Sometimes it is hard for people to agree when you make a crazy sounding prediction, no matter how strong the facts backing you.

Telecom Stocks could correct by up to 80%.

The nature of technology is such that a minor up-gradation can often make redundant even the most well established businesses. From video/ audio cassettes, to CDs, to USBs, and finally to music apps, all off these were multi million dollar industries which rose and fell in just a little over a decade. Back in the year 2000, who would have thought that MTNL will loose its economic moat as a market leader in the telecom industry?

What’s the problem with Telecom Stocks

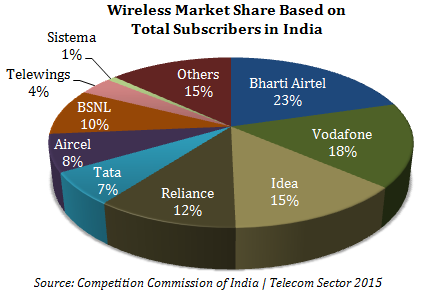

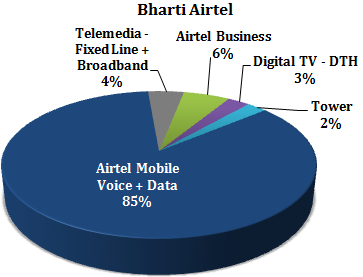

[I] Voice Calling Business is Over With internet becoming increasingly accessible, telecom business is undergoing a sea change. So far, telecom companies get a majority of their revenue from voice calling. Take the example of Bharti Airtel – the largest telecom operator in India with a 22.7% market share in the wireless market. Out of its total income from operation, 17.6% comes from data usage.**

** The revenue figure for data usage is based on Bharti Airtel’s annual report for FY 2015

I have not found any study with projections on how fast everyone will shift to whatsapp calling, which is free!! Here is my own guess, based on absolutely no in-depth research, just common sense – 12 – 24 months. Whatsapp calls are free world over and they are crystal clear, with no call drops.

And just in case – be sure that nobody will ever start charging for whatsapp calls. Just in case they do, many others are planning to come up with a very similar app (FOR FREE!).

The writing is on the wall – either find a way to get more revenue from data usage or be beaten out.

[II] Threat of New Entrants in Data Services

If new entrants can provide faster internet, the party for telecom companies could end pretty soon. Based on very credible knowledge I have reason to believe that a complete revamp of how we surf the internet is likely world-over. (This has nothing to do with Arvind Kejriwal’s free internet plans).

[III] Increasing Free Access

Even without the threat of new entrants, the business model itself faces a problem. Most places of work and recreation now provide free WIFI access which is unlikely to change. If telecom companies start charging higher for data, there is a very real possibility that data usage itself could fall significantly. To take an example – on an average day, I spend about 8 hours in office and 10-12 hours at home. Both my office and home have high speed internet by MTNL (I mean… as high as MTNL gets). Out of the balance 4-6 hours, I am either out driving or meeting a client/ friend for a meal (mostly at places with high speed WiFi access). In short, other than when I am driving, I really don’t use my mobile’s data service. Actually, I think even if I did not have data on my phone, I will be fine.

What Could Work for Existing Telecom Companies

[I] Existing Setup

An established business/ industry has a big advantage when it comes to diversifying or expanding into related lines. Not only do they have the requisite infrastructure, they also employ a large population of people. They are taxpayers and create wealth for the nation.

For these reasons they are in a better bargaining position with the government and with any potential competition to not only secure the first mover advantage but often to change the entire landscape to suit their existing setup. In a majority cases, a change in technology is spearheaded by existing players.

[II] Diversifying into New Lines of Business

With 100% market share (for industry as a whole), it is easier to start offering value added services like DTH television. Not only that, it is often easier to do things which under normal circumstances would have been frowned upon, if not declared illegal.

For example – charging differently to different clients, helping some websites to open faster than others for a higher fee from such websites. There is a reason why net neutrality is such a big issue. If Amazons and Flipkarts of the world start paying telecom companies to help load their pages faster than those of a newbie, they sure will be able to sell far more products at the expense of smaller businesses. This will help them create an industry wide monopoly for each other.

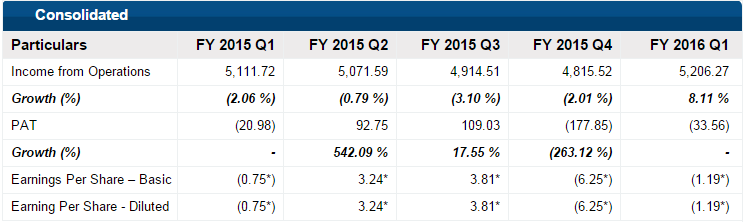

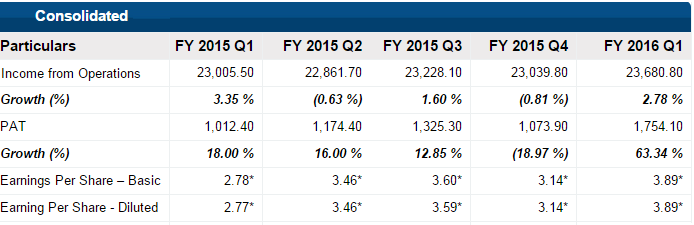

Financial performance and Revenue Breakup – (Listed) Telecom Stocks in India

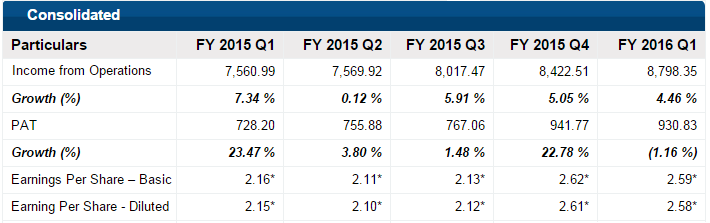

Bharti Airtel

Airtel Mobile: Voice and data telecom services provided through wireless technology (2G/3G/4G).

Telemedia: voice and data communications based on fixed line and broadband.

Digital TV: IncludeS digital broadcasting services provided under the Direct-to-home platform.

Airtel Business: End-to-end telecom solutions provided to Indian and global corporations by serving as a single point of contact for all telecommunication needs across data and voice (domestic as well as international long distance), network integration and managed services.

Tower: IncludeS setting up, operating and maintaining wireless communication towers in India.

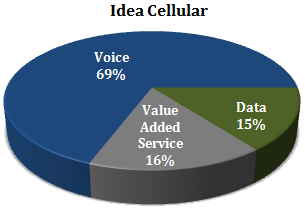

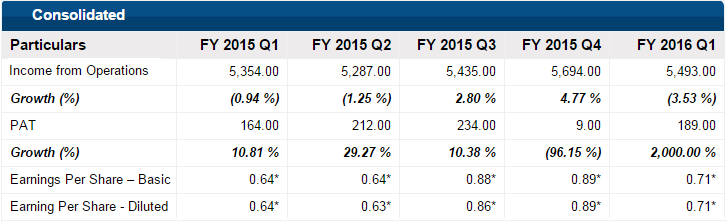

Idea Cellular

Voice – Includes call usage, voice carrier and inter usage connectivity etc in India and Outside India.

Data – data/ broadband services.

Value Added Service – revenue from SMS and voice based value added services.

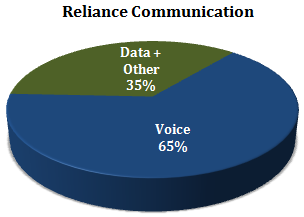

Reliance Communications

Voice – Includes call usage, voice carrier etc.

Non Voice – Includes data/ broadband services, tower infrastructure, handsets, optic fiber cables, direct to home services, internet data center, marketing, infrastructure services etc.

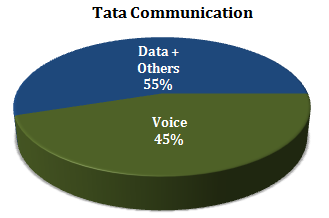

Tata Communications

Voice Solutions includes international and national long distance voice services.

Data includes corporate data transmission services data centers, virtual private network, roaming services, television and other network and managed services

Great analysis. Totally agree.

P.S – whatsapp call has some delay. imo/Skype is better I felt.

-Midhun

I think people tend to use whatsapp calling because they are so used to messaging over whatsapp. The new calling button had that advantage.

Either ways – bad news for telecom stocks.

Nice artilce, what would be the cannabalization impact on stocks lie Bharti Infratel?

Very interesting point to look into.

Would actually love to hear your views/ analysis on that.

Hi Rajat,

It is always insightful to read your blog. I am with you on your prediction. I have not touched Telecom stocks since last 5 years. I am from tech background and conquer with your view of reducing net revenue from calls. Wifi will be omni present as well. Reliance JIO launch will bring the crash to some level.

Keep writing.

Thanks Keshav…

Your view though myopic i.e. your example where you mention your usage of Wifi at Home, office restaurants cannot be generalised now at the moment because of all my friends and colleagues, I and a handful of us use wifi. Even though there is Wi-Fi available in our cafeteria, no one bothers to seek the password as it iis a tedious process. Moreover the connectivity is an issue. We do not have wifi in our office i.e. in Cognizant. Amongst the people I interact with, my family, colleagues, our servants, all use mobile internet. I believe that WiFi is a beginning. It’ll take a decade for it to spread in full throttle that too in urban areas only. It may take another decade or more for it to spread in the rural areas.

The real threat and disruption would be Google where it plans to provide free internet to the world. If that is realised, then even telecom would turn extinct. However, it’s a long way to go.

Interesting points Kamal. This is how far Google has come with its Fibre plans – https://en.wikipedia.org/wiki/Google_Fiber

Is this a good time to go short on r-comm?

Hi Mrinalini – the perspective above is about telecom sector as a whole with a 2-5 year time horizon. Over that period, I believe all stocks in this sector will decline substantially.

But again….when exactly dose this start to happen? May be a year or 2 from now, who knows.

As for shorting…….over this quarter and the next one, there is high likelihood that some of these telecom stocks may actually rise substantially. For example, given the way Airtel in particular has advertised their 4G plan, I believe that a lot of people must have gotten fooled into switching over to Airtel. So here is a contrary view to my own view above – Expect the immediate and next few quarter financials to be fairly healthy particularly how they are charging for the so called 4G service- I think its daylight robbery……anyways, I expect the next few months to be dominated by Idea, Vodafone, r-comm etc. By now there must be plenty of subscribers frustrated with Airtel, the environment is ripe for other providers to make a push 🙂

Hello Rajat,

This is a nice blog and analysis on Telecom sector,

But I feel the views and experiences here are considering only in metro cities or state capital levels. But there is still most of India I not covered by Wi-Fi, where the option is to use private sector telecom operator, in fact govt also encouraging private sector only,

Why would you suggest??

Thank you

You are right Anil.

Most of India is not yet covered by WiFi. That said, my views above are based on what I believe will happen to the telecom sector over a longer term of anything between 2-5 years. A few points are worth noting here:

[1] How long do you think it will take for WiFi to arrive in smaller cities / rural areas? 2 years, 5 years? Personally, I think something between 2-5 years which leaves these companies very little time. 5 years from now all calls will be made using the internet. I hope none of us are disputing that.

[2] Telecom is going through a major shift. For these companies to survive, they must become data providers. In that, they will have to potentially compete with products like Google Fibre in future. I seriously doubt if any level of government incentives/ intervention will help them. It’s pretty clear to me that they have to enter newer business verticals for survival; particularly broadband.

[3] WiFi is usually shared in public spaces, unlike call services (which subscribers need to have independently for their devices). Even if the present day telecom companies become market leaders in providing broadband services, will everyone subscribe? I think at best multiple people will subscribe together. What I am talking about is entire buildings and complexes getting common WiFis.

[4] Too big to fail – A few days back I discussed this with a friend of mine who said this – ‘these companies cannot fail, they are too big, they employ thousands of people and pay a lot of taxes to the government. The government cannot afford to let them go down’.

It is true that companies, once they become ‘too big’ enjoy the patronage of the government. Look at history and you will find that no one is too big to fail. If the world operates on fast fibre lines, I don’t think anybody would doubt that India too will make that switch. Sure, these companies may have the first mover advantage of switching over into a new business which may be related to data or broadband but usually in such a situation all empirical evidence suggests that they are more likely to fail. It’s always the newer guys who come in with a better product and an original idea which succeeds. But again, what’s the big deal, it wouldn’t be the first time that an industry suffers because of up-gradation of technology.

About Free Internet

Personally, I believe that the government will benefit more by giving out free internet to the whole country especially in today’s technology backed startup ecosystem. As I mentioned on twitter yesterday, I know a gardener who cross-breeds beautiful new plant varieties. Imagine if people like him can start websites and start selling across the world how much more tax could the government collect? Imagine how many jobs can a billion plus Indians create by putting their ideas out to the world. All they need is a smart-phone and free internet. Why charge for this? Anyways, in writing all of the above, I may have had this last bias!

Hi,

A very interesting write up here Mr Rajat Sharma, well elucidated points.. except I completely disagree and hold a very different view in that Telecom stocks are not going to die and vanish off in next 2-5 years.

Would want to state my POV in defence of (much maligned!!) telcos:

* In Long Run, let me agree and even assert that Data will dominate and data-fication of all telecom traffic (be it wifi or google fiber or telecom or whatever) is certain. But lets first define long run. 2-5 years is too small period, we should look at a longer period 10-12 years. People take time to change trends and to adapt to making calls from Skype and yes it took 10-12 years from mid 1990s for people to abandon Landlines and adopt Mobile phones.

*In Long Run, Optic-Wired Fiber with Wifi Extender will provide cheaper and better way to conduct/transmit/communicate data between mobile devices than Wireless Spectrum (be it 3G or 4G), but this is “LONG RUN” and would respectfully disagree if anyone says Long run is 2-5 or even 10 years. The State of Fiber optic connectivity is pretty, pretty bad even in big metros and a few well connected neighborhoods populated by yuppies in Big Indian metros is not and never an indicator. Bulk of customers of Airtel and other mobile cos, live in Bharat, not India. Yes, huge investment is going into connecting all villages and by 2020 lot of villages should be technically connected to national internet fiber network but that is just one piece.

Real Issue is connectivity of devices to this network. This is not going to happen within a few years in all places in India , and a few thousand railway stations, cafeterias and restaurants do not represent geography of entire india.

Which comes to real point. Free Wifi etc etc all fine in theory but fact is huge investment is needed in fiber though it is one time in nature. Who will foot the bill. A few cafeterias, universities, restaurants and malls will surely provide free Wifi but experience in India suggests that anything provided Free sees excess demand and quality drops terribly and connectivity (speed) falls so the value of free good diminishes. Expect same w.r.to free Internet by likes of FB and Google and they too will max be able to cover 2-5% of India’s geography

So I rest my argument that complete Fiber +WiFi connectivity across all geographies of India (80%+)to extent that you can do away with wireless spectrum is atleast 20-25 years away and even that will never be free and people will be charged indirectly.

* And that comes to the real issue. What is mobile phone? People want continuous connectivity wherever they go and yes this connectivity is now mostly voice and 10-12 years will be wholly data. But the fact is customers will be ready to pay a small price (200 p.m is very reasonable) to ensure continuous and consistent connectivity for various uses. Which is precisely the business case for Mobile Telcos

So to summarize – LT Fiber+WiFi is going to spread and dominate and in MT Data will trump voice but the case of Mobile Telcos remains intact. Yes, they need to change a lot in business model and current profitability could be under pressure but to write off Mobile telcos is like saying let us stop making ICE Engines since Tesla is here. The main challenge is Telcos should adopt continuously else they will become MTNL. MTNL failed not because telephony went extinct, because they failed to adopt and were stuck with a cost structure (huge staff paid high) which they couldnt do away. Feel Indian Telcos despite some failings will not go MTNL way but rather will try to adopt with varying results.

* Seeing the huge obstacles faced by Reliance Jio or even BharatNet in laying cables (from local authorities) it is doubt ful if a a MNC like Google would be able to afford the capex and time and resources to wire every part of globe and provide internet for free.

PS – I would also like to mention about IOT (Internet of Things) which could mean a huge range of appliances/devices needing connectivity and not all could do it through a fiber+Wifi. Think of transportation vehicles!!. So you would still need wireless spectrum for data communication and telcos could have a business case even after 90-95% of India’s geography is connected by some kind of Fiber+WiFI. And with this goes my very long term prediction – People+Devices will use Fiber+Wifi for communication when resting in any place (Home/Office) but when on move/travelling/commuting people+devices will use wireless spectrum and the latter segment will what Telcos largely cater in future!!

I would also like to comment on the Airtel 4G especially in the context of huge ad campaign they’ve done. I strongly suspect that the real intention of Airtel 4G is not to prove themselves as the “Internet Speed Champions” of India in any way but to rather pre-empt customer expectations out of 4G, and this in turn will directly impact their competitor to be , Reliance Jio. A lot of frustrated customers of 4G could very well say to hell with 4G, no let me stick to GPRS/3G or find a fiber provider. And given that Reliance as a brand has never the kind of mindshare in B2C segment I feel they succeeded (in a negative way, but yes that is business). And meanwhile the rollout delays of Jio persist, kind of showing how hard it is to put any infrastructure in place even if you have the kind of huge capital + corporate power that Reliance Industries has!!

Very good post.

Have one question. If that is happening with internet and telecommunications companies. May be they will come up with WiFi networks. If I am not wrong, Airtel have home WiFi and Vodafone also.

What about them?

Vodafone is coming up with IPO, will they just cancel it?

You are talking about Metros. In small cities like mine. Hardly any free WiFi is available. So may be they will alive with help of this.

But the biggest question is

Who will become supplier of WiFi?

Google? Microsoft? Apple?

Will they list themselves on Indian bourses?

What will happen to the investors who don’t have knowledge about all this crap?

Will MTNL gain old golden days?

Pls comment.

Rajat, ur writeup is a pleasure to read with a lot of information packed in a few paragraphs. The graphical representation adds a lot to value. I do not know where do u get them from but i am happy and wish you the best for ur efforts

Thanks Saurabh.