It is human to think that nobody will care about your money as well as you can. In reality, for most people such thinking leads to the construction of some of the most disgraceful portfolios. Over the past month or so, I have seen portfolios of excellent stocks that are down 30-50%. I have also seen portfolios made up of horrible stocks down about the same. What separates these portfolios is two things:

- The fact that excellent stocks will bounce back excellently, while horrible ones will fall horribly, even going forward. That fall in the price of excellent stocks is temporary and in case of latter, it is mostly permanent.

- Timing: at what price did you purchase the stock/ constructed this portfolio determines the future of your portfolio.

I have always believed that earning 8% in overvalued markets for 2-3 even 5 years is a far better idea than earning 15-18%. Eventually, fixed returns will beat stock market returns if you get your purchase right.

Consider this:

In an overvalued market, you choose to stay invested in fixed income and make 8% every year. At the end of 3 years, you will make ~125 on an investment of 100.

In an overvalued market, you choose to invest in stocks growing at 15%. At the end of year 3, you will never reach 125, no matter in which of the three years does market fall even a minor 10%. Market does fall 10% once in every 3 years. . .. and this is being very conservative. It actually falls a lot more.

I had covered this point in some detail in this 6-month-old article, which seems like it was written more than 6 years ago. Let me assure you that nothing has changed since then. Read Here – Financial Advisors are for your benefit – Here’s What You Should Know

Solution?

A few days back, I asked this question:

The answer to this is simple – Asset Allocation and a good financial advisor.

Read this carefully: A good financial advisor will first gather your personal and financial data and then will use this data to create projections that show you when and how you can accomplish your goals. These projections are based on a set of realistic assumptions about inflation, investment returns, how much you can save, and how much you will earn and spend. Naturally, a lot of your personal circumstances go into these calculations. 98% times what I experience is that investors are neither aware of where to invest nor of their personal circumstances. Interestingly however, they are all aware that they can save 1% by doing all of this themselves.

Advisors may not always provide market-beating performance, but they can provide holistic guidance that will help you build your portfolio much better over the long term. From experience I can tell you that timing is super important, even average securities selected in the right asset class have outperformed the best of securities selected in the wrong asset class. With all the defaults in the debt space, investors wish they had not sold those bonds and debt funds and FDs and had not invested in stocks as early as they did.

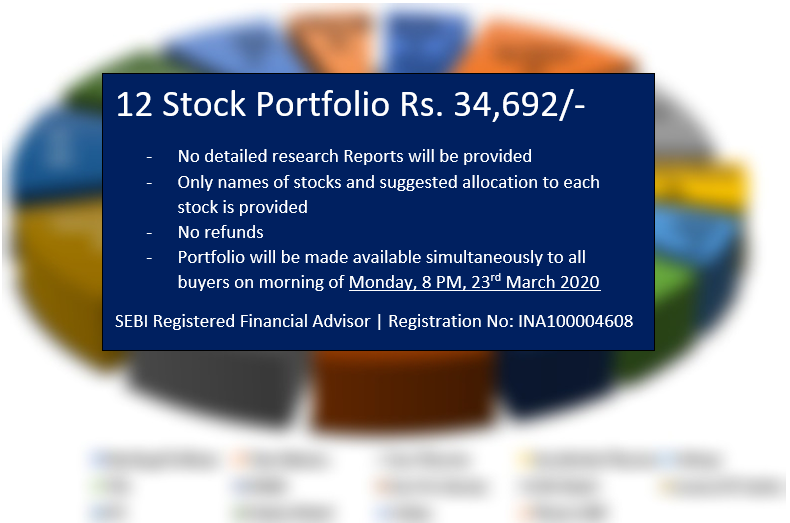

Now then, there should be a switch, if you do not buy stocks now, you never again should. As an experiment, I have created a portfolio of carefully selected 12 stocks which you should buy in these markets and do nothing with this portfolio for the next 5 years (Also: Includes 2 more Bonus special situation stock recommendations).

Expected Return: 18% + CAGR for the next 5 years. In case of interest, you can purchase this portfolio here.

CLICK ON THE IMAGE BELOW TO SUBSCRIBE

For any questions before subscribing, write in to info@sanasecurities.com