The Government’s move to launch the Bharat Bond ETF is no doubt a good decision as it deepens the corporate bond market in India;

But it comes at a time when retail investors are most likely to underperform even a basic Fixed Deposit if they invest in this instrument for the short term.

Before I elaborate on this point, here are the key features of the Bharat Bond ETF:

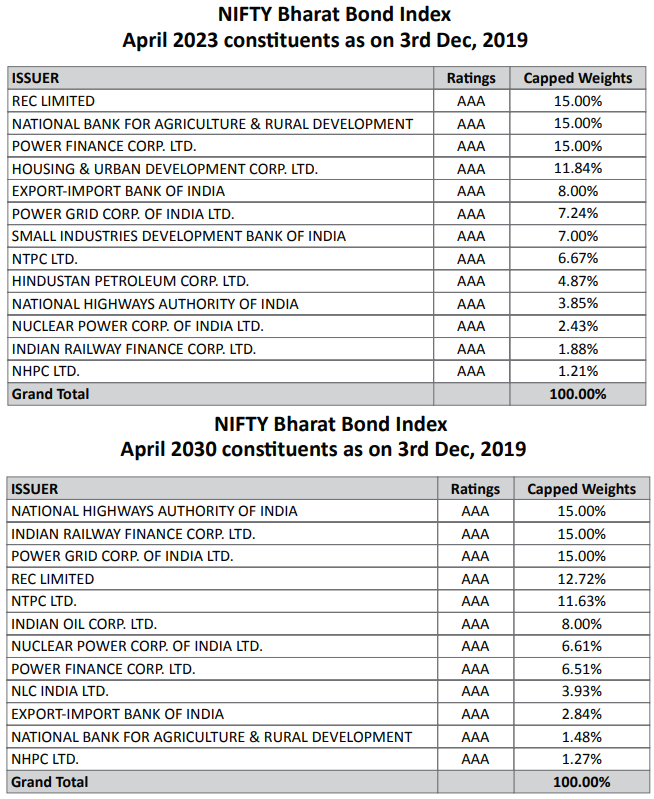

[I] Composition: It is a basket of AAA rated bonds (i.e. debt papers) of state and central Government run companies. These companies could be listed or unlisted. Initially, the Bharat Bond ETF will have debt papers of around 12 Central Public Sector Enterprises (CPSE). Like all ETFs there will be a Management Committee at the NSE to decide on the composition of Bharat Bond ETF. In its first series launching 12 December 2019, the constituents and their weightage is as under:

Bharat Bond ETF Contituents and their weightage

[II] Size: The Unit price of each ETF will be Rs. 1000. You can buy and sell one or many units on the Exchange (NSE and BSE). The ETF will be visible on the Exchange trading terminal.

[III] Subscription: The Bharat Bond ETF will be launched initially on the 12th of December and will remain open for subscription until the 20th December. That said, there should be no mad rush to apply in the ETF launch period given that the bonds are listed on the Exchange and can be bought and sold freely in the secondary market.

[IV] Duration/ Tenure: First series of these bonds are being offered with a maturity option of 3 years and 10 years. In other words, the bonds will redeem automatically at the end of the chosen tenure option.

[V] Projected Return: Going by the past track record of Government bond issuances, first tranche of these bonds to be launched on 12th December will offer interest rate of approximately 7.5% compounded and paid out at maturity.

Projection: Face value of Rs. 1000/ bond is likely to grow to Rs 1242 under the 3 year option. Face value of Rs. 1000/ bond is likely to grow to the two Rs. 2061 under the 10 year option.

[VI] Growth vs dividend options: Initially the Government is offering these ETFs only with a growth option. There is no dividend option. This may or may not change in future series.

Note: In practice however, face value of these bonds keeps increasing with passage of time. Investors can sell single or multiple units of these bonds on the Exchange terminal which serves as periodic interest from the point of view of retail investors. However doing so will take away the tax advantage which these bonds offer (Read next point: Taxation).

[VII] Taxation: The big advantage which the Bharat Bond ETF offers is its efficient and beneficial taxation. On maturity, you are taxed @ 20% with the benefit of Indexation.

For example, under the 3 year option (i.e. look at Projected Return above), your profit of Rs. 242, will be taxed Rs. 28 (based on last 3 year rate of Indexation). Under the 10 year option your profit of Rs. 1061 will be taxed at Rs. 22 (based on last 10 year rate of indexation).

[VIII] Portfolio Disclosure: The portfolio of bonds held by the ETF will be disclosed on a daily basis.

[IX] Associated Cost/ Expense: The cost associated with investing is 0.0005% of the investment value. For example if you buy 1000 bonds of Rs. 1000 face value (i.e. bonds worth Rs. 10 Lakhs), your expense will be Rs. 5 on the transaction.

How are Bharat Bond ETFs better than FD?

FD interest @ 7.5% is taxed at your nominal rate of income tax. Bharat Bond ETF’s accumulated interest of 7.5% p.a. will be almost tax free after factoring in the indexation rate. In effect you stand to make up to 30% more post-tax return by investing in the Bharat Bond ETF issue (Read next point: The Risk).

The Risk

Why then do I say that retail investors might underperform a basic FD if they invest for a short term? This is because, while the ETF will be redeemed at face value upon maturity, the price of the ETF while it is listed on the Exchange will be dynamic.

In other words, it is possible that the bond quotes / trades below its face value in case RBI increases its rates. Alternatively, if there is a rate cut, bond prices will appreciate faster. Effectively, you may be able to trade these bonds for a profit or loss depending on what RBI does to its benchmark rates before the bonds mature.

As retail investors, keep in mind that if you are buying the Bharat Bond ETF, you should buy with a view to hold this till maturity. Do not get convinced that you may be able to sell this ETF at a higher price than what you stand to make at maturity. Given where Government bonds are trading, and given the fact that RBI can control interest rates, who knows where these bonds will be trading next year.