Adani Wilmar Limited (“Adani Wilmar” or the “Company”) is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. The Company offer a range of staples such as wheat flour, rice, pulses and sugar. Its products are offered under a diverse range of brands across a broad price spectrum and cater to different customer groups. The Company is a joint venture incorporated in 1999 between the Adani Group and the Wilmar Group.

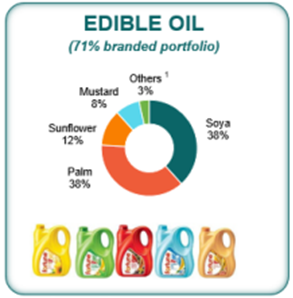

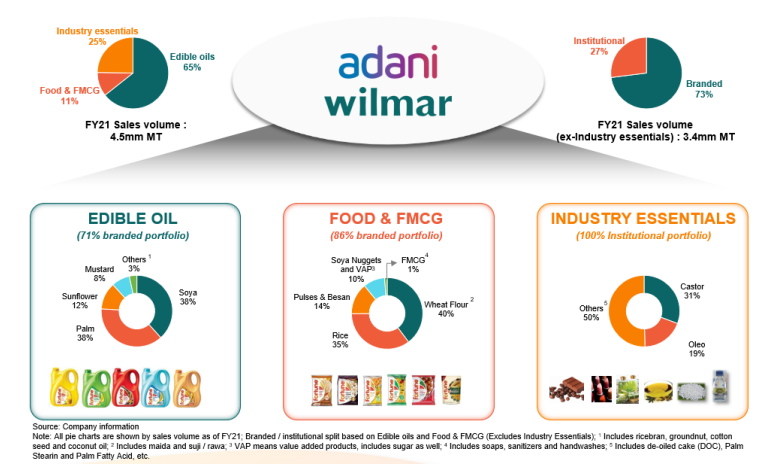

The Company’s portfolio of products spans across three categories: (i) edible oil, (ii) packaged food and FMCG, and (iii) industry essentials. A significant majority of its sales pertain to branded products accounting for approximately 73% of its edible oil and food and FMCG sales volume for FY2021.

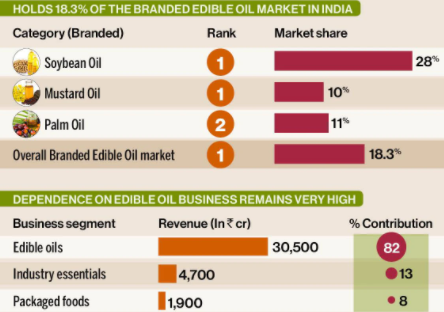

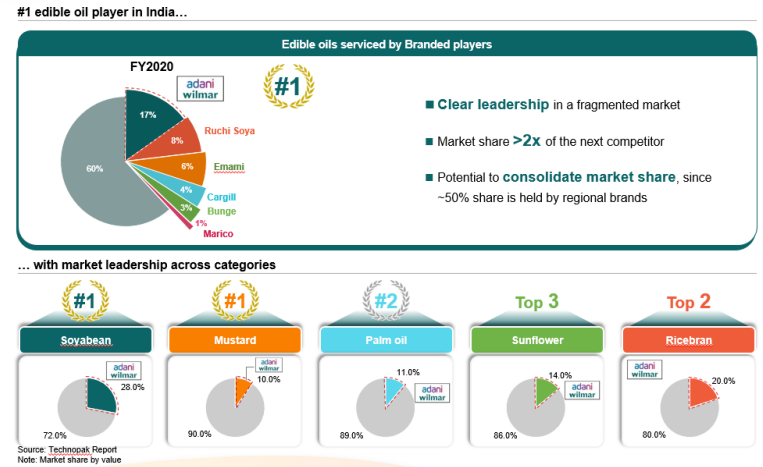

As of March 31, 2021, the Refined Oil in Consumer Packs (“ROCP”) market share of its branded edible oil was of 18.3%, putting it as the dominant No. 1 edible oil brand in India. “Fortune”, its flagship brand, is the largest selling edible oil brand in India. Adani Wilmar has also leveraged its brands and distribution network to offer a wide array of packaged foods since 2013, including packaged wheat flour, rice, pulses, besan, sugar, soya chunks and ready-to-cook khichdi.

Manufacturing Capacities – The Company operates through 22 plants which are strategically located across 10 states in India, comprising 10 crushing units and 18 refineries. Out of the 18 refineries, ten are port-based to facilitate use of imported crude edible oil and reduce transportation costs, while the remaining are typically located in the hinterland in proximity to raw material production bases to reduce storage costs. In addition to the 22 plants it owns, Adani Wilmar also used 28 leased tolling units as of March 31, 2021, which provided it with additional manufacturing capacities. Hence, the Company has and intends to continue to have an asset-light business model.

Distribution Network – the Company has the largest distribution network among all the branded edible oil companies in India. As of March 31, 2021, the Company had 5,566 distributors. Its distributors are located in 28 states and eight union territories throughout India, catering to over 1.6 million retail outlets. As of March 31, 2021, it also had (i) 85 depots, with an aggregate storage space of approximately 1.6 million square feet across the country; and (ii) 619 personnel in its sales and marketing team. The Company leverages its edible oil distribution network for packaged foods, and currently, it has approximately 65% of its edible oil distributors catering to its packaged food distribution.

In addition to traditional retail distribution channels, Adani Wilmar also serve its customers offline and online through Fortune Mart and Fortune Online and provide them with ease of ordering its products from home.

About the Offer

The Company will share shares at Rs 218-230 apiece in its three-day initial public offering that opens on Thursday, Jan. 27 and closes on Monday, Jan. 31. The IPO comprises a fresh issue of Rs 3,600 Cr. Adani Wilmar is seeking a market value of Rs 29,887.8 crore at the upper end of the price band. The company is offering 12% equity of the post-offer equity share capital of the company. The promoters will hold 88% at the end of the IPO.

Financial Performance

| Particulars | FY 2019 | FY 2020 | FY 2021 |

| Revenue (In Rs. Cr.) | 28,797.46 | 29,657.04 | 37,090.42 |

| Growth | – | 2.98% | 25.06% |

| EBITDA (In Rs. Cr.) | 1,131.24 | 1,309.53 | 1,325.32 |

| EBITDA Margin | 3.93% | 4.42% | 3.57% |

| EBIT (In Rs. Cr.) | 1,100.36 | 1,294.95 | 1,305.83 |

| EBIT Margin | 3.82% | 4.37% | 3.52% |

| PBT (In Rs. Cr.) | 567.25 | 609.01 | 756.64 |

| PAT (In Rs. Cr.) | 375.52 | 460.87 | 727.65 |

| PAT Margin | 1.30% | 1.55% | 1.96% |

| EPS (In Rs.) | 3.29 | 4.03 | 6.37 |

| EPS Growth Rate | – | 22.49% | 58.06% |

| Historic P/E (Closing Price of 31st Mar) | – | – | – |

| CURRENT P/E | 36.11 | ||

| Shareholder funds (In Rs. Cr.) | 2,111.01 | 2,570.70 | 3,298.14 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 1,740.92 | 2,161.22 | 1,629.45 |

| Cash (In Rs. Cr.) | 1,215.46 | 1,432.10 | 1,188.46 |

| D/E | 0.82 | 0.84 | 0.49 |

| Interest Coverage | 2.26 | 2.28 | 3.21 |

| ROCE | 29.37% | 27.67% | 26.90% |

| ROE | 17.79% | 17.93% | 22.06% |

INVESTMENT RATIONALE

Comprehensive B2C Packaged Consumer Products Portfolio

The Company focuses on offering a wide portfolio of packaged consumer staples, including edible oil, wheat flour, rice, pulses, besan, soya chunks and sugar, to consumers. The Company is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Essential commodities, such as edible oils, wheat flour, rice, pulses and sugar, account for approximately 66% of the spend on essential kitchen commodities in India. It offers a range of staples such as wheat flour, rice, pulses and sugar.

It also offers ready-to-cook soya chunks and khichdi. The edible oil products it offers include soyabean oil, palm oil, sunflower oil, rice bran oil, mustard oil, groundnut oil, cottonseed oil, blended oil, vanaspati, specialty fats and a series of functional edible oil products with distinctive health benefits, each catering to various price points. The Company has also included several value-added products, including ready-to-cook products and functional edible oil products, to its product portfolio in order to increase its market share.

Strong Brand Recall

“Fortune”, its flagship brand, is the largest selling edible oil brand in India. The Company’s strong brand recall has enabled it to market its products at a premium price. The Company is present in most of the packaged food categories through its “Fortune” brand. The brand structure using a single brand identity for multi-categories optimizes its marketing costs and enhances its brand equity. The Company has brands catering to various price points. “Fortune” with premium pricing and “Bullet” with value pricing – so as to optimize its customer reach, to have products for a diverse range of consumers and achieve better brand recognition. It has a number of masstige brands, including “Bullet”, “King’s”, “Aadhar”, “Raag”, “Alpha”, “Jubilee”, “Avsar”, “Golden Chef” and “Fryola”.

Market leading position in industry essentials

The Company is one of the largest basic oleochemical manufacturers in India in terms of revenue, and the largest manufacturer of stearic acid and glycerine in India with a market share of 32% and 23%, respectively.

Continue to Launch New Products and Enhance Its Customer Base

The Company plans to launch new products to capture consumer trends. The Company has been evaluating new products in adjacent categories, based on a set of criteria, including its ability to create a differentiated offering, competitive intensity, go-to-market capability, back-end product fitment, category, scale and profitability of the new products. The Company’s potential new products may include additional functional edible oils, cold pressed or infused oils, noodles and pasta, poha, biryani rice kit, masala oats and dalia, honey, instant dry mixes for idly, dosa, poha and khaman, Chinese, Mexican and Schezwan flavored rice, traditional savory snacks, biscuits, cookies, khari/rusks, low calorie sugar, vermicelli, cake mix, dishwash bars and floor cleaner. It expects new products to increase its market share and further expand its customer base.

E-commerce Channels

The Company adopts an omni-channel strategy to extend its customer reach. In addition to traditional retail distribution channels, the Company has been utilizing e-commerce channels. It has an exclusive website “Fortune Foods” showcasing the entire basket of products available under the Fortune brand. It has recently launched an online portal, Fortune Online, which is a one-stop-shop for all the products under the Fortune brand. In addition, it has partnered with certain e-commerce platforms, such as Grofers, and have a presence across major e-commerce platforms. Its online sales through e-commerce platforms increased by 53.30% from Rs.298.94 Cr. for FY 2020 to Rs. 458.28 Cr. for the FY 2021.

Rise in Raw Material

The high commodity prices have led to an exponential rise in raw material prices, which resulted in a decrease in its EBITDA margin in percentage terms for the same period.

SUBCRIBE. The demand for packaged foods in India is experiencing a rapid growth. Certain food categories, such as wheat flour and rice, which used to be predominantly sold in loose form, are being increasingly sold in packages. However, the penetration rate of packaged foods in India remains low, which provides significant potential for growth for packaged edible oil and food products. This is further supported by the favorable demographics with urbanization and rise in middle-class population, gradual expansion of modern retail including e-commerce, convenience and healthy eating trends.

A number of packaged food categories such as salt and edible oil have witnessed significant increase in the overall branded product usage. Similar trends are expected in various other large packaged food categories such as wheat flour, rice, besan and soya chunks in the coming years.

In addition to a wide variety of edible oil products and packaged foods, the Company recently launched FMCG, including soaps, handwash and sanitizers. The Company’s diversified product portfolio has enabled it to reduce reliance on a single category of products.