INFOSYS ANNOUNCED 1:1 BONUS ON 4 SEPTEMBER 2018 (POST THE DATE OF PUBLICATION OF THIS ARTICLE).

Summary

INFY stock is available at its lowest valuations in over 20 years.

Strengthening USD and concerns around H1-B visa regime has pulled down the stock.

Gartner and Nasscom growth forecast for the IT sector remain weak for FY 2018.

Most negative news is factored in and is reflecting in the stock price.

Expect a sharp bounce back in stock price over the next 12-18 months.

Infosys Limited (INFY or the “Company“) is a global leader in consulting, technology, outsourcing and services, with a strong workforce of more than 194,000 employees.

Click here for the previous year’s Financial Statements of INFY.

INFY provides business IT services across:

- Application Management

- Business Applications

- Business Process Outsourcing

- Cloud

- Digital

- Engineering

- Infrastructure management

- Management Consulting

- Enterprise Mobility

INFY has a diversified geographical presence with 100 development centers spread across India, APAC, the Americas & Europe, and servicing clients in more than 50 countries.

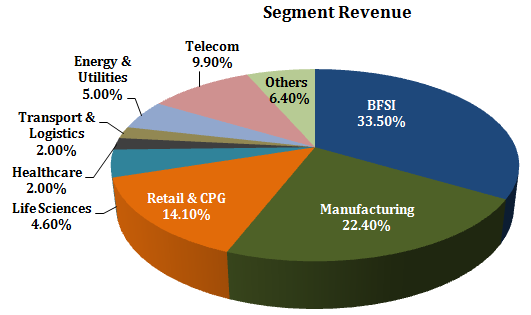

Geographical Breakup – 61.6% of the overall revenue of the Company comes from the U.S., followed by 24% from Europe, 2.5% from India, and 11.9% from the Rest of the World.

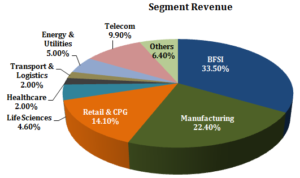

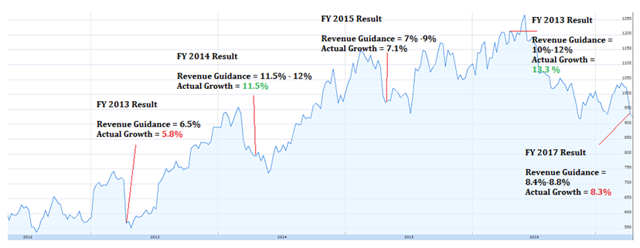

“Within the blue chip IT packs, focus more on companies which get a majority of their revenue from BFSI (Banking & Financial Services Industry) sectors which is likely to do well in the coming years and avoid companies which have more exposure to telecom or other beaten down sectors like metals. INFY’s BFSI domain constitutes 33.10% of its total revenue.”

INFY has a strong balance sheet, strong earnings and a healthy cash & cash equivalent of Rs. 226,250 million (as on 31st March 2017). The Company operates with ZERO debt on its book. INFY has shown consistent growth over the last ten years (i.e. 2007-08 to 2016-17). Its net revenue from operations over this period grew at an impressive CAGR of 17.96%.

For FY 2017, income from operations increased by 10% to Rs. 684,840 million from Rs. 624,410 million and PAT increased by 6% to Rs. 143,530 million from Rs. 134,910 million. INFY has reserves in excess of Rs. 650,560 million.

With healthy operating cash flows and zero debt on its books, we expect the return ratios to stay healthy going forward.

| INFOSYS | 10 YEAR AVERAGE P/E = 19.34 | ||||

| 2008 | 2009 | 2010 | 2011 | 2012 | |

| Price | 357.54 | 331.03 | 653.78 | 809.19 | 716.24 |

| EPS | 20.3 | 26.1 | 27.4 | 29.9 | 36.4 |

| P/E | 17.60 | 12.68 | 23.83 | 27.11 | 19.69 |

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Price | 722.48 | 814.44 | 1108.3 | 1217.95 | 1020.8 |

| EPS | 41.2 | 46.6 | 53.94 | 59.03 | 62.77 |

| P/E | 17.53 | 17.48 | 20.55 | 20.63 | 16.26 |

| Current P/E | |

| Price | 927 |

| EPS TTM | 62.77 |

| P/E | 14.77 |

Based on the above Price/Earnings (P/E) multiple averages for the past 10 years, INFY is available at a cheap valuation and is currently trading at ~24% discount. The other way to look at this would be to calculate the fair price of the stock based on its historic P/E multiple.

In other words if INFY’s fair P/E multiple is seen at 19.34, what should be its price right now? This is an easy calculation to do:

Price/EPS = 19.34

Price = (19.34 * EPS) = (19.34 * 62.77) [this is INFY’s EPS for FY 2017]

Price = Rs. 1,213.97

Based on a 10-year average P/E ratio, INFY’s fair price is Rs. 1,296.01. Of course, many will argue that attributing past valuations may not be right since the industry will not expand at the same rate in the future.

High Dividend Yield Stock

INFY has consistently been among the top dividend-paying companies. The Company has been consistently paying dividends for more than 10 years.

New Capital Allocation Policy

INFY has revised the capital allocation policy after taking into consideration the strategic and operational cash requirements in the medium term. The Company plans to pay Rs.130,000 million via dividend/share buybacks to shareholders in FY 2018.

Additionally, effective from FY 2018, INFY revised its payout policy to 70% of free cash flow from ~50% of PAT earlier. The revised capital allocation policy seems to be a positive step in shareholder value creation.

Growing Client Relationships And Increasing Client Base

INFY’s client-centric approach and high level of execution excellence continues to provide a high level of client satisfaction. This is clearly visible from its repeat business, which is generating ~97% of its revenue. INFY has added 321 new clients in FY 2017, taking the total client base to 1,162.

INFY continues to expand existing client relationships by providing them with a broad set of end-to-end service offerings and increasing the size, nature and number of projects that can be done with them. Further, the Company’s specific industry, domain, process and technology expertise allow INFY to enable its clients in transforming their businesses with innovative strategies and solutions.

| Client metrics | |

| Top 5 client’s contribution to revenue | 12.6% |

| Top 10 client’s contribution to revenue | 21.0% |

| Number of active clients | 1,162 |

| New clients added in the period (FY 2017) | 173 |

| Repeat business % | 97.3% |

Increased Focus On Digital Space

INFY has made strong developments in Social, Mobility, Analytics and Cloud (SMAC) and digital transformation through an inorganic route. According to Nasscom’s 2016 report, SMAC revenue will account for ~20% of the total revenue of Indian IT companies in 2020, from the current levels of less than 5%.

On the domestic market front, India’s government focus on the digital India initiative throws a rich opportunity for the IT players. As INFY is building strong capabilities in the digital technology space across industries, we believe this move would augur well for the Company.

Conservative Management Guidance And H1-B Visa Concerns For FY 2018

Adverse macro-economic environment coupled with cut back in IT spends by vendors and concerns over H1-B visa regime are hindering the growth prospects of the software services sector. The management has given a conservative revenue guidance of 6.5-8.5% in constant currency terms for FY 2018.

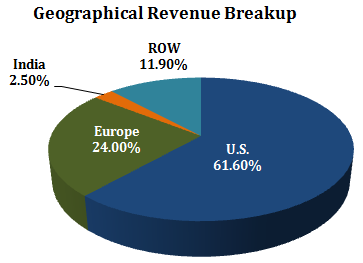

Past Management Revenue Guidance VS Actual Growth

| Infosys | FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 |

| Revenue Guidance | 6.5% | 11.5-12% | 7-9% | 10-12% | 8.4-8.8% |

| Actual Revenue Growth | 5.8% | 11.5% | 7.1% | 13.3% | 8.3% |

| One Year Stock Performance | 1.27% | 10.39% | 34.71% | 11.02% | -15.35% |

Lower IT Sector Growth Rate

Everything bad that could happen to IT stocks happened in FY 2017. Here’s a post explaining all the negative events and its impact on IT stocks. Keeping all this in mind, for FY 2018, Nasscom has deferred to give its estimated growth projection but many brokerage houses are expecting the growth projection in the range of 6-8% lower than the previous year’s projection (8-10%) due to global macro uncertainty, cross-currency fluctuations, structural shift in the industry and political uncertainties.

I believe that most negative news has been factored in and that the stock has corrected much more than it should have. Any positive triggers could result in a sharp recovery in the stock price. Given its strong fundamentals and healthy balance sheet, INFY will continue to pay out higher dividends and makes for a compelling buy at the current price.

Disclosure: I and my clients have holding in the stocks discussed. The above article first appeared at Seekingalpha

Thank you Sir! Bought @918

More downside is pending:

1) USA: Buy local hire local is still valid. Hiring 10K USA Citizens is not a joke.

2) Good talent shying away from IT due to job insecurity. Like 20 years back best of the best are not interested in IT Anymore. Daily annoucements of firing will keep companies on toes for long term.

3) Emotions: Investor sentiments are not in favor of IT and Pharma for now.

Lot of other opportunities in Market why invest in IT !!!!