Price: Rs. 253.75

Date: March 30th 2020

Cadila Healthcare Limited (“Cadila” or the “Company”) is a pharmaceutical company that discovers, develops, and manufactures a broad range of healthcare products including human formulations, veterinary formulations and drugs, diagnostics, herbal products, skin care products, Over the Counter (OTC) products and Active Pharmaceutical Ingredients (APIs).

The Company has a strong presence in respiratory, pain management, anti-infectives, oncology, neurosciences, dermatology and nephrology segments.

In 1995, the Zydus group was restructured and formed Cadila Healthcare under the aegis of the Zydus group. From a turnover Rs. 250 Cr. in 1995 the group witnessed a significant financial growth and registered a turnover of over Rs. 12,700 Cr. in FY19.

Financial Performance

| Particulars | FY15 | FY16 | FY17 | FY18 | FY19 |

| Revenue (In Rs. Cr.) | 8,651.30 | 9,426.80 | 9,376.50 | 11,904.90 | 13,165.60 |

| Growth | – | 8.96% | -0.53% | 26.97% | 10.59% |

| EBITDA (In Rs. Cr.) | 1,755.70 | 2,330.50 | 1,904.40 | 2,847.50 | 2,973.10 |

| EBITDA Margin | 20.29% | 24.72% | 20.31% | 23.92% | 22.58% |

| EBIT (In Rs. Cr.) | 1,468.40 | 2,038.40 | 1,531.10 | 2,308.70 | 2,374.50 |

| EBIT Margin | 16.97% | 21.62% | 16.33% | 19.39% | 18.04% |

| PBT (In Rs. Cr.) | 1,445.50 | 2,098.70 | 1,614.60 | 2,330.80 | 2,382.10 |

| PAT (In Rs. Cr.) | 1150.60 | 1933.90 | 1487.70 | 1775.80 | 1848.80 |

| PAT Margin | 13.30% | 20.51% | 15.87% | 14.92% | 14.04% |

| EPS (In Rs.) | 11.24 | 18.89 | 14.53 | 17.35 | 18.06 |

| EPS Growth Rate | – | 68.08% | -23.07% | 19.37% | 4.11% |

| Historic P/E (Closing Price of 31stMar) | 31.00 | 16.78 | 30.42 | 21.78 | 18.60 |

| Current P/E (TTM) | 29.29 | ||||

| Shareholder funds (In Rs. Cr.) | 4,251.60 | 5,699.20 | 6,960.00 | 8,744.50 | 10,386.30 |

| Minority Interest (In Rs. Cr.) | 168.90 | 135.80 | 156.10 | 191.00 | 1,292.90 |

| Debt (In Rs. Cr.) | 2,333.90 | 2,107.30 | 4,945.30 | 5,112.60 | 7,146.60 |

| Cash (In Rs. Cr.) | 669.90 | 638.70 | 1,543.50 | 1,314.90 | 649.30 |

| Ratios | |||||

| D/E | 0.55 | 0.37 | 0.71 | 0.58 | 0.69 |

| ROCE | 25.99% | 29.34% | 15.79% | 20.27% | 15.79% |

| ROE | 27.06% | 33.93% | 21.38% | 20.31% | 17.80% |

| Interest Coverage | 25.86 | 44.14 | 42.70 | 31.26 | 15.36 |

Quarterly Performance

| Quarterly Results | Q3 FY 2019 | Q4 FY 2019 | Q1 FY 2020 | Q2FY 2020 | Q3FY 2020 | TTM | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 3,577.90 | 3,732.80 | 3,496.30 | 3,366.60 | 3,638.10 | 14,233.80 | 8.06% | 1.68% |

| EBITDA (In Rs. Cr.) | 839.90 | 800.40 | 632.00 | 625.60 | 693.20 | 2,751.20 | 10.81% | -17.47% |

| EBITDA Margin | 23.47% | 21.44% | 18.08% | 18.58% | 19.05% | 19.33% | ||

| PAT (In Rs. Cr.) | 510.70 | 460.10 | 325.30 | 94.00 | 371.40 | 1,250.80 | 295.11% | -27.28% |

| PAT Margin | 14.27% | 12.33% | 9.30% | 2.79% | 10.21% | 8.79% | ||

| EPS (In Rs.) | 4.99 | 4.49 | 2.97 | 1.05 | 3.65 | 12.16 | 247.62% | -26.85% |

WHAT’S DRIVING THE STOCK?

New Government Order of HCQ | Amid Coronavirus

On 4th April 2020, the Government has placed the order for 10 Cr. hydroxychloroquine tablets with Cadila. Cadila is one of the two largest manufacturers of key Covid drug hydroxychloroquine (HCQ) (the other one being Ipca Laboratories). Cadila has ramped up its production by nearly 10X to 30 metric tonnes (15 Cr. tablets of 200mg) per month in view of the huge spike in demand expected due to rising cases of Covid-19.

The Company is confident that it can scale up its production to even 50mt (25 Cr. tablets) if need be. The Company will be able to cater to the requirements as it is among the few companies in the world who have capabilities to manufacture the drug in large quantities.

New Approvals from USFDA

On 2nd April 2020, the Company received final approval from the U.S. health regulator to market Lamotrigine Extended Release Tablets USP in the strengths of 25 mg, 50 mg, 100 mg, 200 mg, 250 mg, and 300 mg. The medication is used is indicated for the treatment of certain types of seizures and will be manufactured at the group’s manufacturing facility at SEZ, Ahmedabad.

On 7th April 2020, the Company received final approval from the U.S. health regulator to market generic Perphenazine tablets USP in the strengths of 2 mg, 4 mg, 8 mg and 16 mg. The medication is used for treatment of schizophrenia and for the control of severe nausea and vomiting in adults. The drug will be manufactured at the group’s formulation manufacturing facility at Baddi.

On 9th April 2020, the Company received final approval from the USFDA to market Imatinib Mesylate Tablets, 100 mg and 400 mg. This medication is used to treat certain types of leukemia (blood cancer), bone marrow disorders, skin cancer and tumors of the stomach and digestive system. The drug will be manufactured at the group’s formulation manufacturing facility at the SEZ, in Ahmedabad.

As of today, the Company has 285 approvals and has so far filed over 386 ANDAs since the commencement of the filing process in FY 2003-04.

U.S. Key Market for Growth

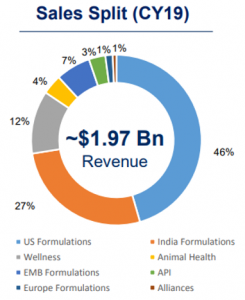

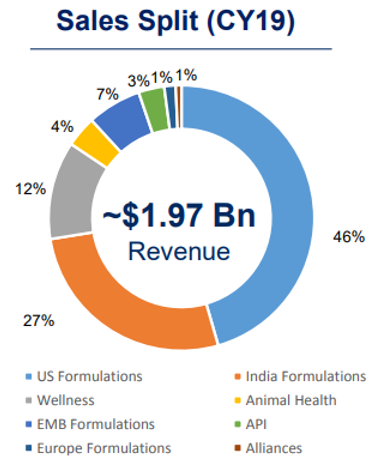

U.S. has been the key driver for the Company in the past five years and grew at 17% CAGR in FY 2015-2019 backed by aggressive filings and product launches. Launches of authorised generics also contributed to overall growth. The Company earns 48% of revenue from the U.S.

During Q3 FY2020, the Company launched nine new products in the US and filed fourteen ANDAs. Cadila received eight new product approvals (including 2 tentative) from USFDA during the quarter. The U.S. pipeline (cumulative) consists of 338 filed ANDAs, 146 pending final approvals.

Strong Domestic Business Prospects

With a market share of ~4.2%, Cadila is the fourth largest player in the domestic formulations market, as per AIOCD. The domestic business is growing at a pace of about 12% CAGR from FY 2014-FY 2019. Cadila gets about 40% of its revenues from India.

Diverse Portfolio with presence in 3 segments:

[1] India Pharma (63% of revenue) – New products & Volumes are major growth drivers. The Company is focused to diversify business through building Specialty Portfolio & Biologics.

[2] Zydus Wellness (28% of revenue) – Thriving in niche categories of health and wellness with Sugarfree, Nutralite and Everyuth. The Company has integrated the acquired portfolio of Heinz having the leading brands viz. Glucon-D, Nycil and Complan.

- Sugarfree – Undisputed market leader with category defining market share of ~95%.

- Nutralite – Demonstrated category and brand leadership through expansion into the $100 Mn+ mayonnaise market growing at 20%+

- Everyuth – Pioneer & market leaders of Scrubs (~32%) and Peel Offs (~81%)

[3] Animal Health – 2nd largest Animal Healthcare Company in India with a wide portfolio of Drugs, Vaccines and Feed Supplements.

As always.. pleasure to read. Was thinking on doing research on some of the Pharma Stocks.. thanks for sharing.. keep enlightening us. May God bless you.