RENEWABLE ENERGY INDUSTRY OVERVIEW

The Union Budget 2023 marked a very substantial event for the renewable energy sector, where the government increased the allocation of funds towards the Renewable Energy sector by a whopping 48%, from ₹69,000 crores to ₹10,222 crores. Talking about the Green Hydrogen Mission during this year’s Budget announcement, the Finance Minister said it would facilitate the transition of the economy to low carbon intensity, reduce dependence on fossil fuel imports and make the country assume technology and market leadership in this sunrise sector. Let’s see what are some Renewable Energy stocks which could significantly benefit from this growing industry.

Crucial Announcements by the Government

- The Union cabinet approved an initial outlay of Rs 19,744 crore for the National Hydrogen Mission. It also announced incentives worth over Rs 17,000 crore will be allotted for electrolyser and green hydrogen manufacturing in the country, while Rs 400 crore will be spent on developing green hydrogen hubs in the country.

- This year’s Budget allocated Rs 5,331.5 crore for the solar power sector, including grid and off-grid projects. This was a 53.65 percent increase compared to the previous’s Budget.

- The program for wind and other renewable energy received Rs 1,245 crore compared to the previous year’s Rs 1,102 crore. Of which, hydropower off-grid and on-grid received Rs 31 crore.

- The government sold its first sovereign green bonds worth Rs 8,000 crore at yields below comparable government bonds. These bonds will help finance the renewable energy investments needed by the corporations.

The government’s commitment to increasing the use of renewable energy in the country is commendable and will play a crucial role in reducing carbon emissions and mitigating the risks of climate change.

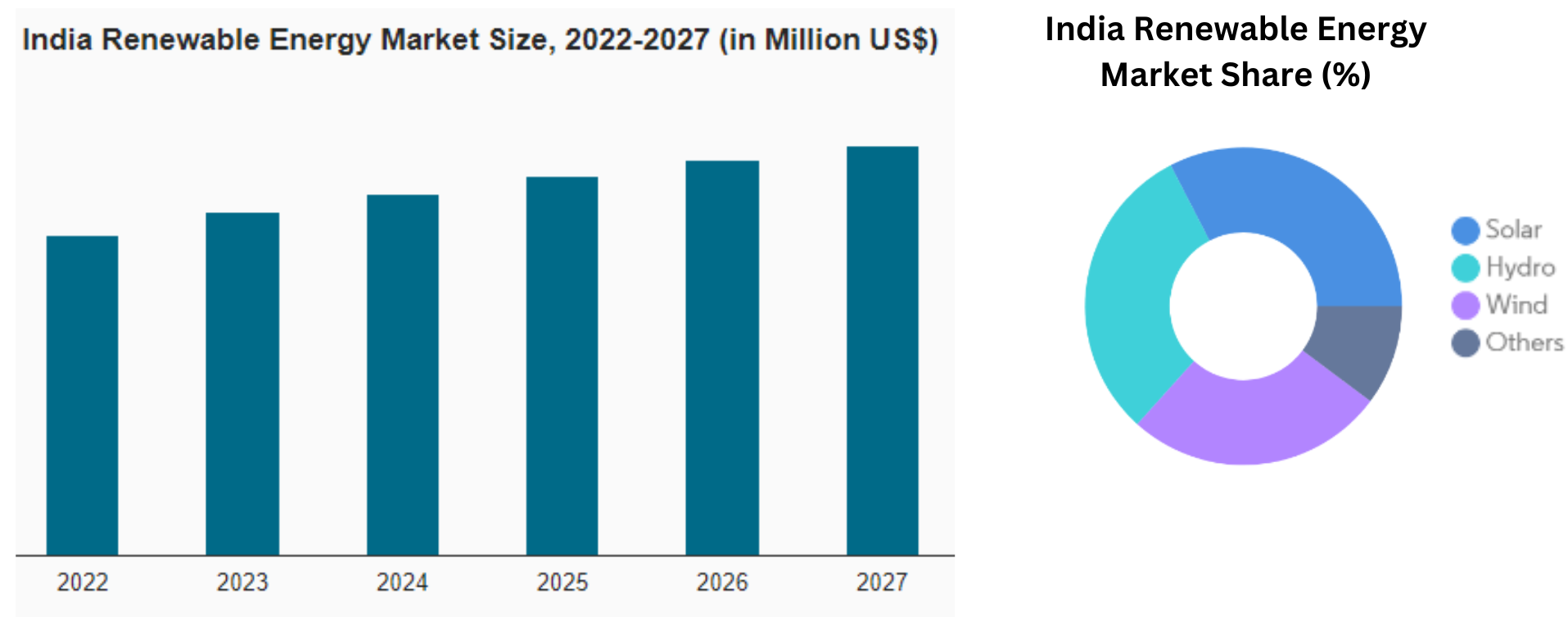

Promising outlook for the Renewable Energy Industry

The Central Electricity Authority estimates India’s power requirement to grow to reach 817 GW by 2030. Most of the demand will come from real estate and transport sectors. It is expected that by 2040, around 49% of the total electricity will be generated by renewable energy as more efficient batteries will be used to store electricity, which will further cut the solar energy cost by 66% as compared to the current cost. The use of renewables in place of coal will save India Rs. 54,000 crore (US$ 8.43 billion) annually. Around 15,000 MW of wind-solar hybrid capacity is expected to be added between 2020-25.

As per the Central Electricity Authority (CEA) estimates, by 2029-30, the share of renewable energy generation would increase from 18% to 44%, while that of thermal is expected to reduce from 78% to 52%. The CEA also estimates India’s power requirement to grow to reach 817 GW by 2030.

Rising foreign investment in the renewable sector (such as the US$ 75 billion investment from the UAE) is expected to promote further investments in the country.

Source: Imarcgroup.com

Source: Ministry of New and Renewable Energy

ESG Investing is picking up

Investors today are more interested in sustainable living and investing. Hence, the demand for Environmental, Social, and Governance Investing, or ESG investing is rising. So, investors, today prefer investing in a company that is making conscious efforts towards saving the environment.

The boom of ESG investing could also be seen in the returns offered by ESG stocks.

In the last five years, the ESG index has outperformed the Nifty 50 index where, the ESG Index has delivered a Compound Annual Growth Rate (CAGR) of 10.80% as of October 2020 whereas, the Nifty 50 delivered a CAGR of 8.99% in the same period.

BEST RENEWABLE ENERGY STOCKS

Let’s have a look at some of the best fundamentally strong renewable energy stocks in India with extreme growth potentials, which could be a value add to your portfolio in the long term.

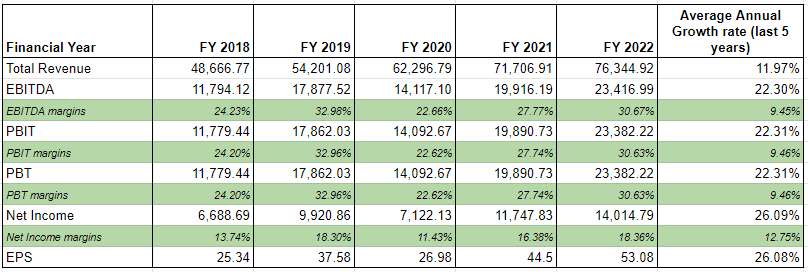

1. POWER FINANCE CORP

Power Finance Corporation Ltd. is an Indian central public sector undertaking under the ownership of the Ministry of Power, Government of India. Since its inception, PFC has been providing financial assistance to power projects across India including generation, transmission, distribution, and RM&U projects. It is India’s largest Government-owned NBFC.

Some Recent upcoming projects:

- The company has bid for two stressed projects–3600 MW KSK Mahanadi Power project and 1920 MW Lanco Amarkantak Power project.

- PFC aspires to contribute to the government’s thrust toward renewable and clean energy sources. It has aligned its business operations to leverage emerging opportunities in Ē-mobility and increased thrust in the transmission and distribution (T&D) space. Being a strategic partner of the Government of India, it will contribute to being an instrumental financial partner in government reform schemes for the Power sector.

- In an attempt to focus more on the renewable energy sector, PFC financed a significant amount of renewable energy projects. In FY2021-22, 15% of its gross loan assets comprised renewable energy.

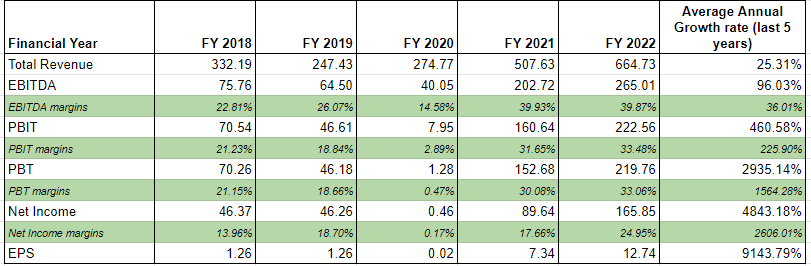

2. BOROSIL RENEWABLES LIMITED

Some Recent Upcoming projects:

- The company will invest Rs 1,500 crore over the next two years to expand its capacity by nearly 2.5 times and supply 15 GW of solar modules by FY25.

- The company is investing another Rs 1,500 crore to take our capacity to 1,550 TPD by FY24 and to 2,100 TPD by FY25 which will help the company supply 15 GW of solar modules.

- The company will also invest in its German plant to increase its capacity to 500 TPD (Tonnes Per Day) from 300 TDP now by 2023.

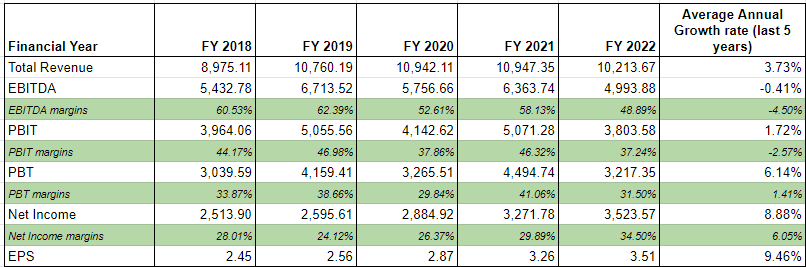

3. NHPC

NHPC Limited is the largest hydropower development organization in India, with capability to undertake all the activities from conceptualization to commissioning of hydro projects. NHPC has also diversified in the field of Solar & Wind energy development etc.

Conferred with the status of Miniratna, NHPC is India’s largest hydropower generator with 15 percent share of the country’s installed hydroelectric capacity. The PSU has an installed capacity of around 7,017 MW (including storage-based 2,174 MW), of which 98 percent is hydro-based.

Some Recent Upcoming projects:

- In FY24, the company is expected to add more capacities, so generation will be much more than what it is this year and last year.

- Subansiri project in Assam is a flagship project of the company now. And it is expected to commission the first two units of this project by June this year. So, that will be in FY24.

- The company is also going to finish its Parbati Hydroelectric Project in Kullu of Himachal Pradesh. That also will be completed in the coming financial year FY24, which is 800 megawatts of capacity, making it almost a 10-gigawatt capacity company by the end of FY24.

4. SJVN

SJVN incorporated on May 24, 1988 under the Indian Companies Act. The company is into hydroelectric power generation originally established as a joint venture between the government and the state government of Himachal Pradesh to develop and operate the Nathpa Jhakri Hydro Power Station (NJHPS). NJHPS is currently the only operational hydroelectric power plant in India and is the largest operation providing hydroelectric power generation facility in India, based on installed capacity, with an aggregate generation capacity of 1,500 MW.

Some Recent upcoming projects:

- SJVN’s Shared Vision of 5000 MW by 2023, 12000 MW by 2025 & 25000 MW installed capacity by 2040 was formulated and set out.

- Ministry of Power has identified five hydro projects of 5097 MW capacity in the Dibang Basin of Arunachal Pradesh for allocation to SJVN.

- The company is currently constructing the Rampur Project, which is expected to be a 412 MW hydroelectric power generation facility located downstream from the NJHPS.

- SJVN has also entered into memoranda of understanding with the state government of Uttarakhand for three hydroelectric projects with an expected aggregate generation capacity of 363 MW.

TATA Power & Suzlon Energy are missing from your Best Renewable Energy stocks to buy. Please kindly examine & analyze Tata Power, which is corrected significantly and near support levels of Rs. 165/170 Levels. Appreciate your kind consideration.

Noted.