Last week, I met someone who wanted to discuss investment options with me. While I don’t do consulting of this nature, he happened to be in my distant family. Fair enough.

I went in wondering if he will ask me about stock investments or may be some complex derivative products, indeed if I could help him play the F&O markets or if commodity futures were something he wanted to look at. 20 minutes into the conversation came his first and the only investment related question for the evening – What is the best savings bank account in India?

Really! Are you kidding me!! It was a Wednesday evening and I had driven all the way to your house and this is what you want to ask – Best savings bank account. I don’t want to talk any more about how the rest of the interaction went but I think he was convinced that ICICI Savings bank account had a slight edge over SBI. Yes we took the 4% – 6% interest rate issue into consideration. Not sure if he has opened an account yet. He seemed a little risk averse. Anyways, I did not find it appropriate to bring up stocks. Just for fun though, I wanted to hear someone convince him about the merits of derivative swaps. Nevertheless, when I spoke about the evening to my office colleagues, instead of laughing about it they started a discussion. In this, I realized something odd – Savings bank accounts do spark a debate. Here is the result of what we did over the weekend:

Note:

- We have selected the banks below to represent what we believe reflects the best mix of various options.

- We looked at SBI, PNB AND IDBI before including Bank of India, which is the only public sector bank in our top 6.

- Amongst our team, we have an account in each of the banks below.

- The contents of this article reflect our collective views. Our views could differ from others who conduct a similar study.

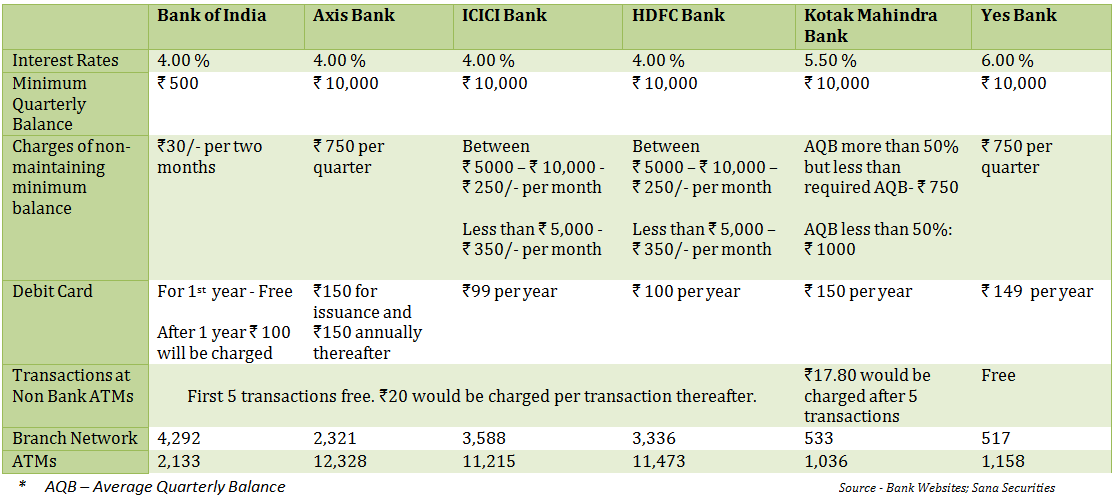

Savings Bank Account – Interest Rate & Bank Charges

(Click on the image to enlarge)

Other key points to consider before switching banks:

- Minimum Balance: Many private sector banks like Axis, HDFC and ICICI Bank require customers to maintain a minimum monthly average balance of 10,000 while a lot of public sector banks like Oriental Bank of Commerce, Punjab National Bank, and now, the State Bank of India don’t have such a requirement. Failure to maintain a minimum balance invites a penalty which is typically about Rs. 750 for a 3 month period. [2] See below for a note on minimum balance calculation.

- Transaction Charges: Before choosing a savings account, make sure that you are aware of all charges fees. Most banks now charge extra for transactions or services. For example – Rs. 100 for the issuance of a duplicate passbook and Rs. 50 (plus taxes) for the regeneration of your debit card PIN.

In our observation ICICI and Axis Bank are particularly severe with respect to charges and non maintenance of average balances.

- Reach and service quality of the bank: Another important factor you should look at before choosing a bank is its service quality and reach. In this regard your individual needs and preferences will be an important consideration in choosing a bank:

-

-

- If you mostly bank online – Choose Bank of India. Their online banking platform is as good as any and they have the least minimum balance requirements + the least severe service & penalty charge for non maintenance. Highly recommended also for – PPF[1] accounts and for opening and linking your fixed deposits to your savings bank account.

- If you need to visit a branch regularly (i.e. deposit and withdrawal of large amounts of cash) – Choose a bank which has branches across the country and avoid public sector banks (not to generalize but we can vouch for bad experiences at – SBI, Bank of India and PNB. These include never-ending lunch hours, lack of clarity on responsible officer and some of the most badly maintained branches. At the same time Yes Bank and Kotak Mahindra, lack coverage in this regard.

-

- If you want a linked demat/ share trading account – Despite slightly high charges, nothing beats ICICI’s 3-in-1 account which links your savings bank account to your trading account. While the brokerage charges are slightly on the higher side, if you are more of an investor than a trader and want to buy and hold high quality blue chip stocks, we highly recommend ICICI bank.

- Credit Cards – Ideally, just avoid credit cards completely. If you must get one, NEVER get it from the same bank where you have your savings bank account.

Our word – If you don’t mind paying just a little extra for services and more importantly, if can stay disciplined with maintaining monthly balances – Choose ICICI Bank. For everything else, there’s Bank of India.

______________________________

[1] PPF – Public Provident Fund is one of the best investment options these days – earning a tax free return of 8 % p.a. for annual deposits of up to Rs. 150,000). Anyone will be well advised to park Rs. 100,000 every year in a PPF account to earn Rs. 8,000 per 100,000. So if you are depositing Rs. 100,000 every year in PPF, then by the 5th year you will be earning a tax free interest income of Rs. 40,000 (Rs. 8000*5).

[2] Banks typically calculate Quarterly Average Balance by dividing the Sum of Daily Closing Balance for the quarter by the Number of days in the Quarter i.e. 90 days. QAB = (Total of all the EOD closing balance)/(number of days in quarter)

Rajat,

I wanted to know why is it recommended not to have a credit card from the same bank where you maintain your Savings Account.

Hi Aditya

In case you raise a dispute regarding a charge/ transaction on your credit card and refuse to pay it, the bank could potentially deduct that much amount from your savings account – that is if you have both a CC and a savings bank account with the same bank. If you believe that you were wrongly charged, let the bank do the convincing. While most modern banks will not do this, would you really like to trust a bank?

Good one,

If u have a savings account and credit card from the same bank.. they can have the right to hold ur funds in the savings account in case if u fail to pay it in time. in such cases you ll not be able to use ur funds available. So its always good to have credit card from other bank unlike from ur savings bank.

i am a student suggest me one bank for savings account out of icici and axis………??

ICICI for sure.

How good is HDFC bank for opening saving account ?

Are they providing best services ?

Services are good but there are many hidden charges.. starting from 4INR to 90INR. Kind of costly bank but if u wanna have better services you can go for it

is there a way to lock the minimum balance with no chance to debit that amount??

No

Every thing is good enough. Only a small correction: PPF stands for ‘Public Provident Fund’, not ‘Personal Provident Fund’

Thanks, corrected that 🙂

hello,

i wanted to open a saving account and as am a student, maximum transactions done for a month would not be more than 3000 so please suggest a bank which gets me the service i needed and pls tell the requirements to open an account in BOI and SBI( both my preferences)

thank you in advance!

Hi,

Your article is really nice and very informative but i would like to add few more points.

1)Select bank based on your city like SBI or PNB serves very well just like private banks in the Bangalore city but if you go to very small town then their service is very pathetic because of the crowds and less staff.

2)ICICI bank service is very good but now a days its like most of the people have account with this bank so if you visit bank branch then it takes time for your turn

3)ICICI changes its online UI very rapidely . In last year they chagned in 3 times i suppose. Earlier UI was quite simple but now a days they are making it complex which is a kind of drawback.

4)You will get lots of call from ICICI/AXIS bank for the loan but it happens very rarely with HDFC bank.

5)Generally it is suggested to have one account in public sector bank and one in private bank. Public sector bank you need account mainly because of online filling forms or applying for govt job and any other govt related work. Private banks everyone knows the use.

6)SBI charges Rs 15 for the message every 3 months which is not in case of ICICI or HDFC bank.

All good points.

ICICI, from my family’s experience, is one of the most sleaziest banks to deal with. They are notorious for misleading their customers on various practices just to make their commission at your cost. For instance, breaking an FD promising that no penalties will be levied just to reinvest in another scheme, for which they will get the incentive for signing up a new account. They are well known on the Internet, by many unhappy customers, for various dubious practices.

Rule of thumb, don’t trust someone else’s advice, do your own diligent homework after listening to everyone’s experiences with the bank in question. If you are lucky to get a good manager who can give you honest advice, then almost any bank is good. But, make sure you’re not stuck with a bank manager who has his own selfish interests ahead of your own.

Thanks for this. Very useful info.

Thanks Nikhil, every time someone writes a good comment on this article, I feel like a savings bank adviser more than a stock analyst.

People… please read other stuff on this site ! :-))

Thanks for your helpful information.

What was your choice if you were a NRI?is there any difference in opening a saving account for Indian nationality people and NRIs?

thanks in advance

As an NRI – All same choices. If you have an Indian residence proof and PAN Card, you can open a regular savings account. This is what I did (I was an NRI for 4 years). If not an NRE/ NRO account is another option.

Thank you Rajat for simple and informative tips.

I have a question.

(I am currently working in IT field last 2 years and earn about 25k per month, i aspire to have my own home at Mumbai, so i am thinking to start saving. )

Can you please suggest me which savings scheme would help me?

I really feel like having basic savings account at ICICI, as i have current accounts and my PPF at the ICICI itself?

Is it recommended, or should is go for basic savings account at other bank like Bank Of Baroda?

Thanks,

R.S.

Frankly, where you have your account would not matter much in your situation so long as you stay disciplined.

I suggest you start allocating some money every month to equities – start an SIP but do it yourself instead of going with a mutual fund or corporate SIP, open a 3 in 1 account with ICICI (with a de-mat account) and buy good quality stocks little by little for the next few years.

Dear Sir,

I am a private sector employee & looking for a bank where i can get a home loan or personal loan.

please advice.

regards

jai

Thanks Rajat great article and tips.

I have a question which I’m confused about. Sorry for asking a weird question. I currently have a Axis account. My relatives tell me SBI or government bank is best, as incase a private bank folds you’ll loose all your money. But with a government bank that won’t happen as the government will repay the lost amount. Is there any truth to this? 🙂

No

thanks for the reply! 🙂

Very informative, just wanted to know if i have to know which bank should i choose if i have to open it for my wife, there will be no transactions i just want the interest rate to be high? please suggest

Savings bank interest rates or FD rates? For savings back – choose Yes, Indusind, or Kotak….purely for high rates.

Hi sir.. I am a student. I want a zero or minimum Balance maintainance saving Account for only deposite and atm withdraw 2or3 time india a month… and a good net banking for fund transfer and bal check… so plzz suggest me

I also searching the same answer

Can a minor of 16 years can get debit card? If yes which bank provides it

All of them 🙂

Bank of India or check SBI.

I am a student, can you suggest me a bank in which i can open a savings account and do i have to maintain that minimum balance for student account also.

Hi sir,

I want to open saving account but i am student so please inform most suitable bank for me which have more facilities and less charges ..

And suitable for me in best way..

Help me please.

Thankyou..

I like the ones I have discussed above. BOI & ICICI. Everyone feel free to share your views.

thanx alot for this write up.i am searching for something like this and found it.thanx again.

Am a housewife , I dont have any regular income, but i want to save money as much as i can ( Little amount like rs.200 every month or rs.1000 once in three month,ofcourse i dont want more charges in my account same time looking for some interest for my money ) please suggest me best bank.

Thank u..

Sir,

Is it possible open two accounts under one customer ID? If yes, which bank provide this facility?

Thanks.

Yes – All banks should provide you with that facility.

Sir,

In above mentioned chart you have said that Yes bank does not charge fee on ATM transactions. Does this mean that customer can withdraw money n number of times from any ATM?

Thanks.

Yes only for Yes Bank – you can withdraw any number of times from any ATM.

What is the minimum balance to be maintained in yes bank and kotak mahindra bank and is there any atm charges or sms charges and online transaction rates…?

Thanks for that informative article. Any idea which is the least corrupt bank? Also, Where is a good place to read about the basics of banking, such as trading accounts, PPF, good banking practices etc.

Thank You.

You should be able to find all that on this very site…search your query in the search box on top 🙂

Finally! A direct, to point and easy to understand finance related help/blog posts is very very hard to find these days. I love how concise and precise you are with your explanation. So helpful. Thanks dude.

Thanks Reetam

Good One!!

GuestLooks like, this information is based only on the things the author/team tried in reality. But its not covering best-in-class public sector banks like State Bank of Mysore(SBM), etc. I’m using SBM services since 4 years & its very easy & efficient to handle FD(also Reinvestment FDs), RD, PPF, etc. Their service at branches is also better when compared to SBI, Kotak & other. Service charges are also very less. Most importantly they offer competitive interest on FDs(in nationalised/public sector banks).

We considered over 10 banks. We had at least one person holding account in each of these banks.

Your comment is inaccurate. SBM (as per us) is not even close to its public sector peers, let alone pvt sector banks. Also, here on this page you will find a list of top Fixed Deposit (FD) interest rates paid by both public / pvt sector banks in India. The list is compiled based on all major commercial banks operating in India with more than at least 10,000 depositors.

Hi Sir,

I would like to know about the best investment plan with an investment of INR 5000 per month. Is savings bank account a feasible option in this case?

Absolutely not. Invest in a good mutual fund. Link your bank account and set up SIP payments to direct debit your account for your desired investment amount each month.

I am a student and i want to save 1500-2000 approx evry month..plz tell me what wil b da bst way 2 save da money in SBI?

Good high quality equity oriented mutual funds.

Useful info. Thnks

Hello sir i want to know why does these private banks like Hdfc insist for Rs.10000 as minimum deposit or Minimum average balance system to open a savings account?

It is mainly to ensure that they are generating some interest income to service and maintain your account in case you do not do any transactions.

I am going to open saving account. Please help mevto choose between Yes Bank and Indusind Bank.

Opening this account for saving purpose like fd and saving account interest.

Go with Yes Bank if those are your only concerns.

Hello sir, I just got a job with 70k per month salary. I need to save up to 5 lacs in 6 months or so. Pls suggest an account.

How is that possible. 70k will not become 5 lacs in 6 months no matter what account you go with.

Thank you for nice inforation.

i would like to know about bank proving good net banking and having good mobile banking app.i have axis aacount.but there app is worst.which bank you suggest for this?

Again, I think ICICI is the best for this.

Hi! The informative articles is no doubt amazing with pin point suggestion that would follow & equally are all the comments with interesting customary yet complex questions kept by the readerd to be answered was itself useful & informative. My concern would be post this thank giving below.

Hello Rajat,

Very informative article…& Thanks for investing your time in replying to almost all the queries…

I have been using IDBI and HDFC and found their services quite good..but those were all corporate/salary accounts…

Now I want to open a savings bank account for investment purpose…i prefer a public sector bank…basically i do alot of online transactions using internet banking…so please advice which one to go for SBI or BOI… and any specific advantage of choosing one over the other…?

Hello Rajat,

I have HDFC and Citibank accounts. In case of Citibank, since I have 1 Lakh fixed deposit, I can have zero balance in my savings account. But in case of HDFC, how much ever money I have as fixed deposit, I need to maintain AMB of 10000. Do you aware of any other private sector bank like YES,Kotak,Axis,ICICI where you can have a certain amount as fixed deposit and have zero AMB?..

Hi Alex – I think most banks will give you a zero balance if you have an FD of 100000 with them. That said, based on your business you may not need to maintain a minimum balance at all, even without an FD. Banks regularly make exceptions n this regard irrespective of their rules.

I would like to open a new PPF account, please advise which bank can offer such service and the best bank 🙂 . I heard post office also has an option to open PPF account. please advise

email me your query at rajat@sanasecurities.com

Hello Rajat,

1. Why one should avoid the credit card from the same bank of saving account?

2. What could be the reason to not choose Yes bank even though it offers 7 % interest rate on saving account as well as there is no limitation on withdrawal from non bank ATM.Is it due to high yearly charge for debit card and high penalty in case of non maintenance of minimum balance or any thing else?

Thanks, Vimlesh

For 1 – just in case of disputes on credit card purchase, you dont want a situation where the bank deducts your savings account pending a resolution. With same bank for savings and credit card account, this is a possibility.

For 2 – your reasons are correct. If you can be disciplined, Yes has great service though.

Even cheaper than SBI & PNB?

Sir very informative article on savings bank account.. Nicely stated and explained..

Sir I wanted to know between kotak and yes which bank is good and considering the FLexi FD sweeping criteria and ease of online transactions ?

I have savings account in ICICI and SBI. Nowadays SBI also much improved their online facility through net banking. For eg:- it is difficult to apply for gold or platinum debit card if you don’t maintain more than ₹25000/- But through net banking I applied a gold debit card and paywave in touch debit card and I received both. Also facility is there to activate debit cards and create its pin. Much improved than where it was….

If we maintain MAB in ICICI Bank without fail, you will get all good service. I like offers from ICICI Bank. This bank comes first for bringing new banking facilities like expression cards, pockets, credit cards on fixed deposits, i-wish.

Hello Sharma,

My salary account is in Axis bank. Now I want to step in to investments and don’t want to have multiple bank accounts. Please suggest me whether I can go with Axis for Demat and other equities and I am very new to this investments field. So please give me some ideas on how to start with mutual fund, equities, stock market etc. and do please brief on SIP.

Thanks in advance.

Sir, I have some questions, please clear my doubts. If I save Rs.5 Lakh money in Savings Account or make FD of Rs. 5Lakh and then all of a sudden my bank goes bankrupt, Shall I get back all the money that I kept with that bank? If Not, How much money out of Rs.5 Lakh I shall get and from whom? Secondly, If I keep that 5 Lakh amount with any Private Sector Bank like ICICI instead of keeping it with PSU Banks and suddenly ICICI Bank goes Bankrupt, then How much amount I shall get back out of 5 Lakh and who will pay me that amount? y Only Concern is Regarding the Security of My Money that I may keep in the form of either Savings or Fixed Deposit in either PSU Banks or Private Banks like ICICI. Sir, please tell me.

Hello Rajat,

I asked ICICI Bank employee for opening my bank account under JAN DHAN YOJANA, but he refused and said only BPL clients can open their account under this scheme or person earning 50000 p.a.

Is it so? Or it was a BIASED answer?? Who can open savings account under JAN DHAN YOJANA.

Hello Rajat,

I am looking for a bank which offers savings account facility with minimum 1000 balance. And no withdrawal charges or deposit charges.

If they do charge. Please tell me the bank which charges the minimum on multiple deposits and withdrawals. Amount is mostly deposited from other states..

I am not sure on this. Anybody who may have an answer, please do respond.

Haha. Funny query and an even funnier reply!

Sir I am a housewife…I can invest rs 4000 every month..I am thinking to take one ppf account for 2000 rs..and other sip for rs 2000…but I dont know which banks sip and ppf will be best for me as I cant take risk..plz reply soon

Thanks in advance

I have sent you an email Sonal, lets talk there.

I wana open saving bank acount…where i open acount between hdfc and icici ?

Either is good. No difference really.