a car but when it comes to your health and wealth choose someone competent and pay him a little more than what he quotes. If the most competent person happens to be in your family, look for the second most competent person.

- Honesty – You will never succeed at doing anything with someone who is not honest. Integrity is the primary reason why people prefer that their financial decisions be taken by someone they personally know. This quality is also the hardest to find when you are looking for an independent person. That said, you are more likely to avoid bad financial decisions when working with someone with all three of the above traits.

[5] Never do something just because it is popular i.e. buying things that you do not need – Last year I witnessed a new craze amongst my friends – becoming members at all sorts of city clubs. They paid anything between 2-10 lakhs to become members of sports clubs and golf courses. I am not sure how well they are using their memberships but I am sure of this – at least half of them (if not more) did this because of the other half, nobody wanted to miss out. 8 of them became first time club members over a span of 6 months. Why did they not think of becoming a member in all the previous years? – It wasn’t popular back then, even though the utility did not change at all. This is how bubbles are created. This is also how religions start.

Irrational buying of something of little value is a clear sign of excessive liquidity in the system – often a pre-cursor to a financial calamity. Avoid peer pressure. Save and invest your money wisely. When unsure put it in a bank @ 8% annual interest. Give yourself 60 days of cooling off.

[6] Don’t fall for the value trap – You know what’s the oldest trick in retail business and one which always works? Increase the price from Rs. 100 to Rs. 300 and then offer a 60% discount. Not only will you sell something worth Rs. 100 at Rs. 120, you can also use the extra Rs. 20 to advertise your ‘discount scheme’ to lure other unsuspecting buyers.

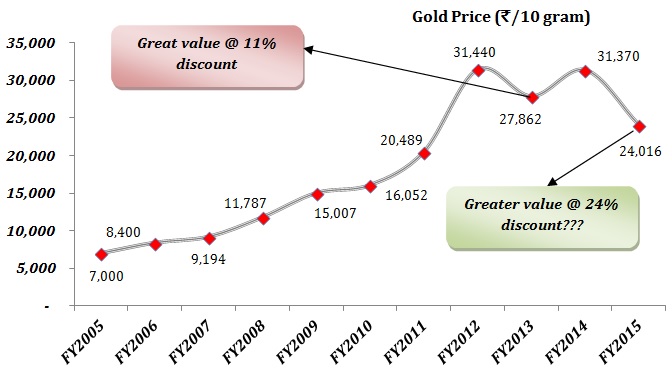

Don’t buy something only because it is available X % cheaper. Think of its utility, its value and its likely price in future. Things appear of great value when they suddenly fall in price. Bigger the fall, more value people attribute to it. This is particularly true in financial markets. In fact, a bulk of bad financial decisions belong to this category. People buy stocks, gold, real estate and all sorts of other assets for one reason alone – the prices have fallen by X%. Value trap is a situation where an asset class appears reasonably valued when compared with its historic prices but where fundamentals for that particular asset class have started deteriorating.

Also read – Investing in Gold – Good or Bad Investment Option?

[7] Investing money to save taxes – From charity to tax free bonds, the market is full of products. I have never understood the fascination with tax avoidance. You’d rather pay 10% more tax than loose 50% investment value with a badly made investment decision. Typically those who market such schemes will approach you towards the end of a financial year when you are most likely planning your taxes. Be careful of what you sign up for. There may be far better options – do not invest your money to save taxes, invest it to grow so you can pay higher taxes.

[8] Being overconfident – We all like to be the one to whom everybody goes for advice. While you may consider yourself smarter than most money managers, there is no harm in asking for their view while making big financial decisions, is there? People spend many years trying to perfect their vocation, respect this fact.

[9] Credit card induced sense of power – You know what a credit card will achieve for you – DEBT. That’s all. In general, it is a good idea to have a credit card as it not only builds your credit score but also gives you access and the ability to buy things. I for one cannot imagine my life without credit cards. From air tickets to the payments I receive from subscribers, I am fairly dependent on them.

Where do things go wrong?

Credit lines give you a false sense of power. The illusion is that you can afford all sorts of luxuries in the market place. The reality does not dawn until the end of the month. Most of us manage to service our credit card debts without once thinking about the long lasting investments we could have made instead of servicing these expenses. There must be a reason why Americans are buried in debt and why India managed to save so much. They got the credit cards first.

[10] Failure to diversify – A lot of people are fond of stocks. Then there are gold lovers and if you are like an old school businessman you probably like real estate, after all it delivered awesome returns over the last 1.5 decades. All of you will believe that the asset that you invest in is bulletproof. It really isn’t – an enduring lesson in money markets which is invariably ignored by investors.

I wish you mentioned about pitfalls in trying to time the market. No one knows whether the market or any particular stock will down or up tomorrow. so if you intend invest in equity, today is the best day.

Very good point Anil.