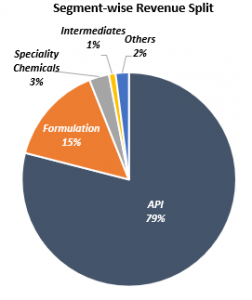

Aarti Drugs Limited (“Aarti Drugs” or the “Company”) is engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharma Intermediates, Specialty Chemicals and also produces Formulations with its wholly-owned subsidiary – Pinnacle Life Science Private Limited.

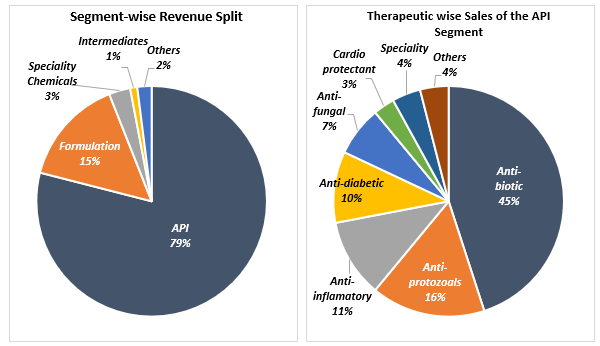

Products under APIs includes Ciprofloxacin Hydrochloride, Metronidazole, Metformin HCL, Ketoconazole, Ofloxacin etc. whereas Specialty Chemicals includes Benzene Sulphonyl Chloride, Methyl Nicotinate etc.

The Company’s products are exported over 100 countries worldwide.

Aarti Drugs enjoys a distinguished clientele of MNCs viz. Sanofi – Aventis, Merck, Teva, Searle, Pfizer, Bayer and Clariant.

Financial Performance

| Particulars | FY16 | FY17 | FY18 | FY19 | FY20 |

| Revenue (In Rs. Cr.) | 1,139.84 | 1,195.17 | 1,243.63 | 1,560.94 | 1,806.09 |

| Growth | – | 4.85% | 4.05% | 25.51% | 15.71% |

| EBITDA (In Rs. Cr.) | 175.69 | 186.89 | 198.48 | 207.37 | 261.82 |

| EBITDA Margin | 15.41% | 15.64% | 15.96% | 13.28% | 14.50% |

| EBIT (In Rs. Cr.) | 139.16 | 148.43 | 158.42 | 164.81 | 213.07 |

| EBIT Margin | 12.21% | 12.42% | 12.74% | 10.56% | 11.80% |

| PBT (In Rs. Cr.) | 95.27 | 116.01 | 124.50 | 131.02 | 185.29 |

| PAT (In Rs. Cr.) | 68.72 | 81.80 | 82.31 | 89.75 | 141.40 |

| PAT Margin | 6.03% | 6.84% | 6.62% | 5.75% | 7.83% |

| EPS (In Rs.) | 28.38 | 34.29 | 34.90 | 38.06 | 60.69 |

| EPS Growth Rate | – | 20.83% | 1.80% | 9.04% | 59.46% |

| Historic P/E (Closing Price of 31st March) | 15.94 | 16.80 | 14.50 | 17.40 | 8.28 |

| CURRENT P/E | 31.96 | ||||

| Shareholder funds (In Rs. Cr.) | 357.40 | 400.13 | 455.43 | 543.45 | 652.49 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 449.64 | 446.21 | 508.34 | 471.46 | 338.04 |

| Cash (In Rs. Cr.) | 4.82 | 4.17 | 4.27 | 5.55 | 7.64 |

| D/E | 1.26 | 1.12 | 1.12 | 0.87 | 0.52 |

| Interest Coverage | 4.00 | 5.13 | 5.68 | 5.19 | 7.76 |

| ROCE | 17.24% | 17.54% | 16.44% | 16.24% | 21.51% |

| ROE | 19.23% | 20.44% | 18.07% | 16.51% | 21.67% |

FY 2020 Highlights:

- During FY 2019-20, the Company has grown consistently on account of its long-term strategy and robust expansion plan.

- EBITDA grew by 26.26 % YoY in FY20 due to better demand and efficient operations.

- In FY20, the consolidated PAT of the Company grew by more than 57.5% due to better margins and good revenue growth. Additionally, in FY20 the Company went for the new tax regime thus lowering the overall tax rate of the company, leading to higher PAT.

- The Company indicated that it has already scaled up its anti-diabetic and anti-inflammatory capacity and it will give impetus to revenue growth in FY20-21. Further CAPEX is planned for introducing new products in anti-diabetic category.

- Business overview:

- Domestic market share leader in most of its top 10 products

- Local clientele is well diversified with the top most client contributing to only 2.93% of local sales

- Top 10 Local Clients contribute to around 24.81% of total local sales

- Export Clientele is well diversified with the top most client contributing to only 3.45% of total export sales

- Top 10 Export clients contribute to only 19.64% of total export sales

- Top 10 products contribute to around 76.43% of the total sales

Quarterly Performance

| Quarterly Results | Q1 FY 2020 | Q4 FY 2020 | Q1 FY 2021 | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 405.43 | 449.64 | 544.67 | 21.13% | 34.34% |

| EBITDA (In Rs. Cr.) | 54.72 | 71.32 | 133.97 | 87.84% | 144.83% |

| EBITDA Margin | 13.50% | 15.86% | 24.60% | ||

| PAT | 22.45 | 58.86 | 85.45 | 45.17% | 280.62% |

| PAT Margin | 5.54% | 13.09% | 15.69% | ||

| EPS | 9.64 | 25.26 | 36.67 | 45.17% | 280.62% |

Q1 FY 2021 Highlights:

- The API segment contributed approximately 85% and formulation around 15% of the total consolidated revenue. Within API segment 65.11% of the revenue came from the domestic market and 34.89% from the export market.

- The Company was able to maintain good operational efficiency which along with good realization in selling prices lead to increased gross margins.

WHAT’S DRIVING/DRAGGING THE STOCK?

- Strong Growth in API Space – On strong demand for Indian APIs and Aarti’s higher realizations, its API sales rose 28.19%. The share of antibiotics climbed to 46% of Q1 FY21 sales (44% the year prior), mainly on more sales of ciprofloxacin, ofloxacin and norfloxacin. New capacities and higher realisations are likely to lead to an 18% CAGR in API sales by FY20-23.

- Management Guidance – the Management expects FY21 EBITDA margin of ~18-20%. The higher Q1 margin was driven by the Chinese disruption and the greater proportion of institutional orders. However, the similar institutional orders are not expected ahead and management expects Rs. 50 Cr.-80 Cr. of institutional orders. Planned capex for the next three years is Rs.3bn-4bn (mainly for backward integration). Additional capex is planned to introduce products in anti-diabetics toward end-FY21.

- On 3rd September 2020, the government imposed anti-dumping duty on import of antibacterial drug ciprofloxacin HCL from China which is likely to provide a level playing field for domestic industry vis-à-vis foreign manufacturers and exporters. China accounts for 97.76% of the total imports of ciprofloxacin HCL in India. The drug is used to treat different types of bacterial infections, including skin infections, bone and joint infections, respiratory or sinus infections, urinary tract infections, and certain types of diarrhoea. The government has imposed the duty for six months. The centre has imposed $0.9-$3.49 per kg on the raw material used in making antibiotics.

- Issue of Bonus Share – In August 2020, the Board approved bonus shares. three bonus equity shares for every one fully paid-up equity share. The Company has fixed October 1, 2020 as the ‘Record Date’ to determine the eligible shareholders entitled to receive the Bonus Shares. After the bonus issue the number of shares will increase from 2.33 Cr. to 9.32 Cr. This is a positive development for Aarti Drugs.

- Increase in Number of FPI Investors – Number of foreign portfolio investors holding the stock rose to 41 in June 2020 against 31 in March 2020.

- Expensive Valuation – Aarti Drugs share hit its 52-week low on March 23 as Indian market took into account the impact of rising coronavirus cases on the global economy. During the short period of five months, Aarti Drugs share touched all-time high of Rs 3,719 from Rs 421, its yearly low. Strong financial performance accompanied by announcement of bonus issue has contributed to the rise in the stock price. The Company reported a 280.62% rise in Q1 net profit to Rs 85.45 Cr. against profit of Rs 22.45 Cr. in Q1 of last fiscal.

At the current price of Rs. 2803.55 (as on 24th September 2020), the Company’s trailing 12 months PE comes to ~ 31.96x which is at 100% PREMIUM to its 5 years average PE Multiple of 14.58x. Based on this, fair value of Aarti Drugs comes out to be Rs. 885.