Britannia Industries (‘Britannia’ or the ‘Company’) is one of the leading FMCG Company in India, delivering products in over 5 categories through 3.5 million retail outlets. The primary business segment of the Company –

(i) Bakery products – Biscuit, Bread, Cake and Rusk

(ii) Dairy products – Milk, Butter, Cheese, Ghee, Dahi, Milk-based ready to drink beverages and Dairy Whitener.

Liquidity and Credit Analysis

Britannia’s average current ratio over the last 5 financial years has been 0.96 times which indicates that the Company has been maintaining sufficient cash to meet its short term obligations.

Britannia’s average long term debt to equity ratio over the last 5 financial years has been 0.34 which indicates that the Company is operating with a negligible level of debt.

Britannia’s average interest coverage ratio over the last 5 financial years has been 64.56 times which indicates that the Company has been generating enough for the shareholders after servicing its debt obligations.

The Company has maintained an average dividend yield of 1.17 % over the last 5 financial years.

WHAT’S DRIVING THE STOCK

Strong Position in the Biscuit Category

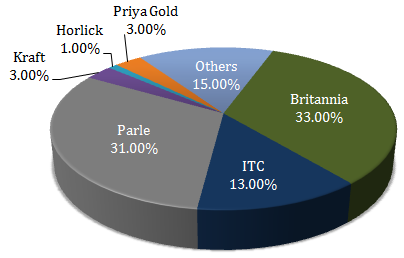

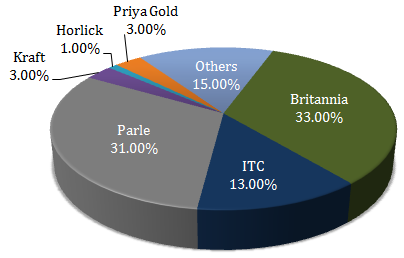

Britannia enjoys leadership position and strong brand recall in the biscuit category where the Company enjoys 33% market share. The Company currently has seven strong brands in its portfolio, including Tiger (glucose biscuits), Treat (cream biscuits), 50-50 (crackers), Good Day (premium cookies), Marie, Milk Bikis and NutriChoice (premium high-fiber biscuits). The Company derives ~90% of its revenue from the biscuits segment while, 10% of its total sales coming from non-biscuits category and International market.

Focus On Premium Brands to Drive Growth Going Forward

In the urban landscape, Britannia is focusing on premiumisation of their product line. Britannia is also making efforts to add new sub brand and introduce new variants/innovations under existing brands. Britannia launched ‘Heavens’ under the Nutri Choice and ‘Chunkies’ under Good Day brand as premium category of biscuits.

New launches include: NutriChoice Heavens, Good Day Chunkies and Britannia Nut n Raisin Romance Cake. On the back of these premium brands, Britannia witnessed a consolidated top line growth of 13.7% at Rs. 7,858.42 Cr. in FY15. In the coming years, volume growth will improve supported by efficient investment on its brand advertising and promotions.

The Company’s focus towards its premium brands would generate significant returns in the coming time as these brands already have a good image in the market and it would be easy for their variants to attract the customers.

Company Brands Includes

| Biscuits | Breads | Cakes |

| Good Day | White Sandwich Breads | Bar Cakes |

| Crackers | Whole Wheat Breads | Chunk Cake |

| NutriChoice | Bread Assortment | Nut & Raisin Romance |

| Marie Gold | Dairy | Muffills |

| Tiger | Cheese | |

| Milk Bikis | Fresh Dairy | |

| Jim Jam + Treat | Ghee | |

| Bourbon | Rusk | |

| Little Hearts | Premium Bake | |

| Pure Magic | Maska Rus | |

| Nice Time |

Diversification of Product Portfolio

Britannia has increased its non-biscuits portfolio like dairy (butter, Milk and Dahi), bakery and healthy breakfast (Poha, upma and Oats) in an effort to diversify its product line which would also support the top line growth in the coming years.

Distribution Network to Penetrate Rural Markets

Britannia has focused on building a robust distribution system which could increase its products reach in urban and rural market. The Company has also invested heavily in expanding the distribution network and improving the product pipeline. In FY 2015, the Company’s products were available in 10 lakh outlets, as against 7.5 lakh in FY 2014. In the same period, Britannia increased its rural reach by over 8,000 outlets in FY 2015 and is planning to increase the same to 1.5 times over FY 2017.

WHAT’S DRAGGING THE STOCK

The Threat of Patanjali Ayurved

Patanjali Ayurved is the newest entrant in the FMCG sector with over 350 products including biscuits, noodles, juices, toothpaste, shampoo, hair oils, skin cream products etc. Patanjali has made an entry with a bang and has in very quick time crossed Rs. 2000 Cr in revenue. As per a report published by IIFL, Patanjali could report revenue in excess of Rs. 20,000 Cr by FY 2020.

This could certainly have disruptive effect on Britannia and other FMCG companies. Patanjali is on a sales push and is planning to make its products available at 2 Million stores by end of 2016 from the current ~ 200,000 stores (that’s a 10 times growth). Further, Patanjali was found and is headed by the immensely popular yoga guru Baba Ramdev, which gives its products a strong brand recall and great advantage in marketing.

Competitive Environment – Entry of Kraft

The Indian biscuit market is led by a few players like Parle and ITC. However, foreign players like Kraft are planning to expand their presence in the branded biscuit segment in India. On the other hand, regional/local brands have a strong presence in the rural markets of India. Any increase in competition from the new and regional players would deteriorate market share of the company.

Stringent Food Regulations

The U.S. Food and Drug Regulators (USFDA) have recently rejected products of many FMCH companies due to reasons varying from products manufactured in unhygienic conditions to pesticides being above permissible limits. More stringent food safety regulations with stricter policies in terms of quality standards, supervision and sanctions perpetually present an ongoing threat for FMCG companies.

Counterfeit Consumer Goods

According to KPMG Report – Sell Smart, July 2015 – fake consumer goods are growing faster than the overall consumer products market. Counterfeit and smuggled products now account for more than a fifth of the FMCG market in India.

Lack of awareness among consumers and incapability to differentiate between genuine and fake goods act as a major risk for the FMCG companies.

canadian pharmacy discount code oxycontin canada pharmacy northwest pharmacy canada