Before I get to some of the most ridiculous places where I spend my money, let me motivate you about the power of small savings with a story.

King & The Shaman

A King once challenged a shaman to a game of chess and offered any reward which the shaman wished for if he were able to beat the king. As luck (or skill) would have it, the shaman won the game. Acknowledging his defeat, the king asked the shaman to state his wish.

The shaman asked for a little rice. He said, “Just put one grain of rice on the first square of the chess board and double it on every consequent square until you cover all 64 squares on the board. Starting with 1 – 2 – 4 – 8 – 16 -. . . .and so on.”

What appeared too little at first was way more than what all kings of the world could offer, put together!

On the 64th square, the king would have had to put INFINITE grains of rice. Somebody who did the math on this came with result of over 2 billion tons of rice. That’s enough to cover the surface of planet earth with 1.5 feet layer of rice!

Don’t Ignore the Power of Compounding

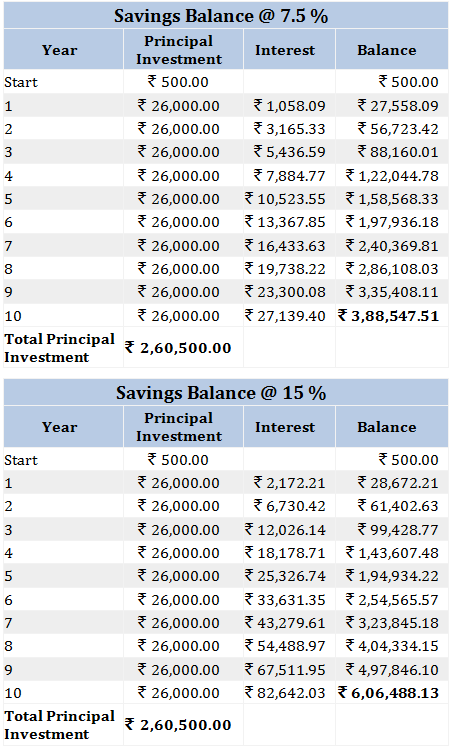

Take a look at the power of compounding and see how quickly things can add up. The calculations below assume that you save Rs. 500 / week and invest that money (for 10 years) at the rates of –

(i) 7.5% (fixed income product) with a bank; and (ii) at 15% p.a. in high quality blue chip stocks.

A saving of Rs. 500/ week isn’t a bad idea right?

No wonder Einstein thought of compounding as the eighth wonder of the world. A few days back, I did another motivating hypothetical where I asked:

How much money should you invest today @18% CAGR so that you will have Rs. 1Cr at the end of 20 years?

The answer is Rs. 2, 80, 000/-

Do this a few times in your working years and you will retire like a king.

Easy Money Saving Tips

I hope that by the end of this post, I will be able to make you realize how much unnecessary spending we do in our daily life. While you don’t have to be a teetotaler and kill all joy of living, try cutting down on 30-50% on the items listed below. In the unlikely event where you spend on none of the things below, please try adding 30-50% of these expenses to your budget. It’s called Balance.

[1] Transportation

Car fuel expense and maintenance cost is one of the most un-noticed expense that we incur in our everyday lives. If you regularly drive to office, try using public transportation at least a few times. You are not only helping your own bank account but also the environment.

| THIS IS HOW MUCH YOU SPEND ON PETROL |

|

| Distance travelled daily (in kms) | 50 |

| Distance travelled monthly (assuming 26 working days) (in kms) | 1300 |

| kms / litre (car economy/mileage) | 11 |

| Cost of petrol / litre in Rs. (Delhi) | 66.93 |

| Daily travel cost for Petrol in Rs. | 304.22 |

| Monthly travel cost for Petrol in Rs. | 7909.90 |

| Annual Servicing ~ 12,000 @ monthly rate | 1000 |

| Monthly Car Cost | Rs. 8,909 |

| Annual Car Cost | Rs. 1,06,908 |

Avoid traffic jams. Improve your health, save money and the environment. Stop Driving.

[2] Smoking

This is one of the worst habits in the world. In addition to being bad for your financial health, it is most likely to kill you in time, with a kind of disease the burden of which will weigh far higher than the joy of smoking.

The example below assumes that the person smokes 7 cigarettes a day. Each cigarette costs Rs. 12/- -the lowest standard rate for the most popular classic cigarettes.

| THIS IS WHAT SMOKERS SPEND | |

| Cash burnt per Day | ₨. 84 (12*7) |

| Cash burnt per Week | ₨. 588 |

| Cash burnt per Month | ₨. 2,520 (84*30) |

| Annual Cash Burnt | Rs. 30,660 |

Think of it this way- if you can kick the smoking habit, it can earn you a 3 day 2 night trip to Dubai . . . . Singapore next year. Hong Kong the year after.

In 3 years you will be out of the habit, then you can start saving.

[3] Don’t Be A Coffee Addict

If you are a coffee addict like me and have just 1 coffee a day from Costa or a similar cafe, you may not like what you read. That said, this is one of those habits which I am happy with, decide for yourself if your money is well spent here.

The example below assumes that you consume just 1 coffee a day and spend Rs.183 (including taxes) – the price of a regular cafe latte.

| THE COST OF YOUR COFFEE |

|

| Per day coffee cost | ₨. 183 |

| Weekly coffee expense | ₨. 1,281 |

| Monthly coffee expense | ₨. 5,490 |

| Annual Coffee Budget | Rs. 65,880 |

Try brewing at home. It’s not that bad really.

[4] Avoid Reckless Shopping

A few days back I did something on behavioral finance, here is an excerpt:

A copy of the full article is available on Linkedin pulse – you can get it here.

Remember Gandhi’s Talisman? – The next time you pick up an expensive gadget, outfit, or any other thing of price, before adding it to your cart, think of the face of the most ridiculous and unlikeable person you ever met. Imagine him in that outfit or carrying that gadget. Then you will find your willingness to buy and yourself melt away.

Avoid “Buy 3 Get 1 Free” Deals

Think of how many times this has happened to you –

“Buy for 3,000 get goods worth 5,000 | buy for 10,000 get goods worth 15,000”.

“Wait! We have something more for you”

“Loyalty card – Now you can use it at our sister concerns”

These are proven emotional tricks and they mean one thing and one thing alone – Leave the store.

That Said, enjoy online shopping – While the discounts last!

Don’t be scared to purchase things online using your credit / debit cards. It is absolutely and 100% safe in all cases. End of story.

Online shopping sites like Flipkart, Amazon etc, provides almost everything at discounted rates. The hope of online retail model is to get people in the habit of shopping online before discontinuing discounts and before brick and mortar stores go out of business. Much as I think this is a flawed business model, you should make full use of it while the party lasts. This will also save you travel cost and time.

[5] Finally, Develop Discipline in Everyday Life:

- Prepare and stick to a budget – decide the maximum amount you would like to spend on different things. Follow this.

- Avoid credit card debt – Although, credit cards offer a convenient way to pay for goods and services but if you are not able to pay the dues on time, it will attract penalties (interest charges), which is an additional expense you will unnecessary incur. Remember – beating 36% p.a. is a hard task.

- Switch off the electrical appliances before leaving the room. Never leave chargers/TV/laptops on standby mode. Download free reading apps (the last time I bought a hard copy book was before 2005).

be scared to purchase things online using your credit / debit cards. It is absolutely and 100% safe in all cases. End of story.

Of course, there are many other areas where you could cut expenses. Fast food, movies, alcoholic beverages being some of them. There must be a reason why I did not cover these. Get the hint

I would love to hear from you about your money saving tips in the comments section below.

Happy Saving!

If I may add: Invest in a good LED and a home theatre. Hook yourself to some torrents, enjoy in comfort of your home. I did it.

Oh yes! before I hear someone firing missiles over mention of torrents….seriously!!!

Enjoy!

Good one Amit.