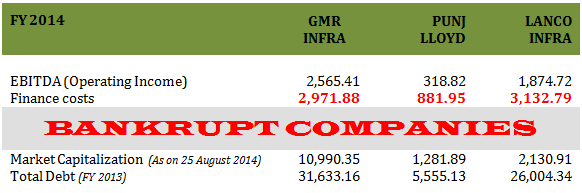

Over the last 3-6 years, infrastructure stocks in India have broken all records at destroying investor’s wealth. Their balance sheets are marred by high debt and almost negligible income. In fact, the situation is so bad for some of these companies that if they operated with such financials in the United States, they would by now have taken protection under Chapter 11 of the United States Bankruptcy Code.

What I am really saying is this – Some of these companies are Bankrupt!

I will also tell you which ones below. The point to take away is that you must avoid investing in these companies at all costs. If you still must invest in any of them, I would like to hear your reasons for doing so because after reading the analysis below, you will realize that some of these companies have drifted to a point beyond recovery.

High debt levels – Is recovery even possible?

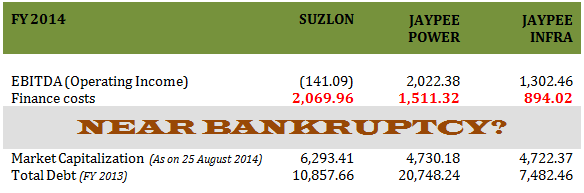

For starters, barring JP Power and JP Infra, all of these companies are not even generating enough revenue from operations to pay of the interest charges on their debt, where is the question of paying back the principal, let alone turning profitable. In fact, for some of these companies, interest charges are greater than their entire market capitalization.

This is why I had said that in the United States, they would have most likely taken the protection of bankruptcy laws. In India as well, many companies like, JP, Lanco Infra and Suzlon from the list above, opt to restructure their corporate debt hoping to turn things around.

That said, even a cursory look at the selected metrics above should make it clear that these companies are never recovering, unless one of the 2 things happen – (i) they sell some of their assets to reduce debt; or (ii) they discover treasures on sites they are working on, and somehow manage to retain them and not hand them over to the government. I will discuss the first of these points below. As for the second one, follow me on twitter where I recently tweeted about miracles of the 21st century.

Selling assets to reduce debt

Here is the best part about selling assets – you manage to improve your accounts (at least optically) for the time being. Both long term debt equity and working capital start looking healthy.

Here is the bad thing – You stop generating enough gross revenue. Basically, you start selling your very business to pay back debt which you had taken to expand the business. In the meantime (from expansion plans to scaling back), the only thing that has happened is payment of a lot of useless interest charges.

Further, in such situations, the word gets out pretty quick and the market starts waiting for a distress sale. The only assets that remain desirable in most cases are the ones which are generating profits, irrespective of the company’s desire to liquidate the so called non-performing or non-strategic assets.

Best Infrastructure stocks across various market caps

While the economy may have started recovering, be careful of investing in infrastructure stocks saddled with high levels of debt. While such companies have the potential of generating extremely high investor returns if they manage to turn things around, at the same time, your wealth could disappear real quick if they don’t.

| Company | Price as on

25th August 2009 |

Price as on

25th August 2014 |

Change |

| Larsen & Toubro | 1,054.31 | 1,524.3 | 44.58% |

| IRB Infra | 195.20 | 249.85 | 28.00% |

| KSK Energy | 211.60 | 95.70 | -54.77% |

| Jaypee Infra | 91.30 | 34.05 | -62.71% |

| GMR Infra | 67.65 | 25.00 | -63.05% |

| Suzlon | 92.10 | 22.75 | -75.30% |

| Lanco Infra | 42.73 | 8.64 | -79.78% |

| Jaypee Power | 82.90 | 15.70 | -81.06% |

| Punj Lloyd | 256.55 | 38.50 | -84.99% |

While infrastructure theme is likely to do well for many years given the need for infrastructure projects in India, this is one sector where investors have to be extremely careful in making stock selection. Some of the stocks above are beyond recovery, while others are highly risky. There are other stocks like Larsen & Toubro in the large cap space and IRB Infra in the mid cap space which surely are amongst the best infrastructure stocks in India, however, they are trading at high valuations.

The article above may be dated and the circumstance of any or all of the companies mentioned therein may have changed since the time of publication. For a list of top stocks across various market caps, visit the subscription section of the website @ www.sanasecurities.com

What is your take about Ansal Properties and Infra.??

Log in Here Tushar – http://www.sanasecurities.com/subscription

Good information

Thanks Umesh.

whats you call on (MAKE) marico kaya now on uppercircuit Rs 564

What about hcc share Sharmaji??

Hi Ram

Any specific reason why you want to buy HCC or are you looking to exit?

Hii Rajat

Any views on how the government’s decision to move away from the BOT type pf infra project awards will change the landscape? I was bullish on IRB infra and it is good to see that you have positive views about it. What is your take on KNR Constructions??