Every time a stock moves a few percentage points (in either direction), traders start a notional mathematics in their mind. “Had I bought 300 or 3000 shares, 20 mins back, I would be X times richer. Had I sold 5 lots @ Rs. X, I would have made Y% return. In fact, I could have arranged more margin money from the other account and gone ‘all in’”.

Take heart, there are some who actually go through reverse emotions – “Had I resisted the temptation to buy 20 minutes back, I would have been in lesser trouble”.

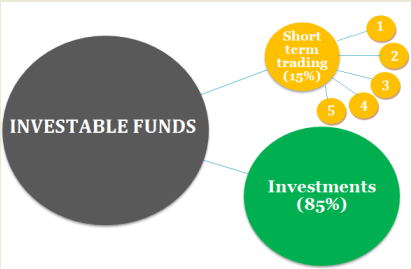

It is a fact that short term trading in stocks can make you quick . . . . in fact very quick money. At the same time, it has the potential to destroy wealth at a fairly quick pace. How much of your assets do you want to trade is a difficult decision. Oftentimes, you may feel that the odds are so much in favor of you that you should risk it all. Even though I have been right a lot more than I have been wrong, I have never increased the value at risk (i.e. the amount with which I invest).

Let me tell you a little secret. A few days back I read an article which claimed that 85% of traders in the F&O market lose money. I am not sure if the 85% stat is correct or not but I know that the number must be fairly high. Why does this happen? It is not because they are more wrong than right. It is because they are not disciplined. If you learn the art, and then, let’s say you can be right 6 out of 10 times, it is then not possible for you to lose money, for you would have learnt the art of risk free stock investing.

Controlling your emotions is not easy.

Those who regularly read my blog posts confuse me for someone who advises against buying stocks for short term trading. This is not correct. In fact I trade myself, both in cash and in the F&O markets.

Selection Rules – Stocks for Short Term Trading

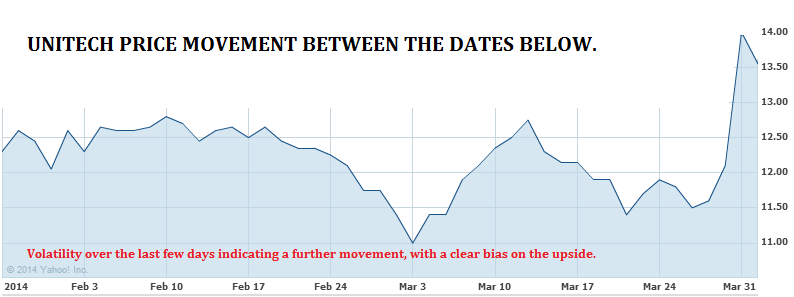

Volatility – Stocks where the prices remain in narrow range are not the best bets for trading. Look for stocks which provide opportunities at different price points. The bigger the range of movement the better.

- Liquidity – Look for stocks which generate high trading volumes. Certain stocks, often in fundamentally strong companies, while there prices are volatile, there is not enough liquidity in them. Make sure that your exit from the stock will be just as easy as your entry.

- Follow news – While technical analysts will tell you not to be biased by news flow and look strictly on chart patterns. If you are not into chart patterns and automated trading software, one of the most interesting ways of trading is to back yourself with knowledge. Find out if the company is likely to launch new products, merge or acquire new assets. Are there any likely developments in the industry which will impact the future prospects and hence the stock prices in a positive or negative way?

- Choose Quality – Often, people trade in stocks of companies with extremely poor fundamentals. In 99% cases, this activity is based on a combination of chart patterns and senseless excitement. Avoid trading in companies with poor management and past financial track record.

- STAY DISCIPLINED – Remember what I had written above. Your profits should not increase your investment amount. Be disciplined and set a limit for the amount of money you want to allocate for trading. Then divide that money in 4-6 different baskets and execute separate trades with each unit. Do not get carried away with profits and losses. In trading there is huge potential for the occurrence of either. There are no consistently smart investors or traders in the market. Whether you trade in the short term or invest for the long term, you are successful if you are right in 50% cases.

Volatility – Stocks where the prices remain in narrow range are not the best bets for trading. Look for stocks which provide opportunities at different price points. The bigger the range of movement the better.

Volatility – Stocks where the prices remain in narrow range are not the best bets for trading. Look for stocks which provide opportunities at different price points. The bigger the range of movement the better.