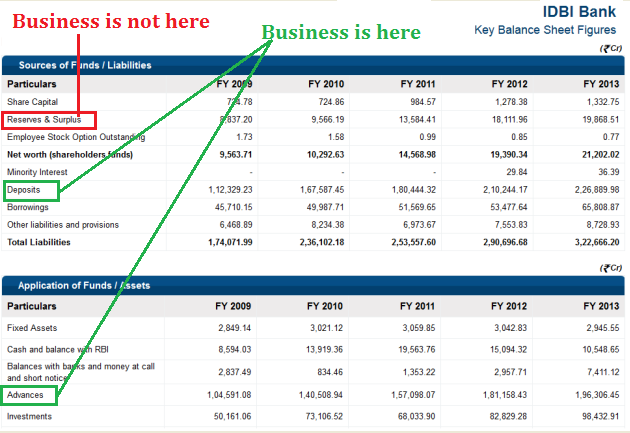

But again, at times the fascination among investors to invest in companies on the strength of their reserves and surplus is so great that they fail to see beyond the reserves. I have forgotten the count of the number of times I have said this – share prices do well when the underlying business of the company does well. That is all there is to it. Of course there are a lot of sentiment driven, news based and technical aspects which all play their part but eventually reliable long term capital finds its way to reliable returns.

High Reserves and Surplus + Bad Business – Case in Point

A perfect case in point in this regard is PSU banks. Massive reserves and surplus, and if one were to count the current market price of the properties they own from pre-independence days, I am sure all of them together could possibly buy a small country of their own. But should Maldives or Bhutan be worried? Unless they have deposits in these accounts, I see no reason why.

As a company in the business of banking, I am not sure if I would like to run their business as my own. I do come across (once in a while) those who have a bank account in some public sector banks but I have no list of reasons why they are still banking with them. Sometimes I hear this – PSU banks are safe. I don’t know what that means. An even more interesting case will be someone opening a new account in one of these banks.

To come back to the point, if you are buying into these stocks because they are available cheap, pay high dividends and have high accumulated reserves and surplus, stop right here. Let me be the first to raise my hand and say, these banks, even at current prices and with a possible market rally around the corner, will destroy your wealth over a period of time. While you may keep getting dividends out of their reserves year after year, their business may already have died. I can tell you nothing about if they have enough deposits to satisfy all their advances, something in me tells me that in a lot of these cases, either the government or a disinvestment with a rights offering is the only way out and that they may have already tipped over the line of safety.

Final Word

NEVER BUY A STOCK ONLY ON THE BASIS OF UNDERLYING RESERVES. The management will keep frustrating you until they have a HOPE of reviving the business. When reserves are lost so will be hope.

I express no views on the long term investing aspects of PSU banks; on the contrary, my short term view is that these banks could rally 20-30% from current levels (- 1 May 2014). I know plenty of investors who are convinced of a turnaround. When you are in the markets for the long term, remember one thing – you are looking for businesses that will succeed. Not businesses that succeeded in past.