A manager may be sitting on one of the most innovative idea, he could have found a way to cut his cost to zero and achieve potentially unlimited profitability; if he is a cheat, you will lose money by betting on him.

For years, successful investors have paid the highest amount of attention on the quality of management. I often wondered why equity research reports did not have a column on integrity and competence of management. Then one day one of the more elegant of the analysts’ told me the reason. He said – “if someone is writing a report, it is implicit that he has checked for this aspect”.

Best Managed Companies: Break-up Based on Type of Management

In the table below, I have listed 20 carefully selected companies which appear in various lists as either (i) India’s best managed companies; or (ii) India’s biggest wealth creators.

| (Stock Price and net profit in %) | |||

| Company | CAGR | CAGR | |

| Motherson Sumi Systems | Professionally Managed | 51.17 | 31.74 |

| Lupin | Family Owned | 41.56 | 21.72 |

| HCL Technologies | Professionally Managed | 40.06 | 38.89 |

| Asian Paints | Professionally Managed | 34.37 | 7.39 |

| Tata Motors | Family Owned | 31.55 | 41.16 |

| TCS | Family Owned | 28.40 | 22.21 |

| ITC | Professionally Managed | 27.81 | 16.38 |

| Tech Mahindra | Family Owned | 25.20 | 34.21 |

| HDFC | Professionally Managed | 21.90 | 19.80 |

| Axis Bank | Professionally Managed | 19.68 | 20.55 |

| ICICI Bank | Professionally Managed | 13.01 | 19.24 |

| Infosys | Professionally Managed | 11.68 | 11.93 |

| Larsen & Toubro Limited | Professionally Managed | 9.86 | (2.26) |

| SBI | Government Promoted | 7.94 | 16.79 |

| Grasim Industries | Family Owned | 5.98 | (5.37) |

| Bharti Airtel | Family Owned | 4.59 | (23.22) |

| ONGC | Government Promoted | 2.71 | 6.20 |

| IDFC | Professionally Managed | 0.61 | 11.43 |

| Reliance Industries | Family Owned | (2.94) | 7.26 |

| Tata Steel | Family Owned | (9.65) | 11.55 |

9 Professionally managed: Companies in this category do not have a promoter / promoter group or where the promoter holding is (ultimately) held by a large group of unrelated investors.

9 Family Owned: Companies in this category have a majority stake held by one or more families and/ or closely related members thereof.

2 Government Promoted: Companies where majority stake is held by the Government of India.

Analysis – Professionally Managed vs. Promoter Run Companies

The debate between professionally managed vs promoter run companies has divided fund and corporate managers alike. Ultimately people are people and they can be honest and dishonest, mostly one part both. The chances that the manager of a so called professionally managed firm (i.e. with no clear promoter group) will cheat are just as high as they are for any other category of company.

Instead of focusing on shareholding patterns, look for managers/ promoters who take their responsibility seriously, are candid with their shareholders, do not go back on their promises, and do not follow the herd (i.e. do things differently from how their industry peers do them). One of the best ways to assess the management is to look at the annual reports of a company from previous years to see what promises were made by the management in those years. Then check if those promises were fulfilled or at the least if any efforts were made to fulfill those promises. Is it one of those companies which keeps changing track or do they stick to their plans?

An Example of A Badly Managed Company

Given that I really respect the analyst who said – “if someone is writing a report, it is implicit that he has checked for this aspect”, I take it that he pays good attention to this aspect and that beyond a point he covers only those companies which he believes are well managed. I do not think that this is industry practice. Not only are badly managed companies being covered extensively, they are also making the cut to be included in mutual funds which manage ‘public money’ as also in indicative stock indices.

In the ultimate analysis, there is never any list of traits which one may use to weed out badly managed companies. It requires careful study and analysis of past actions of the management. Pay attention to what Buffet looks for in the management of a company:

- Is management rational?

- Is management candid with the shareholders?

- Does management resist the institutional imperative?

In almost 80% of the cases, first and second of these traits will tell you a lot about the management. Keep in mind also that, the fact that a management be irrational or that a company be bad has no relation to any other trait about the company.

To give you an example, Cairn India, which in my opinion is one of the worst managed companies in India finds a place in the benchmark S&P CNX Nifty!

This is how the company looks on papers:

- ~ 55k Cr. In accumulated reserves.

- Zero debt on its books.

- Operates in a sector critical for India’s progress. The Government has every reason to make sure that companies like Cairn should success.

- As of today, the company is trading at price to earnings (P/E) of 5.97, has a dividend yield of 5.06%.

Last year Cairn extended a US $1.25 billion loan to its parent – Vedanta group for 2 yrs at Libor+ 300 basis points.

This was after the company closed a somewhat unsuccessful buyback offer for shares (i.e. not enough shares were tendered at the buyback price). It almost seemed like Cairn could not utilize the excess cash in buying back shares and hence decided to extend a loan to its parent, which was in desperate need of cash. The reason given was that this is the best way to generate higher return on Cairn’s spare cash. Yes – 3.5% per annum (i.e. Libor +300) was the best that the management could do, admittedly!

When asked why they do not distribute this out as dividend to investors, the reason given was that Cairn will need this money in future. Yet the management did not think twice before losing control over this money for 2 years by giving it away to Vedanta. Lately with Cairn stock price down, there is talk of merging Cairn India into its parent Vedanta. Is that a surprise? An easy way to do away with the loan! I am sure that this will happen at a huge premium but surely at a disadvantage to Cairn shareholders no matter how attractive the terms may look.

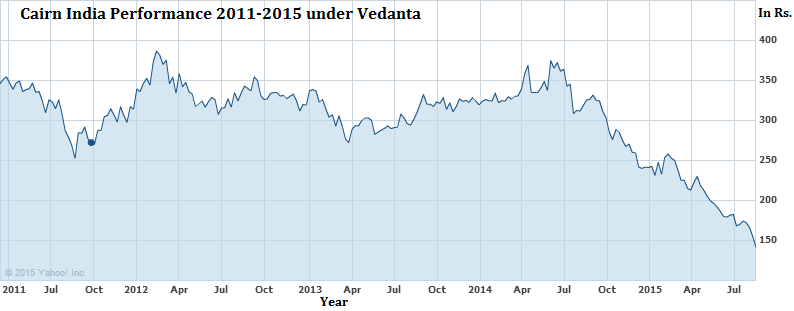

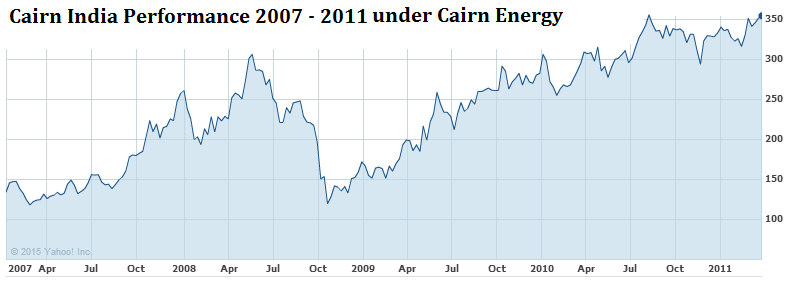

Besides the obvious, the charts above highlight a not so obvious story. 2007-2011 was one of the slowest phase for economies globally. The spike down in 2008 was the result of what later came to be known as the Great Depression II. In all fairness, 2014-2015, saw crude oil prices decline by over 50% but in ultimate analysis, stocks which return nothing for 5 years despite growing economy and rich balance sheets invariably have this one drawback – below par or dishonest management.

For a more detailed post on Cairn India visit here.

Stock markets are filled with fine examples of companies with rumors of operator activity and insider buying and selling and yet people invest in them. This aspect of human behavior has remained a mystery for years. Let you not be the one who indulges in such unprincipled investing. Look for honest managers and well managed companies as your first rule of investing.