Note: The content of this article is suitable for investors looking to deploy capital in equities for 3-5 years, or longer. I will try to answer why I am staying away from equities these days, and why you should too. I am not a trader and do not operate any trading desk. This in no way affects my current strategy on portfolio allocation, including long term incremental investment in select equities. Much to the dismay of some people, I have not gone short on the market or any stock (other than on twitter).

It’s not a Bull Market, it is a Badly behaved Bull

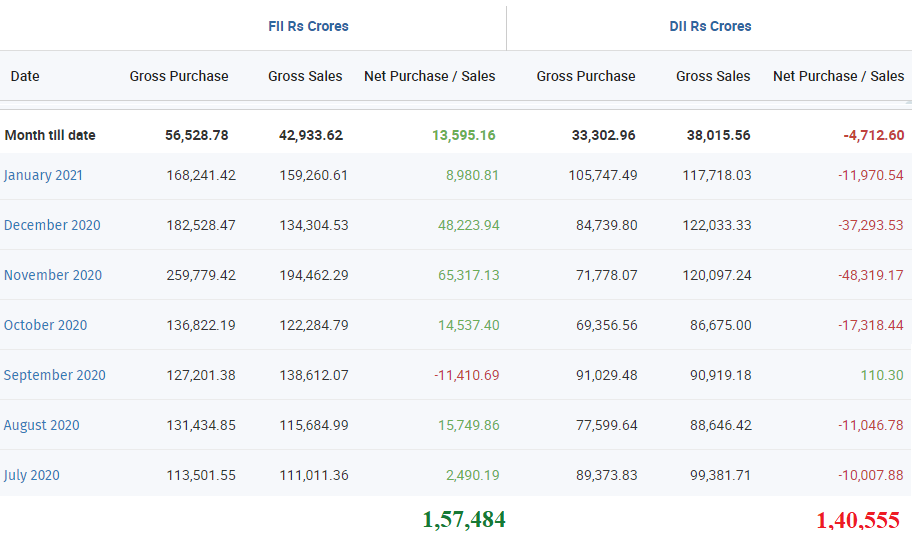

A true bull market is one where interest rates remain stable (or even rise) and yet the market keeps moving higher. That then will be a true sign of robust strong economy. What is instead happening right now is a sharp rise in stock prices which is accompanied by falling interest rates and massive fiscal stimulus from the United States.

Back home in India too, the RBI has maintained low interest rates and has assured of easy monetary policy until things get back to normal. No body wants to admit but in terms of getting out and doing things the way we did in past, we are already back to normal.

I will tell you what is not back to normal as yet – there has been mass unemployment and it will take some time for everyone who lost work to be gainfully employed again. There was a loan repayment moratorium which ended in August 2020. No one is yet sure about the true impact of that since borrowers could restructure their loans and pay back in up to 2 years. It will be interesting to see how corporate balance sheets shape up, particularly of NBFCs in the space of consumer lending.

It does not take deep analysis to comprehend that a lot of the debt issued by banks and financial institutions will go bad. It is a different matter that it is something no body wants to analyze or think about at this point. The focal point of my concern stems from this brushing aside of everything that has gone bad with feel good announcements and a mad liquidity driven equity market rush.

Bank NPAs and State of Corporate Balance Sheets – Exaggerated Debt Levels

Before the pandemic hit us in 2020, the state of banking in India was already very bad with banks reporting all time high NPAs. The Government was forced to merge unhealthy PSU banks with healthier ones. This resulted in 6 public sector bank NPAs being merged with 4 larger banks. Not that those 4 larger banks not have problems of their own – PNB, Canara Bank, Union Bank and Indian Bank. Prior to this many smaller banks were merged with SBI. Still there are the likes of IDBI Bank with gross NPA’s in excess of 27%.

In The Union Budget of 2021-22, the Government of India came up with an idea of setting up an Asset Reconstruction Company (ARC) (i.e. the so called Bad Bank). The intention is to take over all the stressed and non-performing loans of existing banks and dispose them off to whoever may be interested in buying them at best possible price. This at best is a feel-good agenda. Managing and selling bad loans at a good price is one of the core activities of a bank. Now we have a situation where banks will have more money to lend since bad loans are taken off, but the owner of these banks and the ARC remain the same – GOI. What gives?

Basically, now we have online wallets and a whole host of technology to transact with each other, NBFCs to do the lending and borrowing and a new ‘bad bank’ to manage NPAs. I wonder what traditional banks will do?

An even bigger problem is the ever growing debt level on the balance sheets of companies, particularly NBFCs which are facing tremendous redemption pressures, but nobody wants to talk about this either. Top bankers will tell you in private (and not in public) of the many skeletons in the cupboard. In fact, there was a reason why so many credit funds collapsed and why a big fund house (i.e. Franklin Templeton India) was forced to shut 6 of its debt fund schemes freezing Rs. 26,000 Crore of investor money. No body wanted to buy that debt, there was no market for it. If this is not a bad sign of corporate affairs, I wonder what is?

All Time High Valuations – Extremely Low Earnings

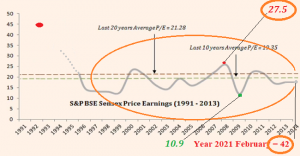

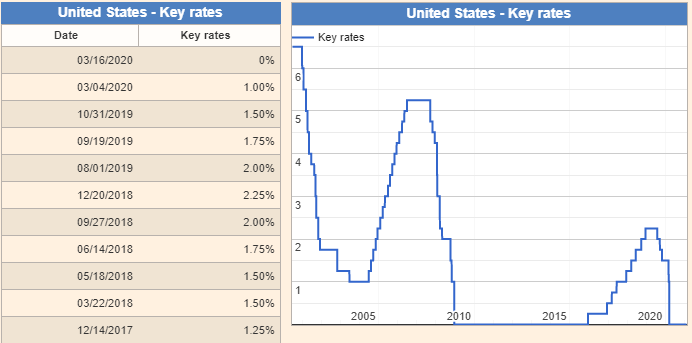

Never before have we seen Price to Earnings multiple on the Nifty climb to 42. In fact, until a few years ago, the long term average for trailing PE ratio on the Nifty was in the region of 19-22. Anything above this was considered expensive.

At 30, it was a unanimous view to look for shorting opportunities. Nobody Nobody told anyone about what to do above 40!!

Yet, investors and managers are trying to justify these valuations with all kinds of theories; my favorite one being – valuations are high because earnings have been low because of the pandemic and they will improve going forward. The truth is that even if earnings were to improve a full 100% for each of the next 4 quarters, we will still be expensive at current stock prices (and trade above that healthy PE of ~ 20). Stock prices must fall and fall a lot for things to look good for buying. Also keep in mind, that 100% corporate earnings growth has never and will never happen. For the past 30 years (i.e. 1990 – 2021), the average corporate earnings growth has been in the region of 12-14%.

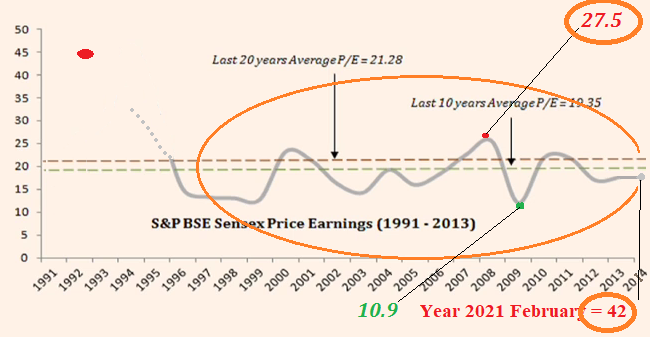

Strong FII Buying – The Trend will Eventually Reverse

Since July 2020 until now, FIIs have purchased Indian equities worth Rs. 1.57 lakh crore. While the complete stats are not available at this point, I can safely say that FII holding in Indian companies has jumped significantly from a year ago (when it stood ~ 20.04% in the Nifty 500 companies). In fact, recently I read a well-researched piece which found that FII holding had increased in 2 out of 3 Indian companies for the quarter ended December 2020. If past has taught us one thing, it is that FII money moves in and out rather quickly.

Most of this liquidity comes from countries where interest rates are near zero (like the United States of America).

Any upward revision in interest rates in those countries could increase the cost of funds for these FIIs by infinite percentage points. Redemption initiated by FIIs will surely cause a domino effect, particularly if this is coupled with any negative country specific news flow. Likely – Bankruptcies in the NBFC space.

You know what they say about trends – they reverse. FIIs will not be buying as aggressively forever, this trend will reverse. What then will support Indian markets? High valuations or even lower interest rates?

Much as I see some great companies trading at reasonable prices, I find it hard to convince myself to go out and buy them.

absolutely enjoyable reading

after three Decades Of knocking around EquityMarkets

One Realises “Black Swan”can materialise out of thin air

Never managed To earn As Much as The Smarter Investors

expensive Learning curve

Agree Completely about Bull Out Of Control

Bought petty quantities durin lockcdown(1)

did Not Sell at that time

raised cash Recently

Would wait for sanity to return

Intrigued by your Background

Good work Needs Appreciation

To speak RAW REALITY is courage. I am an avid fan of Rajat and this is NOT the first time his CONTRA thinking makes absolute sense. The use of words “it is a Badly behaved Bull” makes perfect sense.Rajat sir you have come a long way, and carry a RICH EXPERTISE, hats off to your candid opinion.

I can go on and on about you, but one word that sums you up is that you are fearless since you are ETHICAL at heart. After all, creating wealth is less important than PROTECTING the Wealth(Corpus) we have at hands! Your conviction stands apart as GREED is not a word from your dictionary. Please keep up the good work.

I will frame this comment 🙂 Thanks for your kind words