Bajaj Finance is a NBFC with focus on retail lending for purchase of consumer durables, housing loans and SMEs. The Company is the dominant player in the consumer durable financing segment and continues to increase its market share in the consumer business.

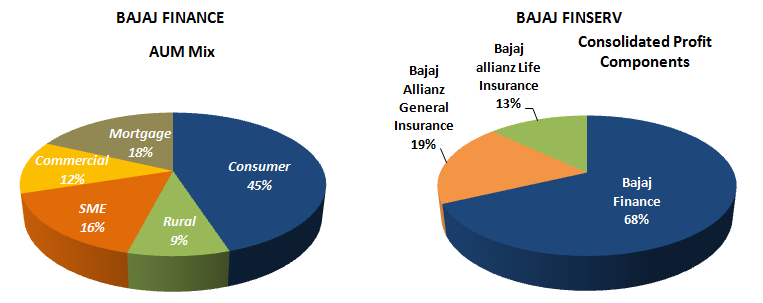

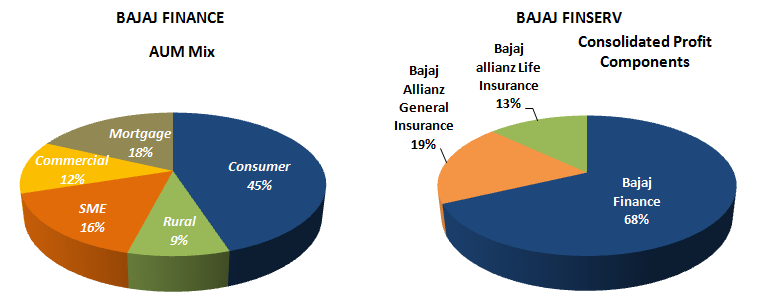

The key thing to watch in Bajaj Finance has always been the loan growth. AUM grew 41% to Rs. 115,888 Cr. in Q4FY19, led by SME and consumer segment. SME grew 38% YoY to Rs. 15,759 Cr. and consumer by 45% YoY to Rs. 44,989 Cr.

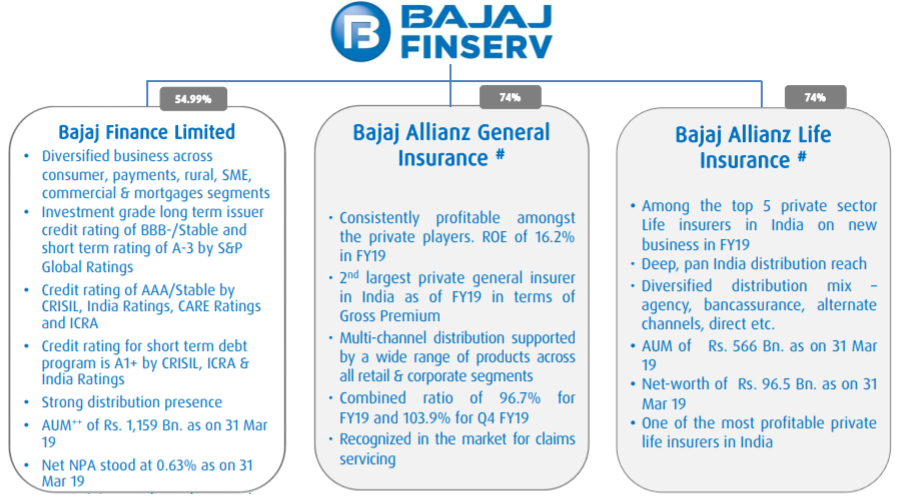

Bajaj Finserv is a holding company of Bajaj group that holds stake in financials and insurance companies of the group like Bajaj Finance (54.99%), Bajaj Allianz Life insurance (74%) and General Insurance (74%).

For Bajaj Finserv, the new business premium growth in insurance business is the key thing to watch.

Read More – Bajaj Finance Stock Analysis

Read More – Bajaj Finserv Stock Analysis

Difference – Bajaj Finance and Bajaj Finserv

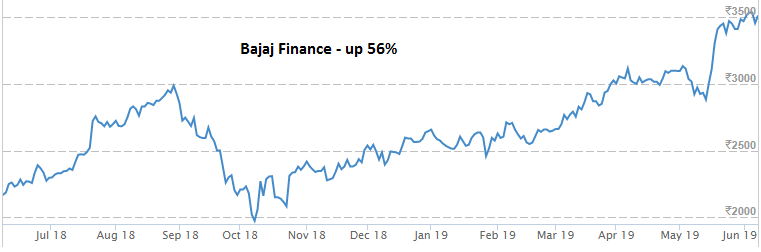

Share Price Performance – Bajaj Finance and Bajaj Finserv

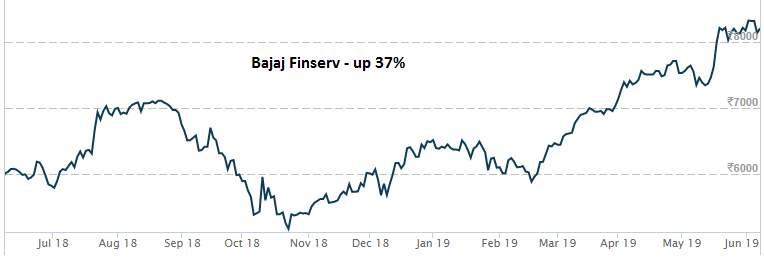

In last one year, both Bajaj Finance (up 56%) and Bajaj Finserv (up 37%) have outperformed the Sensex.

Interesting Fact – Bajaj Finance has become larger than most banks in India. As on 10th June, 2019, only five banks have market cap that exceeds that of Bajaj Finance. These are State Bank of India, HDFC Bank, ICICI Bank Kotak Mahindra Bank and Axis Bank.

Top 10 Private Banks by Market Cap

| Name | Price

(In Rs.) |

Market Cap. (In Rs. Cr.) |

| HDFC Bank | 2,440.20 | 664,965.27 |

| Kotak Mahindra | 1,502.60 | 286,833.93 |

| ICICI Bank | 416.10 | 268,340.04 |

| Axis Bank | 814.15 | 209,479.34 |

| IndusInd Bank | 1,551.65 | 93,559.59 |

| Bandhan Bank | 552.45 | 65,911.86 |

| Yes Bank | 135.90 | 31,486.19 |

| RBL Bank | 669.65 | 28,608.21 |

| Federal Bank | 105.40 | 20,925.38 |

| IDFC First Bank | 42.20 | 20,180.24 |

Top 10 NBFCs by Market Cap

| Name | Price

(In Rs.) |

Market Cap. (In Rs. Cr.) |

| HDFC | 2,196.50 | 378,237.66 |

| Bajaj Finance | 3,520.90 | 204,174.95 |

| Indiabulls Hsg | 733.05 | 31,330.80 |

| LIC Housing Fin | 550.25 | 27,769.08 |

| M&M Financial | 417.45 | 25,788.60 |

| Muthoot Finance | 642 | 25,722.46 |

| L&T Finance | 124.1 | 24,814.23 |

| Shriram Transport | 1,075.20 | 24,394.43 |

| Cholamandalam | 1,465.25 | 22,910.52 |

| GRUH Finance | 300.5 | 22,047.31 |