Thinking about investing? Not sure about the right way to go about selecting mutual funds scheme? With so many funds schemes in the market, the task of selecting a mutual fund becomes mind boggling. With so much information available over the internet, the task of selecting a mutual fund becomes even more confusing.

In this post, I will list 5 rules for selecting mutual funds schemes based on certain key criteria to consider.

To understand different types of mutual funds and their key features visit our mutual fund articles here.

[1] Choose Mutual Funds That Match Your Financial Goals

There are different types of mutual funds available to invest in including equity, index, debt, liquid, gold and thematic funds (like infrastructure, pharma etc) – the list is quite exhaustive.

Your Goal should not be this – I want to make the highest profit/ rate of return on my investment.

The above is an example of a half goal. To complete, you must add the amount of risk you are willing to take. Will you be OK if in attempting to make a 100% return in a year, there is a 74% chance of losing 80% of your capital? You get the picture.

Keep in mind that you don’t have to invest in all these funds. Different funds have different risk profile, liquidity profile and time profile. Hence, it is not possible that all funds will match your needs, risk-appetite and investment horizon. Therefore, you must first decide on the type of funds that would suit your needs. Only then you should start selecting the best funds within those categories.

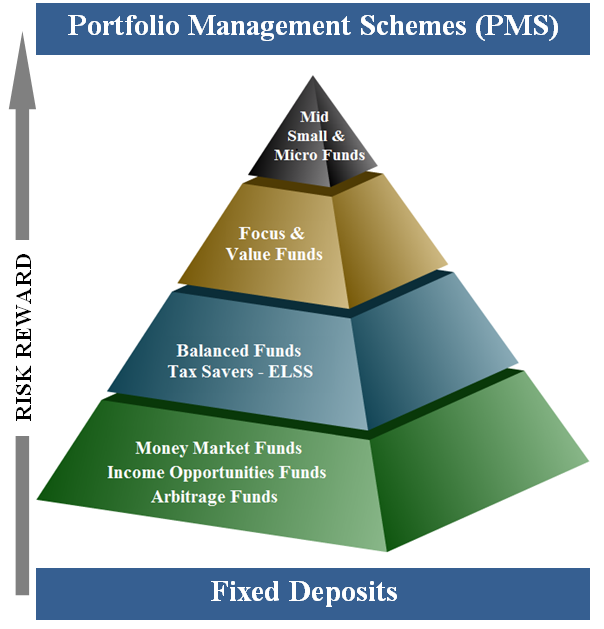

Click on the Pyramid below to get a Classification of Different Types of Mutual Funds.

Risk Profile

| Risk Profile | Fund Mix |

| Conservative | Mix of Debt Funds, Income Funds, Fixed Maturity Plans |

| Moderate | Mix of Balanced Funds, Debt Funds |

| Moderately aggressive | Mix of large cap equity funds, balanced funds and some exposure of mid cap equity funds |

| Aggressive | Mix of mid and small cap equity funds, sectoral funds and large cap equity funds |

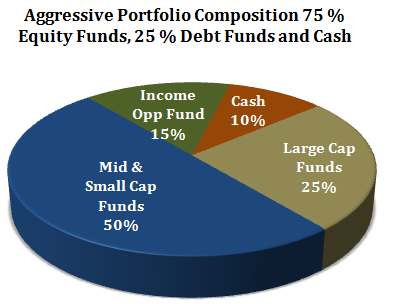

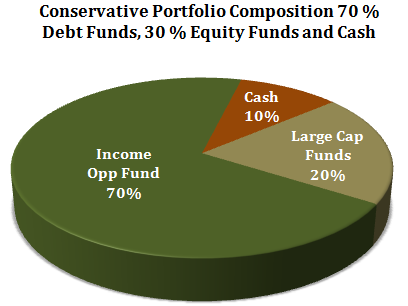

Age Profile

Age plays an important role in getting the right mix between the different mutual fund schemes. Simple thumb rule: 100 MINUS YOUR AGE RULE for equity allocation: which means that if you are 35 years old, then 65% of investible funds should be in equities at any given time.

For example: Mutual fund allocation of a young couple with two children:

For example: Mutual fund allocation when you are retired:

[2] Past Performance to Predict Future Performance

Standard disclaimer that you will find on all mutual fund factsheet – “Past performance is no guarantee of future returns. Please read the offer documents carefully before investing.”

Many investors base their mutual funds investing decision only on the basis of past performance. But investors cannot really be blamed. Historical returns are so trumpeted in advertisement and fund’s fact sheet that investors consider past performance as a reasonable guide in selecting mutual funds.

Point to note is that past performance will ONLY enable you to assess the historical returns of the fund over various time frames, but to know how the scheme may perform in the future, a lot more research and analysis is required.

“Past performance is not a reliable indicator of future performance so don’t be excited by last year’s high returns. But past performance can help you assess a fund’s volatility over time.”

This year’s “top performing fund” may become next year’s below average fund. Thus, it is important to look at consistency of performance. A good mutual fund scheme is one that consistently manages to outperform its benchmark over 5+ years.

[3] Choose Between Direct and Regular Plan

Currently, mutual fund schemes are sold under 2 plans – DIRECT and REGULAR.

Difference between Direct and Regular Plan

Regular Plan: Until January 2013, mutual funds were sold mainly by third party distributors who charged a commission on sales.

Direct plans were introduced by SEBI in January 2013 to help investors earn higher returns by doing away all distribution commissions. Investors under this plan can invest directly with Asset Management Companies (AMCs).

Regular plan is suitable for investors who may not be sophisticated enough to invest in mutual funds on their own and may need the help of an educated Investment Advisor to explain key features of various funds.

How to decide: If you think you can track your investments and understand the risks involved with various schemes, choose Direct Plans. Otherwise you should not mind paying a little commission for quality advice. The correct way to think about this is – even if I as an investor manage to select the right scheme, should I not pay a small commission to someone who is an expert to tell me not only the scheme to invest in today, but also when to sell it and switch to another scheme. The commission is really meant to be fees for ongoing monitoring of your fund’s performance.

Typically the commission for a regular plan will make you earn ~ 0.50%- 1% less over a direct plan on an annual basis.

Also Read: How to Buy Online Mutual Fund Plans

[4] Don’t Own Too Many Funds

Being too diversified is the most common mistake that investors make.

Sometime back one of my investor said that despite investing in so many funds he was not making any higher return than he would make in a fixed deposit. He had as many as 20 mutual funds in his portfolio with all kinds of schemes. Naturally he could not track all of them, nor could his Investment Advisor have been able to, if he had one.

“Diversification is healthy only up to a reasonable extent. If you overdo it, diversification actually works against you.”

Also Read – How Many Mutual Funds Should You Own + Ideal Portfolio

[5] Do You Really Want To Invest In Mutual Funds At All?

This is an important question you should ask yourself before you start investing in mutual funds. Why not directly invest in stocks? There are many advantages that you have when you are directly investing in stocks:

- Save on fund management commission

- Select and create your own portfolio

- Shuffle your portfolio, which means that if any of your stock is not performing well, you can immediately sell that and opt for a better performing stock

- Similarly, if any of your stock has met its target, you are free to book profit and reinvest your money.

The only thing that you need to maintain while doing self investing is DISCIPLINE.

“It is not hard to make money in the market. What is hard to avoid is the alluring temptation to throw your money away on short, get-rich-quick speculative binges. It is an obvious lesson, but one frequently ignored.

– Burton Malkiel; A Random Walk Down Wall Street.”

Sometime back, I wrote a detailed post on the Golden Rule for Self Investing Success?

Long term investing requires thorough understanding of various investment products. You should use the service of a good SEBI Registered Investment Advisor. Should you wish to consult me, please write in to me at – rajat@sanasecurities.com

Mutual funds is a good investing idea but their is always confusion in selecting a good mutual fund, by the way the points are good to choose a mutual fund.