Astrazeneca Pharma India Limited (“Astrazeneca” or the “Company”) covers the manufacturing, sales and marketing activities of the company in India.

The Company is committed to deliver life-changing medicines to patients through innovative science and global excellence in development and commercialization.

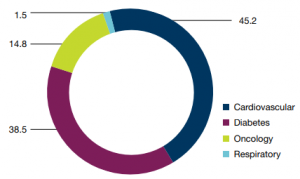

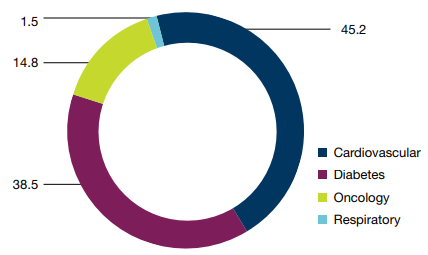

The Company has an innovative portfolio in crucial areas of healthcare including cardiovascular, renal & metabolic diseases, oncology and respiratory.

Financial Performance

| Particulars | FY16 | FY17 | FY18 | FY19 | FY20 |

| Revenue (In Rs. Cr.) | 563.73 | 543.71 | 571.00 | 728.29 | 831.81 |

| Growth | – | -3.55% | 5.02% | 27.55% | 14.21% |

| EBITDA (In Rs. Cr.) | 16.42 | 36.94 | 46.29 | 71.30 | 120.69 |

| EBITDA Margin | 2.91% | 6.79% | 8.11% | 9.79% | 14.51% |

| EBIT (In Rs. Cr.) | -1.01 | 21.11 | 31.55 | 56.38 | 102.11 |

| EBIT Margin | -0.18% | 3.88% | 5.53% | 7.74% | 12.28% |

| PBT (In Rs. Cr.) | 5.76 | 35.50 | 43.80 | 72.67 | 113.96 |

| PAT (In Rs. Cr.) | 5.26 | 20.05 | 25.91 | 54.45 | 72.21 |

| PAT Margin | 0.93% | 3.69% | 4.54% | 7.48% | 8.68% |

| EPS (In Rs.) | 2.10 | 8.02 | 10.36 | 21.78 | 28.88 |

| EPS Growth Rate | – | 281.18% | 29.23% | 110.15% | 32.62% |

| Historic P/E (Closing Price of 31st March) | 547.77 | 116.61 | 89.50 | 89.96 | 77.71 |

| CURRENT P/E | 122.03 | ||||

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| ROCE | 10.52% | 16.57% | 18.75% | 23.70% | 33.12% |

| ROE | 3.37% | 9.00% | 10.49% | 18.10% | 19.81% |

Quarterly Performance

| Q4 FY 2019 | Q1 FY 2020 | Q2 FY 2020 | Q3 FY 2020 | Q4 FY 2020 | TTM | Q-o-Q % | Y-o-Y % | |

| Revenue | 190.30 | 204.56 | 208.48 | 223.86 | 194.90 | 831.80 | -12.94% | 2.42% |

| EBITDA | 6.37 | 35.57 | 33.56 | 36.76 | 14.78 | 120.67 | -59.79% | 132.03% |

| EBITDA Margin | 3.35% | 17.39% | 16.10% | 16.42% | 7.58% | 14.51% | ||

| PAT | 9.82 | 21.52 | 14.42 | 26.70 | 9.58 | 72.22 | -64.12% | -2.44% |

| PAT Margin | 5.16% | 10.52% | 6.92% | 11.93% | 4.92% | 8.68% | ||

| EPS | 3.93 | 8.61 | 5.77 | 10.68 | 3.83 | 28.89 | -64.12% | -2.44% |

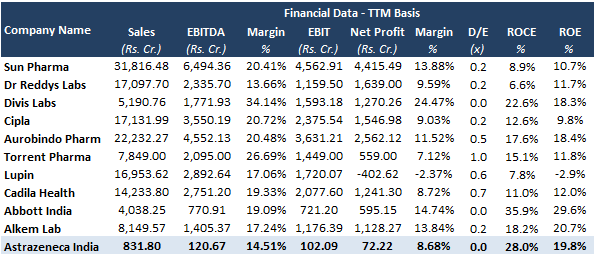

Peer Comparison

INVESTMENT RATIONALE

Share Price In Action Due To COVID-19

Over the last 1 month, the stock price has appreciated by ~20% due to the positive sentiment driven by hopes that the Company will benefit from its parent’s covid-19 vaccine candidate that is being developed with the University of Oxford.

The Company mentioned that it has not received any communication from its parent on vaccine trials and that the development is being handled at its headquarters in Cambridge, UK. The only India connection to the vaccine trial is that the Company’s parent along with the University of Oxford has signed a pact with Serum Institute of India for production and supply of the vaccine to the US and UK.

On 4th June 2020, Astrazeneca plc announced a $750m agreement with Coalition for Epidemic Preparedness Innovations (CEPI) Gavi the Vaccine Alliance, and the Serum Institute of India. Under the licensing agreement, Serum Institute will supply 1 billion doses for low and middle-income countries, with a commitment to provide 400 million before the end of 2020.

Launch of New Drug Qtern

In March 2020, the Company launched Qtern, a combination of its two innovative drugs dapagliflozin and saxagliptin, for the treatment of type 2 diabetes. Dapagliflozin is part of a new class of anti-diabetes drugs called SGLT-2 inhibitor, which help patients achieve improved control in blood sugar levels.

INVESTMENT CONCERNS

On 7th June 2020, SEBI has strongly “censured” Astrazeneca Pharma India Ltd’s promoter and Elliot Group for professional misconduct and following unfair trade practises during the company’s delisting plan in 2014. SEBI, in a 65-page order, said that Astrazeneca Pharma India Ltd’s promoter AstraZeneca Pharmaceuticals AB Sweden, and Elliott Group, which held 15.52% stake in the Company, had a ‘private arrangement’ to sail through the delisting process. It further mentioned that the entire process was intended to jeopardize the interests of retail public shareholders and investors of the company at large.

Expensive Valuation

The Company is trading at price to earnings (P/E) ratio of 122.03x, nearly five times the industry P/E of 24.2x.

Highly Regulated Industry