INDIAN SOLAR ENERGY INDUSTRY

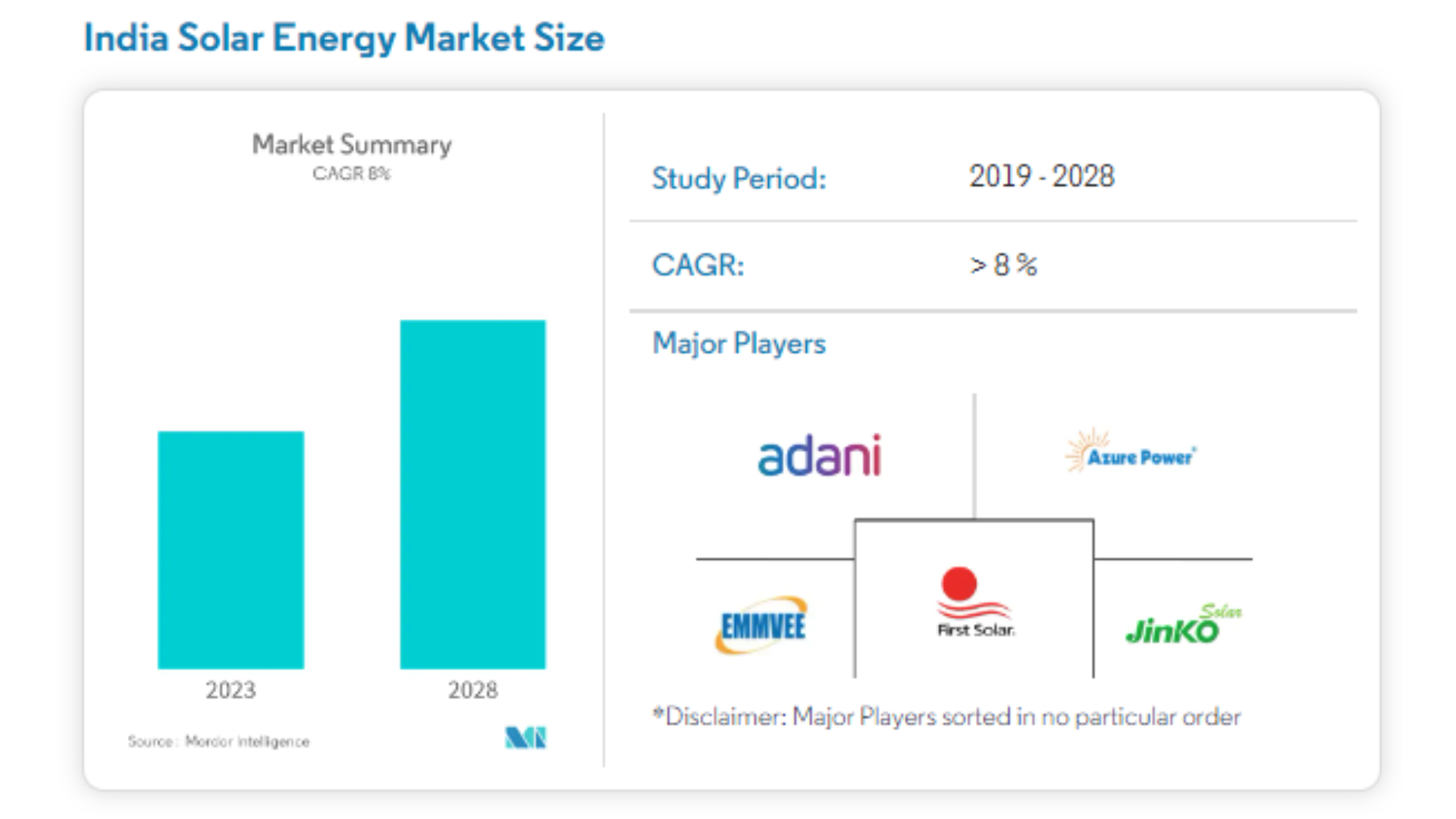

The solar power market share in India is expected to increase by USD 240.42 billion from 2021 to 2026, at a CAGR of 35.24%. There has been a spurt in the demand for renewable energy since conventional electricity generation methods such as thermal power plants are getting exhausted. In India, solar power is one of the most popular renewable sources of energy. The solar energy market is constantly expanding through efficient collaboration between the government and the private sector. In 2021, India achieved the fifth position in solar power deployment, globally. The Ministry of New and Renewable Energy (MNRE) regulates the market. Some of the major producers are Adani Power Limited, Tata Power Company Limited, ReNew Energy Global Plc, and Torrent Power Limited.

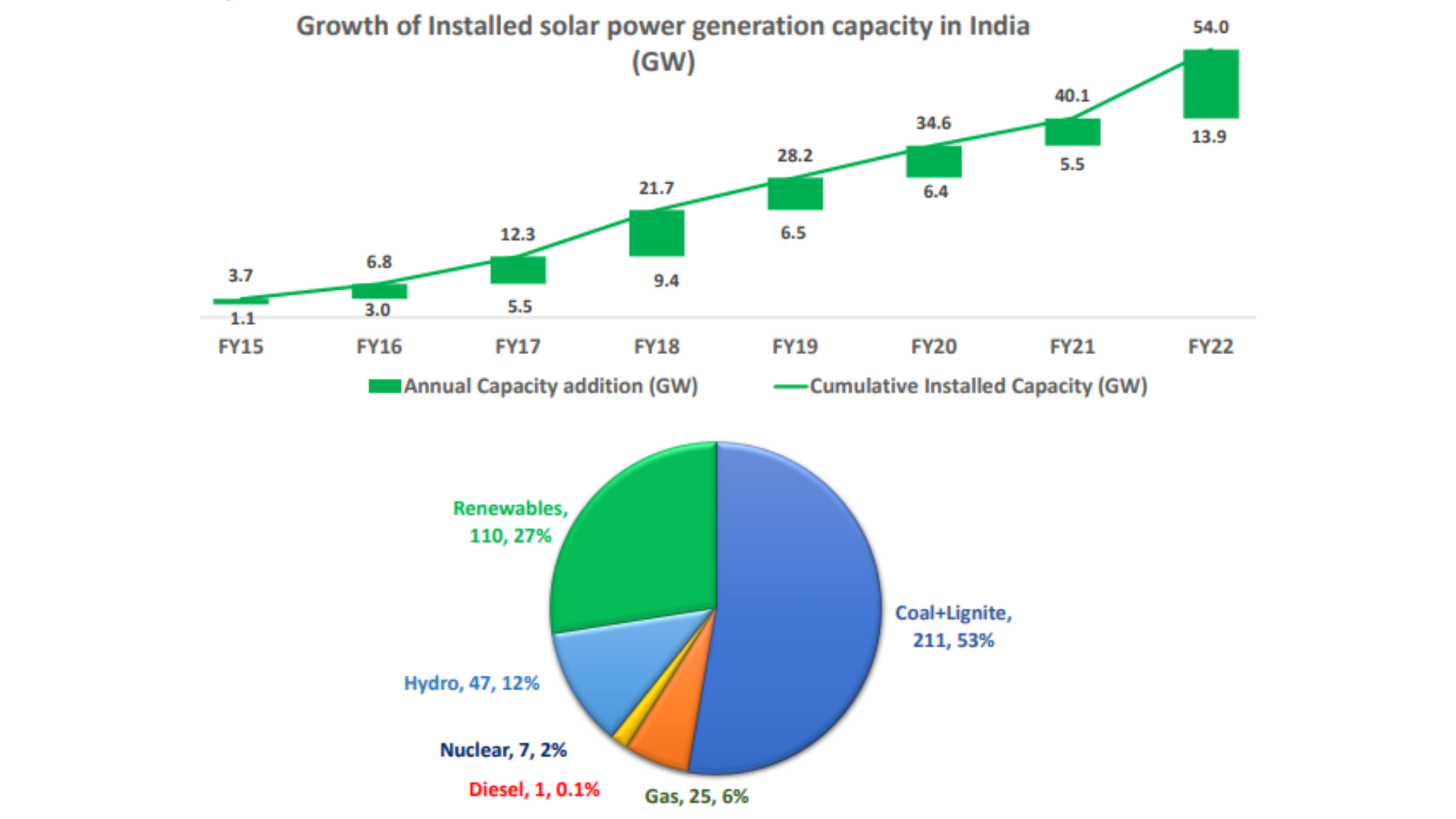

- Out of total installed power generation capacity of 399 GW as of Mar’22 in India, renewables form around 27% of the same (110 GW) of which solar (54 GW) is about 49% of the renewable capacity.

- Government of India has a target to install 175 GW of Renewable Energy by 2022, of which Solar is 100 GW

- The target for Solar has since been raised to install 300 GW by 2030.

- FY22 has witnessed the highest annual installations and set the pace for future.

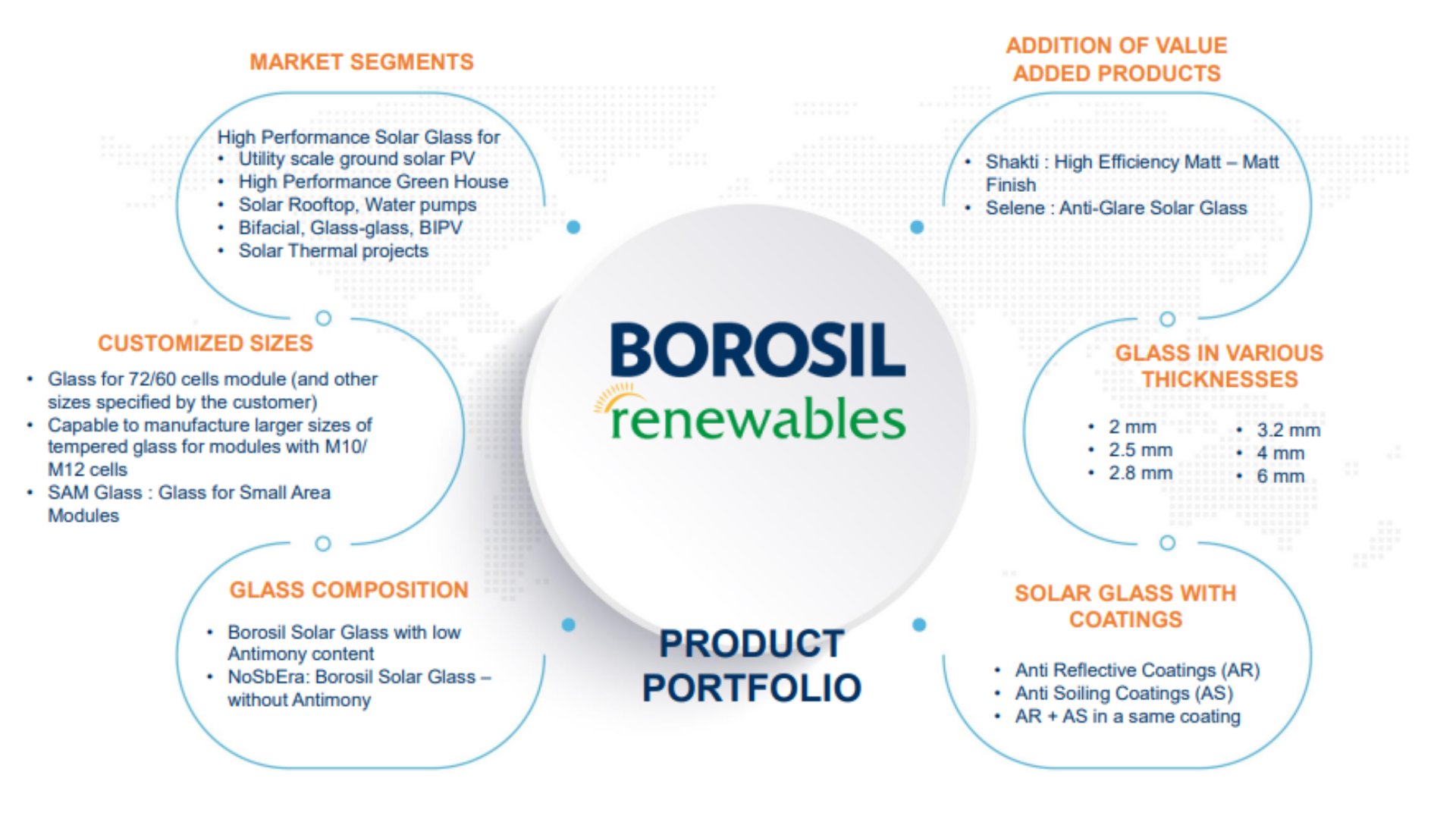

BOROSIL RENEWABLES PRODUCT PORTFOLIO

- Borosil Renewables Limited (BRL) is the first and only solar glass manufacturer in India.

- The company has a strong focus on innovation and is known for its pioneering achievements:

- the development of the World’s First fully tempered 2 mm thick solar glass

- solar glass with the lowest iron content giving the highest glass efficiency

- first company in the world to successfully remove the most hazardous substance – “Antimony” – from its solar glass etc.

- Recently the company launched new products like Selene: an Anti-glare solar glass suitable for PV installations

near airports, Shakti: a very high-efficiency solar glass in a matt-matt finish. - Amongst the upcoming products with enhanced features is the solar glass with Anti-soiling coating. The company has a strong focus on expanding its domestic & export footprints.

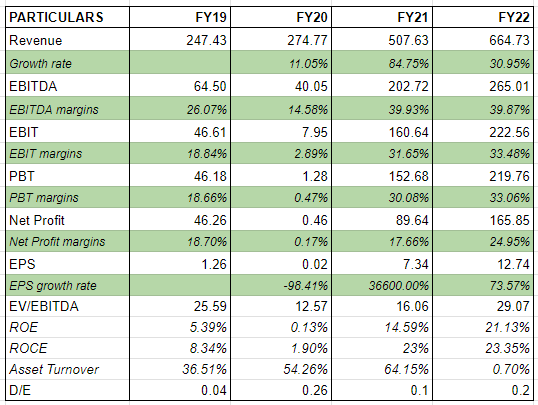

KEY FINANCIALS OF BOROSIL RENEWABLES

Figures in Crores(Crs)

LATEST QUARTERLY RESULTS OF BOROSIL RENEWABLES

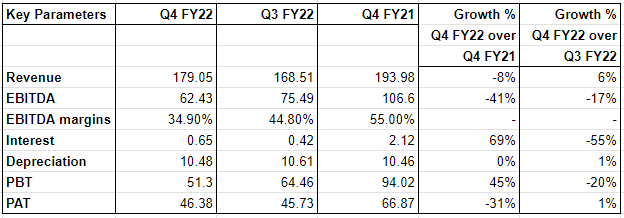

Q4 FY22 Highlights:

- During the quarter, the Company achieved Net Sales of INR 179.1 Cr., a decrease of 8% over the corresponding

quarter of the previous year. The average ex-factory prices of tempered solar glass during the quarter were lower

by about 14% compared to the corresponding quarter in the previous year as the higher volumes helped contain

the decline in sales value to 8%. - Export Sales during Q4FY22 (including to customers in SEZ) were INR 39.3 Cr. (INR 38.9 Cr. in the corresponding

quarter), comprising 21.9% of the turnover. - EBITDA during the quarter was INR 62.4 Cr. corresponding to an EBITDA margin of 34.9% as compared to a

margin of 55% in Q4FY21. The lower EBITDA margin was mainly due to lower ex-factory realizations and higher

input costs as compared to the corresponding quarter. - During the year, the company recorded Net Sales of INR 644.2 Cr., an increase of 28% over the previous year. The average ex-factory prices of tempered solar glass during the year were about INR 133 per mm as compared to INR 119 per mm in the previous year.

- Export Sales during the year FY22 (including to customers in SEZ) were INR 171 Cr. ( INR 110 Cr. in the corresponding

period), comprising 26.6% of the turnover. - EBITDA during the year was INR 265 Cr. corresponding to an EBITDA margin of 41.1% as compared to a margin of 40.4% in the previous year. The higher EBITDA margin was led primarily by better ex-factory realizations even after absorbing higher landed cost of inputs, higher production and state Government subsidies (INR 9.7 Cr).

- PAT during the year was INR 165.9 Cr. corresponding to an PAT margin of 25.7% as compared to a PAT margin of

17.8% in FY21.

INVESTMENT RATIONALE

Market Leaders and the first mover advantage:

- Borosil Renewables Limited (BRL) is the first and only solar glass manufacturer in India.

- As a leading supplier of fully tempered thinner glass (up to 2mm), Borosil Renewables are poised to serve these emerging segments and some of its customers have already obtained certification for 2.8 and 2.5 mm glass.

- The company has a strong focus on innovation and is known for its pioneering achievements:

- the development of the World’s First fully tempered 2 mm thick solar glass

- solar glass with the lowest iron content giving the highest glass efficiency

- first company in the world to successfully remove the most hazardous substance – “Antimony” – from its solar glass etc.

- Recently the company launched new products like Selene: an Anti-glare solar glass suitable for PV installations

near airports, Shakti: a very high-efficiency solar glass in a matt-matt finish. - Amongst the upcoming products with enhanced features is the solar glass with Anti-soiling coating. The company has a strong focus on expanding its domestic & export footprints.

Government incentives for boosting growth:

- The customs notification has been issued on 1st February 2022 making the imposition of Basic Customs Duty (BCD) on solar cells (25%) and modules (40%) effective from April 1, 2022, following the announcement from the Ministry of New and Renewable Energy (MNRE) in March 2021. This has come into force from 1st April 2022.

- Production Linked Incentive (PLI) scheme for domestic solar cell and module manufacturing hiked to Rs. 24,000 Cr in the Budget 2022 from Rs. 4,500 Cr announced earlier. This will propel domestic manufacturing of high-efficiency solar modules and solar cells with further backward integration to create a robust ecosystem to ensure a robust supply chain for high growth.

- Approved List of Models and Manufacturers (ALMM) for government-supported schemes, including projects from where distribution companies procure electricity for supply to their consumers. As a major step, the scheme was extended to all the projects under net-metering and open access projects and the same to be effective from 1st October 2022.

- Antidumping Duty (ADD) on solar tempered glass imports from China since August 2017.

Booming Industry prospects:

- The National Solar Mission targets 100 GW of Installed Capacity by 2022 which is targeted to grow to 300 GW by 2030. Needs annual solar installations of 25 GW to achieve the target.

- Tenders by SECI for large ISTS-connected projects assuring offtake and payment security to the project developers.

- The Kusum program aims to install 30.8 GW by 2022 with an incentive for farmers to install Solar Pumps/Grid Connected Projects etc. with domestic content requirements for Solar Cells and Modules to boost Domestic Manufacturing. This is expected to be 110 GW by 2030.

- Total Production Linked Incentive (PLI) scheme hiked to Rs. 24,000 Cr. In budget 2022 for domestic solar cell and module manufacturing up from Rs. 4,500 Cr announced earlier. This will propel domestic manufacturing of high-efficiency solar modules and solar cells with further backward integration to create a robust ecosystem to ensure a robust supply chain for high growth.

- The Solarization of Railways have started with 500 MW of Rooftop Generation Capacity by 2022 and 20 GW of Land Capacity to be installed by 2030 for self sustenance.

Thank you very much for the details Borosil Renewables stock analysis. The stock is corrected significantly due to Govt’s decision on anti dumping duty , declined in profits, potential competition from local and international players and poor market sentiments. Current price levels of Rs. 412 are decent to enter this counter.

I agree.