Amongst the many styles of making money in the market, swing trading has delivered the best results over the last few months. This has been possible mainly because of volatility in stock prices.

Swing trading is the practice of earning a profit by buying and selling a security including stocks at different price points with the goal of earning a positive return. This could include buying low and selling high or selling high and buying back at a lower price.

Swing trading rules for short term

- Best time for swing trading – days when the markets are volatile with a positive bias. In stock markets – Initiate and exit positions during these times – first hour of trade and between 2.30 pm to 3.10 pm. Ideally, you should avoid initiating trades with an intra-day view after the first hour of market opening. In 8 out of 10 cases, you will lose money.

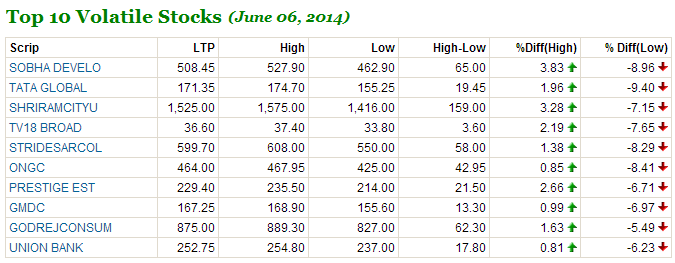

- Take Risks and look for volatile stocks – When I mentioned discipline above, I for sure did not mean being idealistic or for that matter selecting the most fundamentally sound stocks. When it comes to swing trading, it is pointless to select a stock which hardly ever moves beyond a range. Look for stocks which remain volatile. Here, you are not planning to buy something and hold it forever. All you are trying to do is earn a quick buck making use of price volatility.

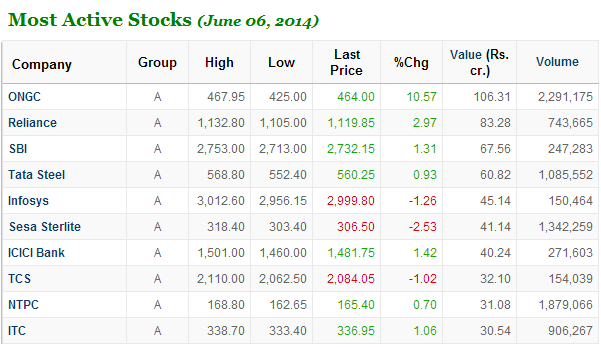

- Make sure that the stock has adequate liquidity i.e. is frequently traded – Just looking at the volatility metric is pointless unless the stock has enough buyers and sellers on a daily basis. Make sure that the stock you buy gives you an opportunity to exit when you want to. Check the daily trading volume in the stock from a reliable source such as NSE’s website. To be absolutely sure, you could look for high volatility stocks from an index like the BSE -200.

- Avoid swing trading in the F&O markets, if you must trade, be disciplined – This may just be a very personal opinion that I have but when you are trying to earn a profit based on price swings, the ability to wait it out is your best friend.

I will tell you something here. Take any price point for any stock. Now you may choose to buy or sell at this price point and in 90% + cases, the stock will do both – rise above that price and fall below it, at some point in the future. Agreed?

Of course nobody would like to wait for months to earn based on price fluctuation, but if you had time on your side, then this is true – YOU CAN NOT LOSE. The difficulty is that everyone does not have time, people want to make profits quickly, and lots of profits very quickly. In F&O markets time is really not on your side. You must square off or role over your position in a rather short span of time. If you must employ swing trading in the F&O markets, be prepared to cut your positions and take losses at a pre determined price level. Do not keep hoping for the price to move in favorable direction. It reminds me of a friend, an avid trader, who had a big sticker atop his computer screen which read – “there is no hope”.

- Diversify your trades – If you take to swing trading, ideally you should be looking at your overall profit and loss position and not your position on every individual trade. As I said above, the stock will surely fall below and rise above any price point at some point of time (in 90% + cases). Of course, it would not be the best thing to do to block your money on a trade for a long period of time. The best approach is to trade in 3-5 stocks at any given point of time. This way, so long as you are able to earn profit in 3 out of the 5 trades, you could sell the other 2 positions in loss and move to the next round with an overall profit.

I have been reading all your posts. Very informative and true ideas. Thank you rajat.

Always nice to hear about it. Thanks Ramakant.

How can I be careful from gaps in swing trading. What are the steps I have to take to avoid big loss when gap happens in swing trading? What website can follow for earnings report?