Constant news flow and major corporate announcements after market hours make many wonder if they should buy/sell their stocks as soon as the market opens?

For example – when a company reports really bad quarterly results or an extremely bad news surfaces post trading hours, far too often, investors wonder if they should sell their holding immediately.

If you are sure that you want to trade (i.e. buy or sell) on the basis of such announcement, you really don’t have to wait until the next day. You can trade in the after market hours. I.e. after the stock markets close for trade at 3.30 PM IST and before they opens at 9.15 AM IST (depending of course on whether your stock broker allows that – most brokers do these days).

Does selling in after market hours give you any advantage?

Short Answer – Investors often (wrongly) believe that selling in after market hours will ensure a better sell rate for the stock when the market opens (and vice-versa). If you are the first one to buy a stock in closed market hours, you will get the first share to be traded in the morning when the market opens. The truth is that after market hour orders will not be of much help in such scenarios (on the contrary, they may actually result in a loss).

At best – After Market Orders or AMO’s are meant for those investors who for whatever reason do not have access to the markets during normal hours (for example – for someone who may be overseas or in a different time-zone etc).

For those who may be curious and are interested in some technicalities, let me explain what happens to after market hour orders and you can decide if it helps or hurts more (on a case by case basis).

Market Timings

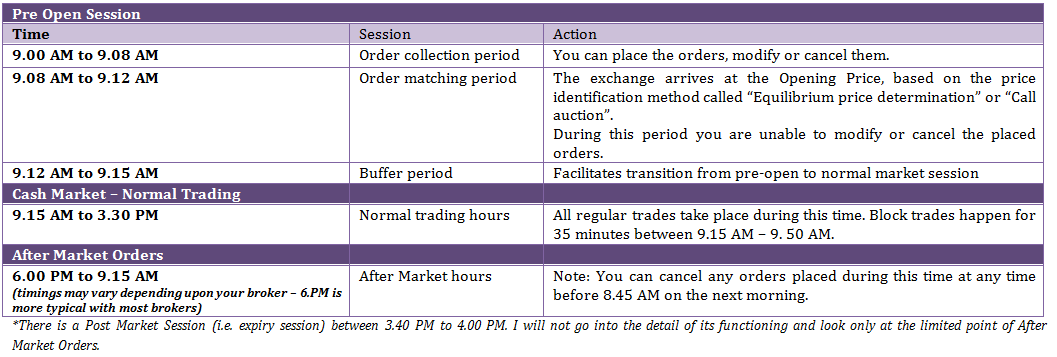

Related question – what is the pre-open session (i.e. what happens in the 15 minutes from 9.00 AM to 9.15 AM)

In regular market (i.e. 9.15 AM – 3.30 PM), chances are pretty good that you will find someone to buy at your desired price. There is enough liquidity as most trading happens during this time.

Unlike regular orders, after market orders are not immediately sent to the exchange. Naturally, as the exchange is closed for business during this time.

These orders sit with your broker who sends them to the exchange before it opens for trade for the next trading session. Consequently, the equilibrium for these orders is not formed in a live market but in the pre-market trading session. The same rules of price and time stamping as they apply to regular market orders[1], do not apply in this case. For a helpful chart on how equilibrium price gets established in regular market hours visit here.

After market hour orders are matched in the pre-trading session. The order matching in pre trading session happens in the following sequence:

- Match-able buy limit orders are matched with match-able sell limit orders.

- Residual buy or sell eligible limit orders are matched with market orders.

- Market orders are matched with market orders.

Determination of Equilibrium Opening Price

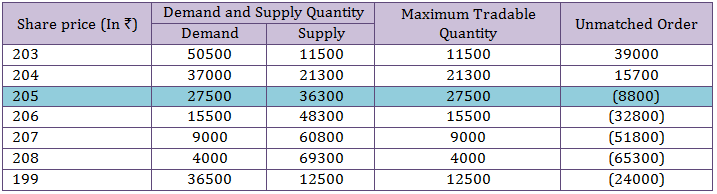

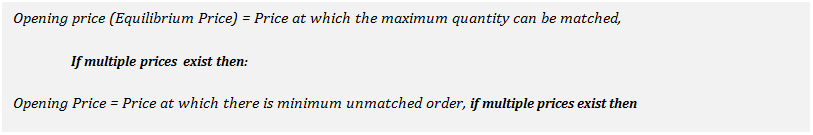

The equilibrium price is the price at which the maximum quantity can be matched. In case more than one price meets the said criteria, the equilibrium price is the price at which there is minimum unmatched order quantity.

Example of how Equilibrium Price determination actually works?

Based on the principles of demand and supply, the exchange comes up with an equilibrium price for all orders places in the pre-open session. This is the price at which maximum number of shares can be bought / sold. In below example this price = Rs. 205. This becomes the opening price for the next trading session and all unmatched orders are queued in the system with the same rules of price and time stamping as they apply to regular market orders.

- After finding the equilibrium price all orders are executed at the equilibrium price and all unexecuted orders are carry forwarded in open market in the following way:

-

-

- Limit orders at limit price

- Market orders at final equilibrium price (opening price)

- If opening price is not discovered, market orders at previous day’s closing price.

-

- Price band of 20% shall be applicable on the securities during pre-open session i.e. if the closing price of scrip is Rs. 100, you cannot place an order beyond Rs. 80 – Rs. 120 price range during pre-open session.

____________________________________________________

[1] (i.e. similar priced buy and sell orders are matched first. If there is more than one order at the same price, the order entered earlier gets a higher priority)

usc pharmacy store corner drug store canada weight loss drugs

Great information.

I love the business and the client Money.

I want to be full time business person in stock market.

Do suggest.

My best advice – start putting out your own research. Investors are always interested in hearing from anyone who can be of help. The rest follows with time.

Just one observation on this line “These orders sit with your broker who sends them to the exchange before it opens for trade for the next trading session”.

I think the orders are sent to the exchange as/after it opens …. in my experience with HDFC Securities online trading system, in fact these type of orders appear on the trading screen almost 2-3 minutes post start of pre-opening session. So there is no chance of any time priority placing orders this way 🙁

Regds,

Bosco

First off I would like to say great blog! I had a

quick question that I’d like to ask if you don’t mind. I was interested to know how you

center yourself and clear your thoughts before writing. I have had difficulty clearing my mind in getting my

thoughts out. I truly do take pleasure in writing

but it just seems like the first 10 to 15 minutes

are lost just trying to figure out how to begin. Any recommendations or tips?

Thanks!

If you really enjoy what you write about, then that should not be the case.

Also, try to ask people what they want answers to. It makes the job easier :-). Good Luck.