If a pandemic is all it takes to revive an ailing economy and create a bull run, then we should have one at the frequency of a cricket world cup – once every 4 years. Think about it, the Nifty 50 benchmark was trading at 12,100 in February of 2020 and rocketed past 18,600 about 20 months later in October of 2021.

Reason?

Surely, it can not be the pandemic and near close-down of all business activity alone. Something else must have happened.

Hear are 5 reasons why I have been bearish on the markets for the last 8-10 months.

INTEREST RATES

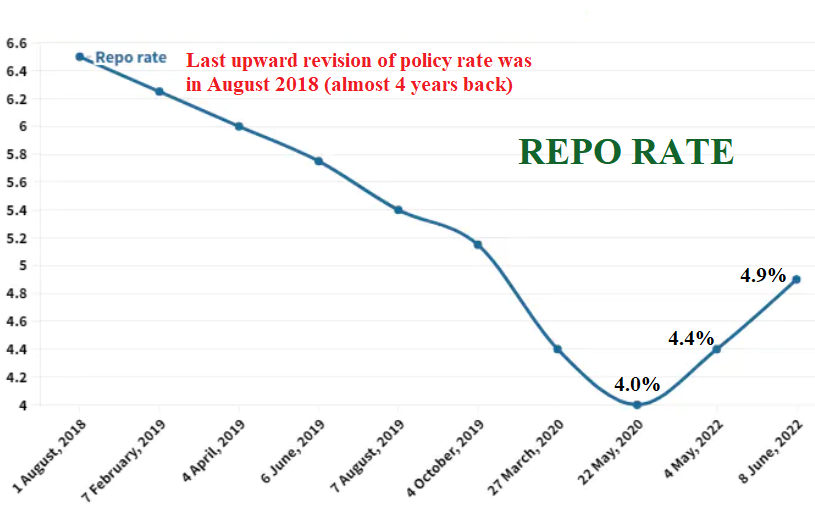

RBI’s Repo rate was lowered twice between February 2020 and May 2020. It was lowered from 5.15% to 4%, an overall reduction of 22%; i.e., money and credit became 22% cheaper. This flooded the markets with excess liquidity even when most of the country and perhaps the world was sitting at home, not contributing to any major economic growth.

Keep also in mind that if you go back a year from 2020, it wasn’t the best of times anyways. Between August 2018 and August 2019, RBI’s benchmark interest rate was reduced by 17% from 6.5% to 5.4%. In short, in less than two years between August 2018 and May 2020, India was flooded with insane amount of liquidity with credit becoming almost 40% cheap.Money kept flowing into all asset classes. Stock markets particularly were the biggest beneficiary of this. Demat account opening activity was at an all time high. Technology enabled people to pump in money into stocks right from the comfort of their homes.

This must end now.

Interest rates are being revised upwards not just in India but world-over. This excess liquidity must be sucked out. As interest rates go up, money will flow towards safer and higher interest-bearing fixed income schemes. This will have a materially negative impact on stock prices. Its just a question of how quickly this will happen? My sense is that this ample liquidity will start drying up slowly and like always, retail category backed by the mutual fund industry will keep pumping in money until the markets fall another 5-10%, which is when you are likely to see that last leg of the fall which is always the most brutal.

Further, as interest rates move higher there will be further stress in financial services space. I expect many banking and NBFC companies to face significant problems going forward.

FII AND DII FLOWS

Foreign institutions have been on a constant selling spree in India. In terms of value, they have sold more of Indian equities in the past one year than ever before. In terms of percentage holding, FII holding of Indian equities is at a decadal low. DIIs on the other hand are loving it. Backed by a war chest of mutual fund/ SIP money, they continue to buy at the hands of FIIs.

This will naturally not go on forever. The painful last leg of the fall which I mentioned in the previous point will be triggered once retail and mutual fund investors start withdrawing. I have no crystal ball to predict when that will happen but going by the nature of phone calls I have been receiving and my general interaction with retail participants, we still have time before major redemptions start. I think interest rates have to go up another 50-70 bps and markets have to fall another 5% before retail sellers throw in the towel. Watch out for another 5% fall for a real bearish trend to start.

INFLATION & CORPORATE PROFITS

We have been dealing with record high inflation worldover. High inflation will continue to create margin pressure on companies as raw material prices remain inflated. Even if inflation were to get controlled, its impact will reflect in corporate profits for at least the next 3-4 quarters. The other problem which inflation creates is that it leaves less money in the hands of the consumer. This in turn results in lower spending and lower revenue for corporate India.

CRUDE OIL PRICES & THE UKRAINE WAR

For a country like India, high crude prices can never be good news. For FY 2021-22, India spent over 23% of its annual budget and forex in importing crude oil. Higher crude prices means lesser money with the government to fund infrastructure and subsidies. This not only results in a slowdown of overall economic activity but is also the primary reason for high inflation as prices of goods across the board goes up.

The war in Ukraine, between Russia and the West, just does not seem to be coming to an end. It is no secret that oil producing nations and in particular the OPEC nations have a huge leverage in controlling oil prices. Think about it, the demand for crude oil keeps growing and the supply is controlled by a few nations.

Russia is the second largest oil producing country in the world. European Union has banned Russian oil coming in from the sea route effectively reducing its import of Russian oil to a mere 10%. Many other countries have stopped buying oil from Russia, its primary export. This further gives leverage to OPEC nations to control prices.

Expect oil prices to remain high at least for the next few months.

COVID -19 & LOCKDOWNS

Covid 19 is still not behind us. This has the potential to disrupt things at any point of time. Measures like work from home and partial lockdowns are detrimental to economic activity. Covid 19 has become a permanent dampener of sorts for many industries, particularly travel, hospitality and food & beverage. We need an effective resolution to this.