2nd May 2016

This is an update to an earlier post I had written almost 2 and a half years ago – in December of 2013 to be exact. Earlier post is available on lower half of this page. This post serves as a comparison to how things have changed since then.

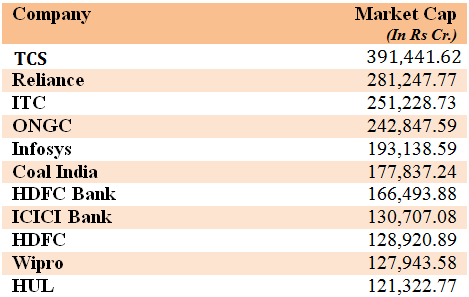

Top 10 Indian companies (based on market capitalization) as on 26 April 2016:

| Company Name | Market Cap (In Rs. Cr.) |

| TCS | 489,444.45 |

| Reliance | 329,384.25 |

| Infosys | 282,099.26 |

| HDFC Bank | 280,375.88 |

| ITC | 260,689.27 |

| Sun Pharma | 195,919.73 |

| HUL | 193,023.18 |

| ONGC | 183,558.04 |

| Coal India | 182,637.68 |

| HDFC | 177,266.66 |

Performance below is based on how these stocks have performed over the past 5 years (backwards starting 26 April 2016 – date of this update).

For Performance for previous 5 year period (counted backwards from December 2013 – scroll down to the end of the post).

Outstanding performers

Sun Pharma – Up 263%

HCL Tech – Up 228%

BPCL – Up 215%

Hindustan Unilever – Up 206%

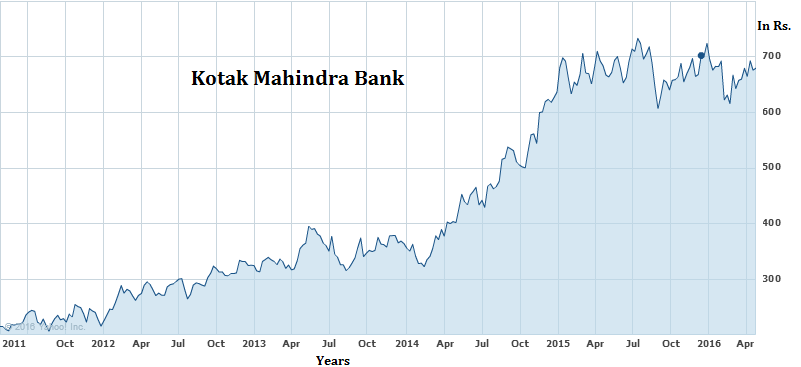

Kotak Mahindra – Up 190%

Mediocre performance

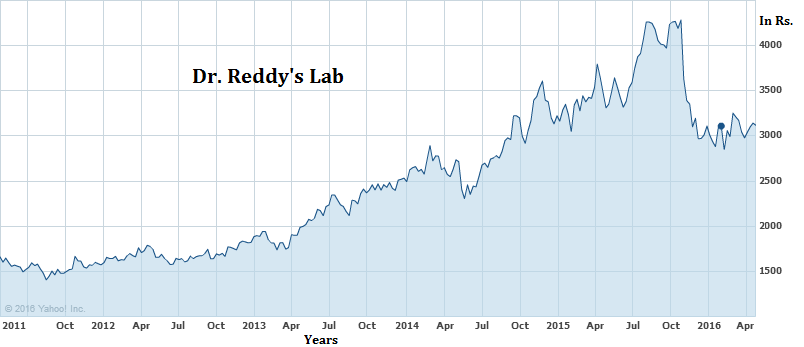

Dr. Reddy’s Lab – Up 89 %

Axis Bank – Up 71%

ITC – Up 69%

Tata Motors – Up 67%

Infosys – Up 65%

Below Par

BHEL – Down 70%

Hindalco Industries – Down 55%

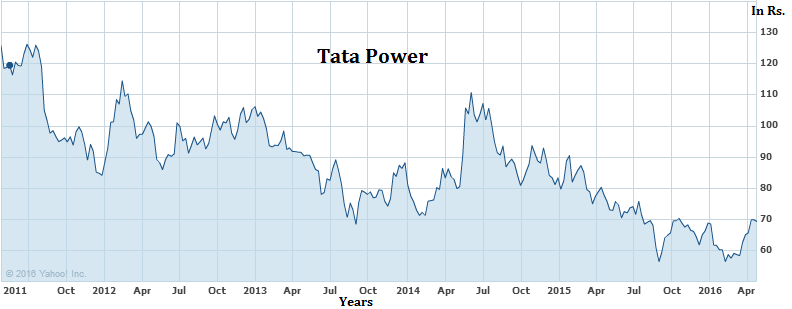

Tata Power – Down 46%

Tata Steel – Down 45%

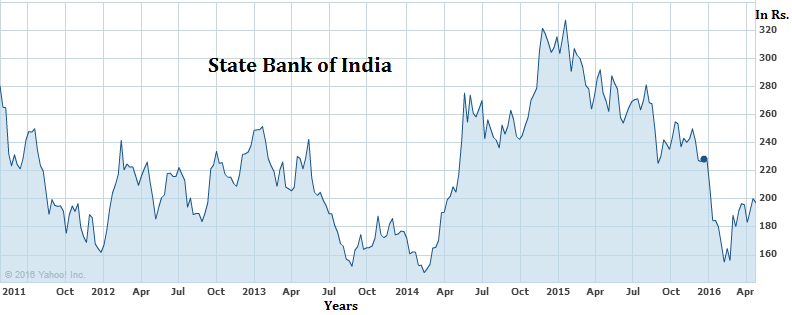

SBI – Down 32%

There are absolutely no sectoral winners or losers. If at all, metals and power have performed badly while private banking and FMCG have done well.

If one were to look beyond the world of large cap stocks, it would be obvious that over the past 5 years, mid and small cap stocks have outperformed large caps. This was obvious when I had written the original post(see, note at the end of post).

If I had to make a similar prediction today, I would reverse my stand here completely. Of course, good quality stocks could come from any sector/business or market cap. On a market wide basis however, over the next 3-5 years, Large caps will outperform mid and small cap stocks by a fair margin. I regularly monitor these here — Blue Chip stocks in India).

Earlier Post dated – December 2013

Let’s assume that you could look into the future and then had to answer this simple question – What are the 3 best Indian stocks for long term investment?

You will realize that giving out 3 names will still not be easy. Stocks which do well over a 2 year period may not perform well over a 5 year period and vice versa. The idea of having a long term investment plan itself could prove to be futile unless it is implemented with some idea of what long term means to you?

A couple of days back I was working with a list of large-cap companies. The intention was to make a list and then screen it on value-parameters (– see my next post below) to find out if there were growth opportunities for my surplus funds which I won’t need for a few years. Even before I started screening, I found an interesting trend. Most of the large-caps had given good positive returns over the last many years. To the point, that if I were to choose any 2 dates, 3 years apart from each other, in ALMOST ALL CASES, the stock had given a handsome return, mostly well in excess of 10% annualized return.

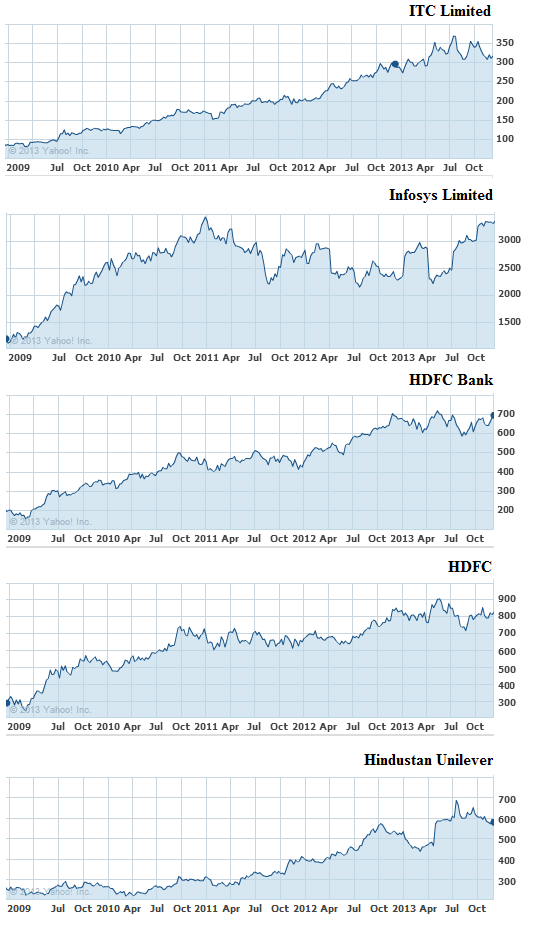

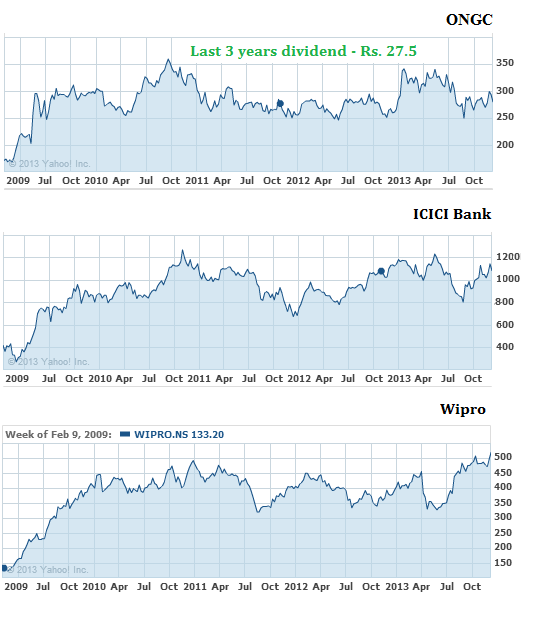

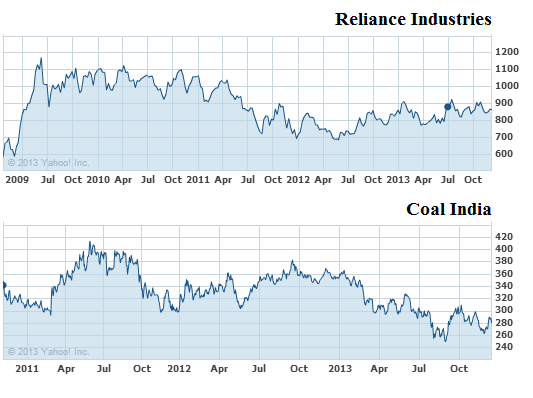

To test this yourself, look at the list of the top 10 Indian companies (based on market capitalization) below:

Choose any 2 random dates in the last 5 years, the dates being three years apart from each other. Chances are that you would in each case make a very handsome return. An enduring lesson of blue chip investing, one that often gets overlooked.

Despite the fact that the last few years have been the slowest years for equity markets, with most of the world slowly coming out of a recession and earnings growth at their lowest levels, and even in an environment of high inflation and interest rates, near zero reforms, a majority of these companies have not only given (get ready for this) – extremely high returns, but have infact proved to be the best place to invest money in India over the last few years. Of course this sounds unbelievable. Believe me; I am not making anything up here. The facts as represented by the table above and the charts below, speak for themselves.

Outstanding performers

Mediocre performance

Below par

The performance of these large caps which have a high weightage in the Sensex and the Nifty baskets is just what has helped the Sensex and the Nifty hold on to the levels at which they have been trading for the last few years. If you were to look beyond the world of these large cap stocks, you will soon find that hardly any that have managed to give positive returns during the last few years.

The flipside of which is that mid-cap and small cap stocks have performed so horribly during this time that most of these are available at ridiculous valuations to say the least (note: I maintain my view that over the next 3-5 years, select midcap stocks are due for a Multibagger kind of return. I regularly monitor these here — midcap stocks in India).

In my next post I have discussed the value-parameters which are helpful in short listing stocks from a list. The approach focuses on parameters relevant to low risk investment growth stocks based on which I add and remove blue chips to my portfolio.

Continue reading next post — Stock Selection Criteria

Can you recommend a blue chip share selling at a reasonably cheap price which gives regular good dividends and timely bonuses for a long term buy?

There is a full list of such companies

Thanks for the information. The information was really helpful for me.

Thanks Manish. Did have a look at your blog too. Its nice. Happy you like the post.

sir I have got some shares of asrtra zenac lab of allotment and company is doing buy back would u please recommend what to do exit or hold

I would like to invest in some good share for short term basis ( apx 1 to 2 years). Kindly suggest which share I can buy for this?

Joseph

Please help for long term investment

The blog gave good information about investment and best investment company in India as well

Thanks for liking it !

Thanks for the update with such a informative blog. Sent you a mail.

Hello Sir ,

I would like to invest in some good for long term. please suggest me .

Thanks

Amit

http://www.sanasecurities.com/subscription

Dear sir,

How is Finvasia ? Is it trustworthy as a discount broker ?

Finvasia has asked me to submit my Client-wise balance at the institution where I have a demat account. Is that ok?

Is Nifty 50 good for long term investment

You can do better.

sir i want to invest in equity for long 3-5 years prospective..plzz suggest some good stocks for long term

Call my office on 011-41517078 and register yourself as a client.