The Company has a diversified lending portfolio across retail, SMEs and commercial customers. Bajaj Finance also operates through a 100% subsidiary called Bajaj Housing Finance Ltd. which is registered with National Housing Bank as a Housing Finance Company.

Current Price – Rs. 3,440

Bajaj Finance focuses on six broad categories:

(i) Consumer Lending, (ii) SME Lending, (iii) Commercial Lending, (iv) Rural Lending, (v) Deposits, and (vi) Partnerships and Services.

- Consumer Business –

- Present in 927 locations with 74,400+ active distribution point of sale

- Largest consumer electronics, digital products & lifestyle products lender in India.

- Two wheeler financing business contributed to 44% of Bajaj Auto’s domestic two-wheeler sales in Q4 FY 2019.

- Three wheeler financing business contributed to 39% of Bajaj Auto’s domestic three-wheeler sales.

- Rural Business –

- Highly diversified lender in the rural locations offering 10 loan products in consumer and RSME business categories with a unique hub and spoke business model.

- Geographic presence across 903 towns and villages with retail presence across 14,500+ stores.

- SME Business –

- Focused on affluent SMEs with average annual sales of Rs. 10-12 Cr.

- Offer a range of working capital products to SME & self employed professionals.

- Commercial business –

-

- Offer wholesale lending products covering short, medium and long term needs of Auto component, Light Engineering and Specialty Chemical companies and financial institutions in India.

- Offer a range of structured products collateralized by marketable securities or mortgage.

- Payments –

-

- EMI Card franchise crossed 18.7 MM cards in force (CIF)

- Bajaj Finserv – RBL Bank co-branded credit card CIF stood at 10.53 Lacs as of 31 Mar 2019

- Bajaj Finserv Mobikwik app has 8.3 MM active users as at 31 Mar 2019 who have linked their EMI card to the wallet

Financial Position

| Particulars | FY15 | FY16 | FY17 | FY18 | FY19 |

| Revenue (In Rs. Cr.) | 5,418.28 | 7,383.66 | 9,992.19 | 12,744.41 | 18,485.09 |

| Growth | 33.02% | 36.27% | 35.33% | 27.54% | 45.04% |

| EBITDA (In Rs. Cr.) | 3,640.82 | 4,947.87 | 6,692.29 | 8,546.98 | 12,930.20 |

| EBITDA Margin | 67.20% | 67.01% | 66.98% | 67.06% | 69.95% |

| EBIT (In Rs. Cr.) | 3,605.22 | 4,891.53 | 6,621.12 | 8,444.91 | 12,786.05 |

| EBIT Margin | 66.54% | 66.25% | 66.26% | 66.26% | 69.17% |

| PBT (In Rs. Cr.) | 1,356.95 | 1,964.68 | 2,817.41 | 3,843.44 | 6,179.16 |

| PAT (In Rs. Cr.) | 897.88 | 1,278.63 | 1,836.38 | 2,496.37 | 3,994.99 |

| PAT Margin | 16.57% | 17.32% | 18.38% | 19.59% | 21.61% |

| EPS (In Rs.) | 17.90 | 23.73 | 33.40 | 43.92 | 68.75 |

| EPS Growth Rate | 25% | 33% | 41% | 32% | 57% |

| Historic P/E (Closing Price of 31st March) | 22.95 | 29.17 | 35.07 | 40.24 | 44.00 |

| PEG Ratio | 0.92 | 0.88 | 0.86 | 1.26 | 0.77 |

| CURRENT P/E (based on price of 24th May – Rs. 3,466.15) | 50.42 | ||||

| CURRENT P/B (based on price of 24th May – Rs. 3,466.15) | 10.17 | ||||

| Book Value Per Share | 95.71 | 137.86 | 174.59 | 274.20 | 340.80 |

| D/E | 4.71 | 4.99 | 5.13 | 4.20 | 5.16 |

| Interest Coverage | 1.62 | 1.69 | 1.76 | 1.85 | 1.95 |

| ROCE | 13.16% | 11.00% | 11.25% | 10.25% | 10.54% |

| ROE | 28.27% | 26.45% | 29.35% | 24.25% | 31.37% |

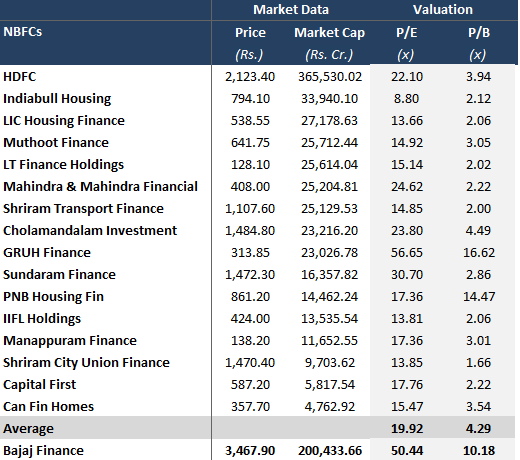

Peers Comparison

WHAT’S DRIVING THE STOCK?

Well Diversified NBFC

Bajaj Finance has emerged as one of the largest retail asset financing NBFCs in India. The Company offers wide range of products to its customers through multiple segments which includes products such as consumer durable loans, digital product loans, lifestyle product loans, 2-wheeler and 3-wheeler loans, salaried personal loans, e-commerce consumer finance, working capital loans, loan to professionals, commercial loans, gold loans, home loans etc.

Robust Financial Position

Bajaj Finance has maintained its robust growth trajectory, with deepening geographical penetration and increasing repeat business. In Q4 FY 2019, Bajaj Finance posted a net interest income of Rs. 3,395 Cr. in, up 50% on a year-on-year (y-o-y) basis.

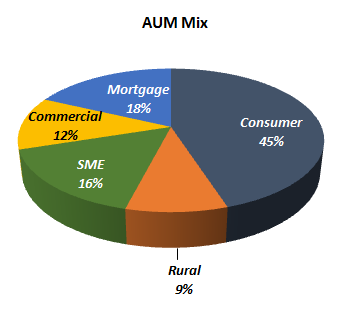

Strong AUM Growth

AUM grew 41% to Rs. 115,888 Cr. in Q4FY19, led by SME and consumer segment. SME grew 38% YoY to Rs. 15,759 Cr. and consumer by 45% YoY to Rs. 44,989 Cr. The Company has maintained a largely stable AUM mix – Consumer Finance: 39%, Mortgage: 29%, SME: 14%, Commercial: 10% and Rural: 8%. Strong growth in new customers, expanding cross sell base, along with product and geographic expansion has helped the Company to drive strong, sustainable loan growth. Existing customers contributed to 65% of new loans booked during FY19 vs. 60% in FY18.

Stable Asset Quality – Asset quality remained stable QoQ with GNPA ratio at 1.54% and NNPA ratio at 0.63%. Bajaj Finance’s asset-liability profile is comfortable. As on March 31, 2019, till August 31, 2019, the Company has debt repayments of Rs 12540 Cr. of which commercial paper repayments are around Rs 7695 Cr.

Management Guidance

- Targeting 8-10% market share in the housing finance business over the next few years.

- Mortgages will account for 36-38% of total AUM in 3-4 years and commercial lending would be 12-15%.

- Steady state RoA to be 3.2-3.5%.

Well Diversified Funding, Strong Parentage, Credit Rating

The borrowings of Bajaj Finance as on FY19 were at Rs. 101,587.85 Cr. The borrowings are well diversified with NCDs proportion the highest at 38% followed by banks at 34% and CPs/FDs at 26%. This is owing to strong parentage and credit rating (consistently holding AA+/stable and LAA+ stable rating from Crisil and Icra over the last seven years, with a positive outlook). Further, the fixed deposit scheme has been rated FAAA/Stable by Crisil and MAAA/stable by Icra). The Company is able to raise funds at competitive rates from various sources.

WHAT’S DRAGGING THE STOCK?

Continued stretched valuations

Management Outlook – Consumption outlook appears slightly slower currently v/s 6 months back

Witnessing reduced competitive activity in 2W financing

Average ticket size in business loans declined from Rs. 2.4m four years back to Rs. 1.6m two years back to Rs. 0.7m now.

What is the intrinsic value of the stock? Or what will be the price/value in 2025?