Indian Insurance Sector

Indian Insurance sector can be broadly categorized into two parts – Life Insurance and Non Life Insurance which includes health insurance, and general insurance like car, two wheeler, travel insurance, home, individual personal accident, and business insurance. At the end of March 2016, there were 52 insurance companies operating in India; of which 24 are in the life insurance business and 28 are in non-life insurance business.

With the passing of the Insurance Bill in Parliament in March 2015, Foreign Direct Investment (FDI) of up to 49% is allowed in an insurance company as compared to 26%. A lot of other factors like low insurance penetration, increasing health awareness are looking good for the pure insurance companies and insurance-related companies like HDFC, Bajaj Finserv, and Max India.

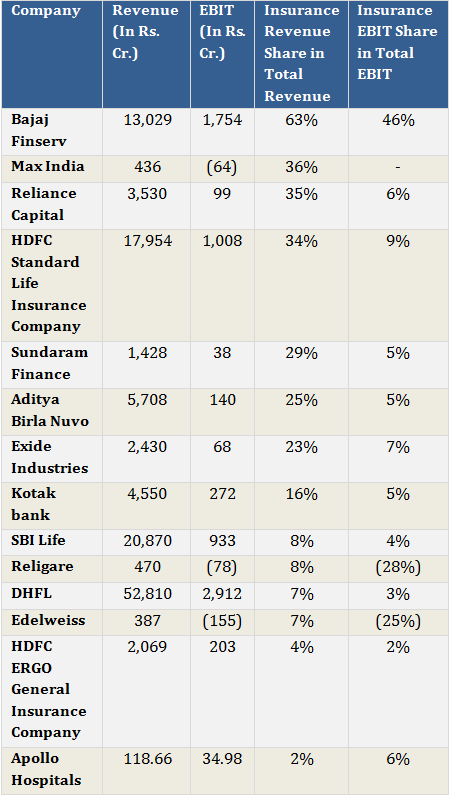

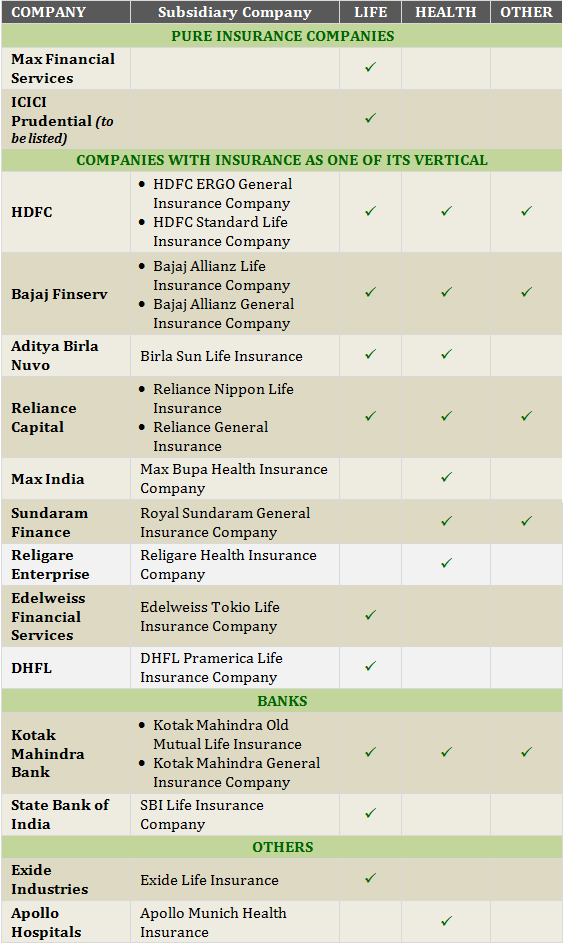

LISTED COMPANIES IN THE INSURANCE SECTOR

The Indian life insurance sector is the 10th largest life insurance market in the world with market size of Rs. 3.7 trillion (on a total premium basis). The total premium in the Indian life insurance sector grew at a CAGR of approximately 17% between fiscal 2001 and fiscal 2016. Despite this, India continues to be an underserved insurance market with a life insurance penetration of 2.6% in FY 2016, as compared to a global average of 3.5% in FY 2016.

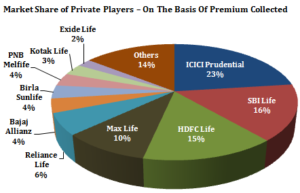

Life Insurance Corporation of India (LIC) commands the leadership position in the Indian insurance market with 51% market share on the basis of individual new business premium. Although, in the past few years, private players have started gaining market share in terms of premium collected from 38% in FY 2015 to 49% in FY 2016.

Market Share of Private Players – on the basis of premium collected

Indian Health Insurance Sector

Indian Health Insurance sector is poised to grow at 21% CAGR to reach Rs. 55,000 Cr. by FY 2020 from its current size of Rs. 6500 Cr.

Key Health Insurance Driver

- Only 15% of the population of India is covered under some form of health insurance with private health cover available for only 2.2% of population;

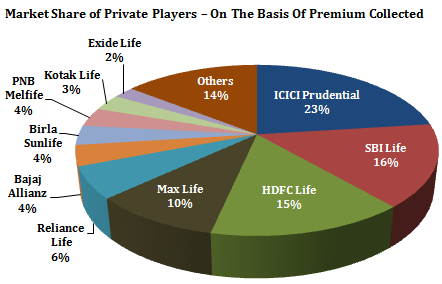

- Health care costs accounted for only 4% of Indian GDP; 58% of this health care costs are met as ‘out-of-pocket’ expenditure;

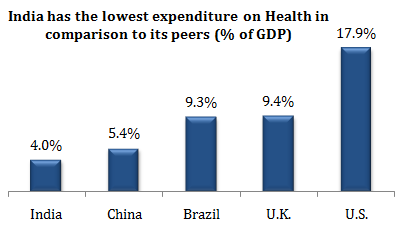

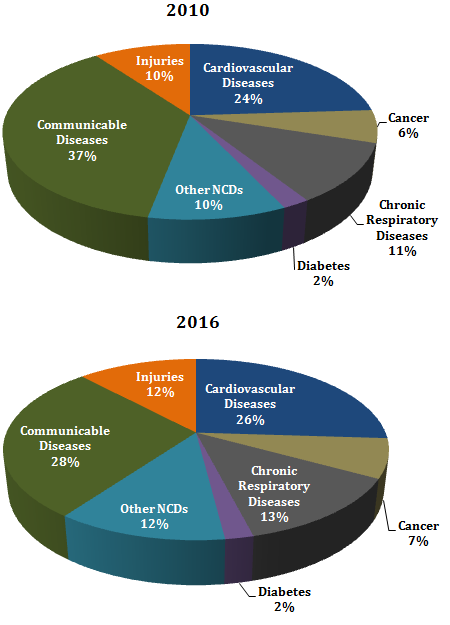

- Rising health costs and increased incidence of life-style diseases have brought the spot-light on benefits of health insurance;

Increasing Incidence of Non Communicable / Lifestyle Diseases %

Source – WHO – Non Communicable Disease Country Profile 2016

- Growing income, urbanization and increased corporatization of health care leading to exponential growth in the health insurance segment.

Listed Pure Life Insurance Companies

[1] Max Financial Services Ltd – Currently, there are no listed life insurance companies in India other than Max Financial Services Limited, which is a holding company for Max Life Insurance.

Financial Track Record – For FY 2016, the Company’s gross premium income stood at Rs. 9,216 Cr., growing 13% over the previous year and a Profit after Tax stood at Rs. 439 Cr., up 6% from Rs. 414 Cr. last year. The Company has a strong capital position with a solvency ratio of 343.0% as at March 31, 2016 compared to the IRDAI-prescribed control level of 150.0%.

Important Update – In June 2016, HDFC Standard Life Insurance Company Limited (“HDFC Life”) and Max Life Insurance Company Limited (“Max Life”) announced that they will enter into an agreement through a merger of Max Life and Max Financial Services Limited into HDFC Life.

[2] ICICI Prudential Life Insurance Ltd (to be listed) – The Company is the largest private sector life insurer in India on the basis of total premium collected with market share of 23 %.

Financial Track Record – For FY 2016, the Company’s gross premium income stood at Rs. 19,164 Cr. ICICI Prudential’s profit after tax stood at Rs. 1,653 Cr. in FY 2016 and return on equity has exceeded 30% for each year since fiscal 2012. The Company has a strong capital position with a solvency ratio of 320.0% at March 31, 2016.

Asset under Management – As at March 31, 2016, the Company had Rs. 1,04,000 Cr. of assets under management, making the Company as one of the largest fund managers in India.

Other Listed Companies with Insurance as One of Its Vertical – rest of the revenue for these companies comes from various other business

View: I believe that the insurance sector will see immense growth in the coming years. I particularly like stocks in the health insurance sector which is making expensive treatments possible for the large middle class of India.