Single most important strategic decision in investing is how best you allocate your mutual funds investments. There are different types of mutual funds available to invest in including equity, index, debt, liquid, gold and thematic funds (like infrastructure, Pharma etc) – the list is quite exhaustive.

Keep in mind that you don’t have to invest in all these funds. Different funds have different risk profile, liquidity profile and time profile. Therefore, you must first decide on the type of funds that would suit your needs.

The way your investment will grow over time depends on how much is invested where and for how long. For example: if large lump sum amount is required in 5-10 years, the ideal allocation will be equity fund that provides the scope for capital appreciation and performs best over a longer period of 5-10 years.

Read More: 5 Rules for Selecting Mutual Funds

Note: If you think you can track your investments and understand the risks involved with various schemes, you should choose Direct Plans. Direct plans were introduced by SEBI in January 2013 to help investors earn higher returns by doing away all distribution commissions. Investors under this plan can invest directly with Asset Management Companies (AMCs).

Test for Mutual Fund Allocation

Before finding out your ideal Asset Allocation, you need to find out your Risk Profile. A simple set of questions can help you determine your risk taking appetite. Each question has a number and the total numbers adds up to your total score.

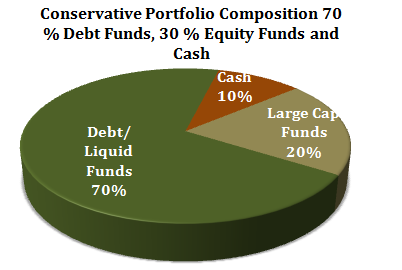

- Score below 14 means you are a Conservative Investor

- Score between 14 to 18 means you are a Moderate Investor

- Score is above 18, it means you are an Aggressive Investor

STANDARD RISK PROFILING QUESTIONNAIRE:

- Your age:

- Above 50 years

- Between 35 to 50 years

- Between 25 to 35 years

- Less than 25 years

- How long will you stay invested, i.e. investment tenure?

- Between 1-3 years

- Between 3-5 years

- Between 5-10 years

- More than 10 years

- No of Dependents:

- More than 3

- 2 to 3

- Only 1

- Only Yourself

- Past Investment Experience

- No

- Little Exposure

- Moderate Exposure

- High Exposure

- What is your primary goal?

- Preserve the Investment

- Generate Income

- Grow the value moderately

- Grow Money Substantially

- Which Portfolio would you prefer?

- Maximum 5% and Minimum 3% return

- Maximum 10% and Minimum 2% return

- Maximum 15% and Minimum 5% return

- Maximum 20% and Minimum 10% return

| Risk Profile | Fund Mix |

| Conservative | Mix of Debt Funds, Income Funds, Fixed Maturity Plans, Large Cap Index Funds |

| Moderate | Mix of Balanced Funds, Debt Funds, Large Cap |

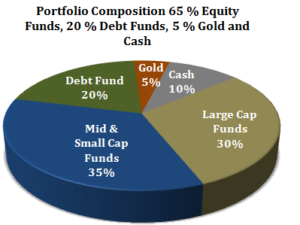

| Moderately aggressive | Mix of large cap equity funds, balanced funds and some exposure of mid cap equity funds |

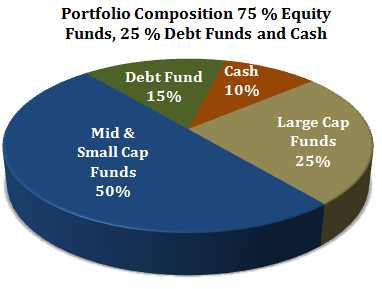

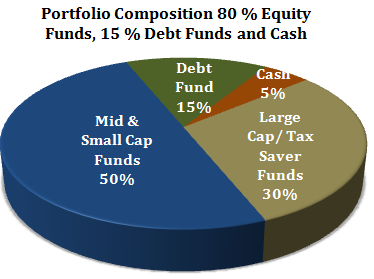

| Aggressive | Mix of mid and small cap equity funds, sectoral funds and large cap equity funds |

Mutual Fund Allocation According to Age Profile

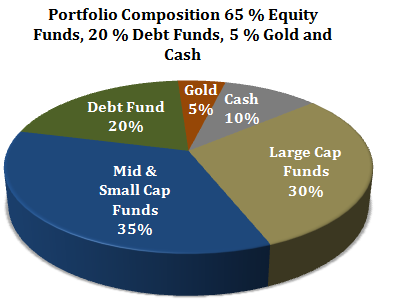

Age also plays an important role in getting the right mix between the different mutual fund schemes. Simple thumb rule: 100 MINUS YOUR AGE RULE for equity allocation which means that if you are 35 years old, then 65% of investible funds should be in equities at any given time.

Mutual Fund Allocation According to Financial Goals

Before you begin investing, you need to determine your financial goals. Consider what you want to accomplish with your money, and how your investment portfolio fits into the overall picture.

Do you have shorter-term goals, like sending your child to college in the next five years? Do you have a 30-year timeframe for your retirement portfolio? The goals you have will determine the types of investments you include in your portfolio.

Case 1: A person in the age of 20’s, starting with first salary

Right advice would be that he should start investing in investment options for growth in the long run as he has time on his side. He must have more exposure to equities as an asset class. For tax saving also, he can consider investment in ELSS funds instead of PPF.

In equities also, he can take more exposure to mid & small cap funds.

Read here: Comparison between ELSS and PPF – What Should you Choose?

Case 2: A person in the age of 30’s with new added responsibilities and new goals like marriage, house, and car. Firstly, he should take stock of all his income, expenses and should know what really his financial status is. For long term horizon, equity should be preferred choice as it enables wealth creation in the long term as compared to other investment options. For short term goals like car and house, you can also start an SIP in some ultra short term liquid funds that will pay anything between 8-10% annually.

Read here: Fixed Income vs. Equity Investment

Case 3: Mutual Fund Allocation of a New Married Couple

Consider a 35 years old man and got married 1 year ago. His wife is 25 years old. Both will be planning a baby after two years. He draws a monthly salary of Rs. 1, 35,000 and wife draws a salary of Rs. 25,000 per month. Their monthly household expenses are Rs. 50,000. Their investment purpose is long-term goals of child’s education, child’s marriage and retirement. The couple also have some short term goal like buying a car, house and have emergency fund.

| Goals | Amt needed | In (years) |

| Car | Rs. 4 lakhs | 1 |

| House | Rs. 30 lakhs | 4 |

| Child’s higher education | Rs. 47 lakhs | 20 |

| Child’s marriage | Rs. 1 Cr. | 28 |

| Retirement | Rs. 13 Cr. | 25 |

Starting early will put lesser burden on your finances because it requires a smaller outflow. During the early ages of your child, the allocation to equities should be the highest and as your time horizon shortens, the equity component should gradually reduce.

For example, if your target is to reach a corpus of Rs 25 lakh when the child is 18 years old.

Ideal asset allocation for child’s education

| Age Group | Equity (%) | Debt (%) |

| 0-3 years | 80 | 20 |

| 4-7 years | 75 | 25 |

| 8-11 years | 55 | 45 |

| 12-15 years | 45 | 55 |

SIP Amount: You need to save only Rs 5,449 a month if you start now (assuming that your investment grows at a conservative 12% every year). But if you wait for six years, you will have to invest Rs 7,454 a month to reach the target. Wait for four more years and the required amount jumps to Rs 15,154

You can use this SIP Calculator to know the right SIP amount to reach your financial goals. Click here

| Age of Child | Time Available | SIP Amount To Reach Rs. 25 Lakhs | Investment Option |

| 3-4 years | 13-14 years | Rs. 5,449 | · Mid & small cap equity Fund

· Large cap equity funds · Stocks |

| 6 years | 12 years | Rs. 7,454 | · Mid & small cap equity Fund

· Large cap equity funds · Stocks |

| 10 years | 8 years | Rs. 15,154 | · Diversified equity Fund

· Balanced Fund · Debt Fund |

| 14 years | 4 years | Rs. 40,254 | · Large cap equity Fund

· Balanced Fund · Ultra short term Debt Fund |

| Over 15 years | Less than 3 years | Rs. 57,431 | · Balanced Fund

· Ultra short term Debt Fund · Monthly Income plans |

Case 5: Mutual fund Allocation When You Are Retired

One of the simplest methods to allocate is have an asset allocation that offers a reasonable trade off between risk and return. A balanced fund in which fund managers generally keeps 60% of its assets in stocks and 40% in debt – is an example of moderately low risk asset allocation.

Read Here: Top Monthly Income Plans in India

Case 6: Mutual fund Allocation to Plan your Taxes

ELSS funds are diversified equity funds but have a lock-in period of three years from the time of investment. They provide tax deduction under Section 80C of the Indian Income Tax Act whereby investors can claim a deduction of up to Rs. 1,50,000 from their income for the year by investing in ELSS fund.

Also, in ELSS the income from dividends and capital gains are tax free and the lock-in period is the shortest among all tax saving options (lock in =3 years).

Being equity linked instruments, they give highest returns among all tax saving options over a longer period. Use them to save tax as well as create wealth but do keep in mind your overall asset allocation. If you are young, ELSS should account for nearly 50-60 % of your savings under Section 80C. But if you are in your 50s or 60s, no more than 20-25 % should go into these funds or you may want to avoid these completely.

Case 7: Mutual fund Allocation to Earn Regular Income

[1] Monthly Income Plans

Earning a regular monthly income from their investments is one of the most important needs of many investors, particularly those who have retired.

Monthly Income Plans (MIPs) are debt oriented mutual funds, which invest a small part of the fund (15-25 %) in equities. MIPs offers regular income in the form of periodic (monthly, quarterly, half-yearly) dividend payouts.

MIPs outperform the returns from debt funds but carry far lower risk than an equity fund because a majority of the money gets invested in fixed income securities. Conservative investors who don’t like taking too much risk can opt for MIPs.

Read Here: Difference between the Monthly Income Plans and Post Office Monthly Scheme

[2] Systematic Withdrawal Plan

Systematic Withdrawal Plan (SWP) is a facility that allows an investor to withdraw money from an existing mutual fund at predetermined intervals. The money withdrawn through a systematic withdrawal plan can be reinvested in another fund or retained by the investor in cash.

Case 8: Mutual fund Allocation for Saving For the Near Term

Medium-term debt funds

Not all your goals are long term. You may be saving to buy a car six months later. Equity-linked instruments in the short term could upset your portfolio. Instead, opt for liquid funds to save for your short-term goals. These funds invest in bonds and deposits and are completely delinked from the stock markets. They do, however, carry interest rate risks.

| Investing Duration | Fund type | Alternatives |

| <1 month | Liquid Fund | Saving Bank Account |

| Between 1 and 9 months | Ultra short term debt fund | Bank Fixed Deposit |

| 6 months to 2 years | Short term bond funds | Bank Fixed Deposit or Fixed Maturity Plans |

| >2 years | Long term bond funds | Bank Fixed Deposit or Fixed Maturity Plans |

Please tell me what type of mutual fund should be invested at the age of above 50 years.