If I could make a list of the best stocks to buy in any market environment and such list was approved by everyone whoever buys a share, then very soon, that list will become a list of stocks to avoid or the “worst stocks to buy”. What exactly does that mean?

If you put on a finance news channel, you will see that analysts have different views on the same stock. It is neither rare, nor wrong to get conflicting views on the same stock:

6 May 2014; 2.25 PM – Sell Tata Motors @ Rs. 390 – XYZ Analyst

6 May 2014; 2.27 PM – Buy Tata Motors @Rs. 390 – ABC Analyst

Is this wrong or should you question the logic of the news channel. Absolutely not!

If at all the contest is between XYZ and ABC where the future price action will decide a winner. Think about it, for every seller there must be a buyer; else the trade won’t go through. So every time you sell a stock at a given price, REMEMBER – there is someone happy to buy that stock at that price. In the above scenario, XYZ feels Rs. 390 is too much for a Tata Motor share (at least at the given point of time). ABC has different views. Result – a successful trade.

Short point – There is never a universally accepted list of “best stocks to buy” at any given time. Things change with change in business plans, management, and industry outlook and of course – the stock price.

Best Stocks to Buy: Focus on the Points Below

[I] Do you understand the business?

I am not going to repeat everything what Buffet ever said but understanding businesses goes beyond what appears on surface. Focus on finding out revenue streams and expense streams, the rest will follow. How does the company make money and how does it spend it? Remember, the words of McDonald’s CFO – “We are not basically in the food business. We are in the real estate business.”

I remember when I was young; I used to watch the World Wrestling Federation (WWF). I thought it was about strong men who win belts and trophies based on brute power. As I grew up, I figured that it was like a soap opera in a simulated fight environment. I lost all respect for Hulk Hogan.

Don’t get fooled. Understand the real business.

[II] Who runs the business?

I was not entirely sure, if this should have been point no.1 or 2. Unless the management cares for shareholder value, you are unlikely to benefit from even the most lucrative business. These days it is easy to find out a lot about the management on the internet. Read about the management on their website. Look for what shows up when you Google search their name. Try to find out about their professional and business history. Search their name on CIBIL’s website.

Here again, look beyond those who appear to be running the business, look beyond the CEO’s and the CFO’s. Especially in India, look at the majority stakeholders and check their records.

A few years back I wrote a piece on the role of corporate governance and what to look for when assessing management quality. The best stocks to buy under any market environment are the ones in companies which are run by honest and efficient managements.

[III] Does the stock offer value?

Thousands of man hours are spent every month at research firms across the world. Their goal – buy stocks that offer the highest value.

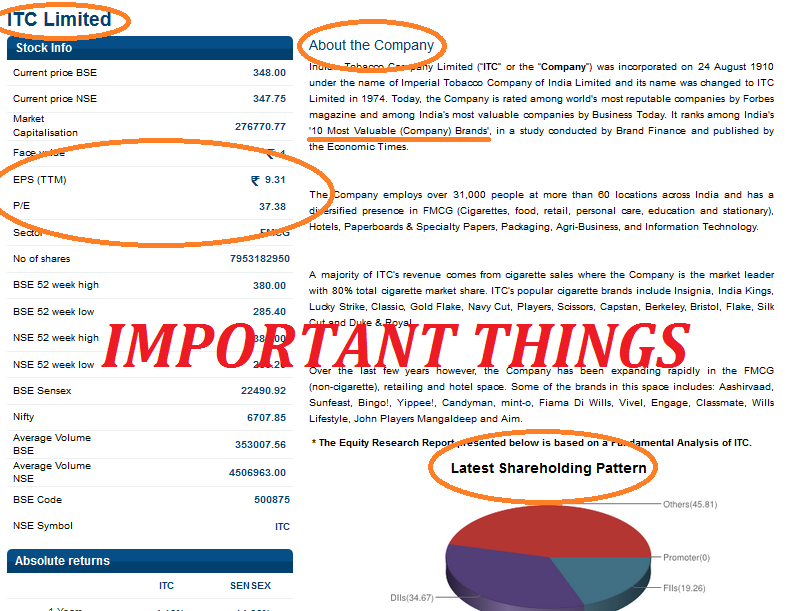

While there could be many approaches to assess the value of a stock, like the cash flow (or DCF) analysis or just looking at the current price to earnings ratio, in an ideal scenario, you should be using different approaches for different industries.

Even when you use the most basic PE method to asses a rough value, companies in certain industries will report a higher price to earnings figure in comparison to companies in other industries. For example, technology and FMCG companies command higher PE ratios since it is believed that their earnings (and accordingly the EPS) grow at a faster pace.

What is more important is to benchmark companies within the same industry and measure their performance against each other and then make an assessment if the price is justified given everything else that is going for and against the stock.

Here again, as a pure value investor, one may be looking to buy fundamentally strong undervalued stocks with a proven track record. At the same time, those who look beyond the sphere of value investing may also like t0 factor in/ look more towards future growth potential. For a differentiation criteria on these parameters refer to this post on – blue chip and growth stocks.

This by no means is a comprehensive checklist of things to do before making a stock purchase decision. On the contrary, if at all, this post should be taken as a point of reference when you start getting interested in a particular stock. Also go through the recommended posts below to get some more perspective on selecting the best stocks to buy.