There has always been debate among investors about the ethic of charging a fixed management fee as opposed to a fee based on the performance of the fund manager. If an asset manager is sure about his ability, why not have an option like the one below:

Ill charge 50% profits over 10%; and share 50% of losses over 10%, or a similar ratio mutually decided.

At least I am not aware of anyone who works on this model. I don’t think there is anything in the law that prevents one from doing that; and I am also certain that whoever moves first with such a proposal is likely to change the playing field completely. It’s not like people invest on their own when markets are bullish and give money to asset managers when markets are slow. In any event, who has ever been able to predict the market on a yearly basis?

Nevertheless, we will restrict our enquiry to performance fee based PMS schemes and look at Alchemy Capital’s High Growth and High Growth – Select Stock PMS Strategies*

Essentially both the schemes work on high risk – high reward model and focus primarily on mid-caps. Here’s how the disclosure documents breaks things down:

| Large Cap | 25% – 100% | Market cap of 100th stock in the S&P BSE 500 is the cut off for large caps |

| Mid Cap | 0 – 75% | Market cap between 101st – 400th stock in the S&P BSE 500 is the cut off for mid cap |

| Small Cap | 0 – 20% | Market cap below 400th in the S&P BSE 500 |

While the approach may look very rigid in that the fund sticks to trying to find value in a restricted space of 400 stocks which are covered by every major fund house and investor, the fund has been able to generate very good returns over time.

| Period | Alchemy High Growth | BSE 500 | Nifty | Sensex | CNX midcap |

| 1 Mth | 0.9% | -1.0% | -1.6% | -2.4% | -1.3% |

| 3 Mth | 6.4% | 4.3% | 3.1% | 1.9% | 4.4% |

| 6 Mth | 14.2% | 13.0% | 11.7% | 10.4% | 10.9% |

| 1 Yr | 21.3% | 16.3% | 12.9% | 11.5% | 18.9% |

| 2 Yr | 16.9% | 14.3% | 11.5% | 9.9% | 18.3% |

| 3 Yr | 18.8% | 10.9% | 7.6% | 6.0% | 18.0% |

| 4 Yr | 28.6% | 19.8% | 16.0% | 14.3% | 29.1% |

| 5 Yr | 21.8% | 15.7% | 13.5% | 12.7% | 20.9% |

| 7 Yr | 16.6% | 9.5% | 9.1% | 8.5% | 11.2% |

| 10 Yr | 12.4% | 8.7% | 8.3% | 7.6% | 11.7% |

| Since Inception | 26.2% | 17.2% | 15.3% | 15.6% | 20.2% |

Main difference in the 2 strategies – A typical folio in High Growth Folio consists of 20 – 25 stocks and a typical folio in High Growth – Select Stock consists of 5 – 10 stocks.

Note: Unlike many other AMCs, Alchemy does not list out its stock holdings. It is possible for 2 clients to have different holdings in their portfolios.

| Period | Alchemy High Growth Select Stock | BSE 500 |

| 1 Mth | 1.1% | -1.0% |

| 3 Mth | 9.8% | 4.3% |

| 6 Mth | 18.2% | 13.0% |

| 1 Yr | 21.5% | 16.3% |

| 2 Yr | 19.8% | 14.3% |

| 3 Yr | 23.1% | 10.9% |

| 4Yr | 34.0% | 19.8% |

| 5 Yr | 26.3% | 15.7% |

| Since Inception | 25.7% | 16.2% |

Alchemy High Growth – Performance Fee Based Model vs. Fixed Fee Model

Typically, most mutual funds and PMS services work on a fixed management fee model (for more see here for another scheme – MOSL Value Stragey PMS Review where they charge 2-3% annually on the assets under management irrespective of the performance.

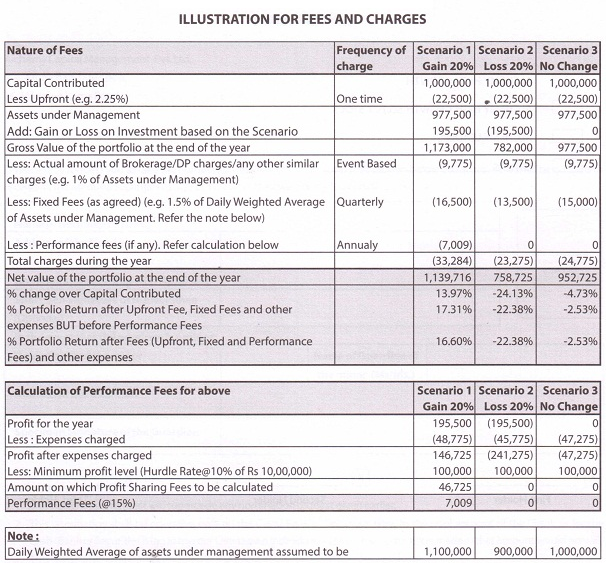

Alchemy also offers a fixed fee model and in addition offers a performance fee plan where the fund charges based on its performance. Typically the fund house charges – 15% of return above an annualized return of 10% (hurdle), at the end of every year starting from the date of client agreement.

The chart below highlights fees and charges of the scheme under various scenarios of market returns:

Note: We do not charge our clients the upfront commission of 2.25% in 2nd line item for investing in this scheme (or for that matter in any PMS Scheme). Feel free to call us and discuss.

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

In general, It is Impossible to save on the management fee (of~ 2.5%) by purchasing disclosed portfolio stocks on your own. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases.

________________

Lashit Sanghvi, Ashwin Kedia, Rakesh Jhunjhunwala and Hiren Ved founded Alchemy Capital Management in 1999.

* The fund also runs a 3rd strategy – Quest for the Best primarily focusing on large cap universe which is not covered in this post.

I hv invested at PMS of alchemy capital recently through an agent, but still no mail or SMS regarding my PMS