Key Facts:

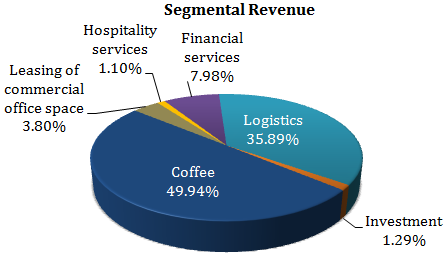

[1] Diversified Business – Coffee Day Enterprises Limited (“Coffee Day” or the “Company”) operates in the following divisions:

- Coffee and related businesses – Cafe Coffee Day (CCD), Cafe Coffee Day Lounge, Cafe Coffee Day Square, Coffee Day Xpress, CCD International and coffee vending machines;

- Leasing of commercial office space – Technology parks and Special Economic Zone (SEZs) – Under Tanglin brand;

- Logistics – Via its subsidiary Sical Logistics which is an integrated logistics provider;

- Investments – Major investments include 16.76% holding in Mindtree Limited (listed on both BSE and NSE), and stakes in Ittiam Systems, Global Edge Software Limited and Magnasoft;

- Financial Services – 85.53% stake in Way2Wealth, investment advisory and commission brokerage company;

- Hospitality – The Serai Resorts through a wholly owned subsidiary, Coffee Day Hotels & Resorts Private Limit.

[2] The Company’s Logistics arm – Sical Logistics Limited is listed on both BSE and NSE and has a market capitalization of Rs. 850.71 Cr. as on July 9, 2015. Coffee day holds 52.83% in Sical.

[3] The Company is operating in losses (on consolidated basis) for the previous 3 financial periods.

| FY 2013 (In Rs.) | FY 2014 | Nine Month Period Ended 31 December 2014 |

| NET LOSSES | ||

| 21.41 Cr | 77.03 Cr | 75.23 Cr |

| EPS | ||

| (1.83) | (6.60) | (6.44)* |

* EPS is not annualized.

[4] The Company has consolidated debt of Rs. 3,758.49 Cr. as of February 15, 2015;

[5] Net worth (Shareholder’s fund) stood at Rs. 555.99 Cr. and Rs. 464.63 Cr. as at March 31, 2014 and December 31, 2014, respectively;

[6] Debt to Equity ratio stood at 3.87 (based on the most recent debt and net worth figures disclosed in the DRHP).

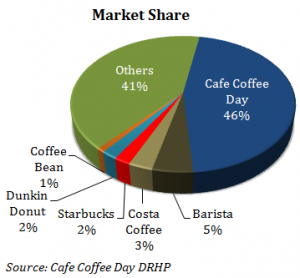

Indian Cafe Market – Competition Analysis

India has traditionally been a tea drinking nation. Per capita consumption of coffee has been ~ 110 grams per year in comparison with developed countries where coffee consumption is substantially higher. With growing influence from coffee chains like Cafe Coffee Day, Starbucks, Costa Coffee etc., coffee consumption and socializing at coffee shops is increasingly becoming popular in India.

On the back of young population, increasing proportion of working age population, and higher disposable income, the size of the organized Cafe market is estimated to grow to Rs. 151 billion by 2020 at a CAGR of 15% (Source: Company’s DRHP).

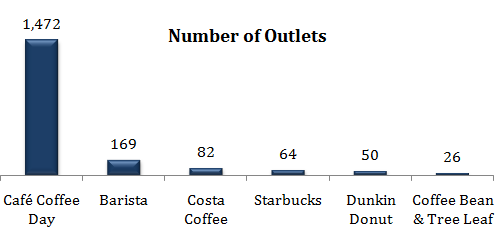

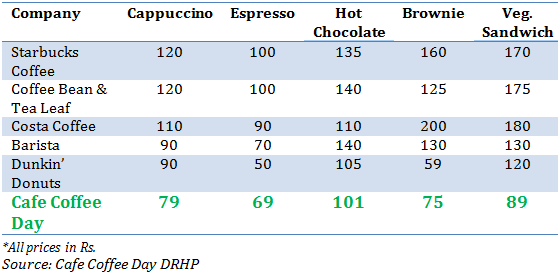

Cafe Coffee Day has been the pioneer in establishing coffee culture in India with the very first outlet back in 1996 in Bangalore, followed by Barista in 2000. Cafe Coffee Day faces competition from both local and international players in terms of price, product offerings, and ambience of outlets for coffee, food and beverages. The competitors range from large and established companies to emerging startups and unorganized small food and beverages vendors. Primary competitors in include Starbucks, Costa Coffee, Barista, Coffee Bean and Tea Leaf and other local Cafes.

Also the Company faces competition from quick service restaurants such as McDonald’s, Dominos, Dunkin Donuts, KFC, and Pizza Hut.

Cafe Coffee Day – IPO Use of Proceeds

Coffee Day has filed a Draft Red Herring Prospectus (DRHP) with SEBI for an initial public offering (IPO) to raise Rs. 1,150 Cr.

Shares will be issued in accordance with the Issue of Capital and Disclosure Regulations (ICDR) issued by SEBI as applicable to loss making companies – Accordingly, shares would be offered to public investors through a book building process wherein 50% of the net issue would be allotted on a proportionate basis to Qualified Institutional Buyers (QIB). Up to 5% of the QIB portion (excluding the anchor investor portion) will be reserved for domestic mutual funds. Not less than 35% of the net issue (or net issue less allocation to QIBs) would be available to the retail investors.

Use of Proceeds as per the DRHP

| [1] Expansion of Coffee Business – Rs. 287.51 Cr. | |

| Setting-up of new 216 Cafe network outlets and 105 Coffee Day Xpress kiosks during FY 2016 and FY 2017 | Rs. 87.71 Cr. |

| Manufacturing and assembling 8,000 vending machines | Rs. 97.36 Cr. |

| Renovation of existing (240) Cafe network outlets and (7,000) vending machines | Rs. 60.58 Cr. |

| Setting-up of a new coffee roasting plant facility, along with integrated coffee and tea packing facility | Rs. 41.86 Cr. |

| [2] Repayment/prepayment of loans of the Company and Subsidiaries – Rs. 632.80 Cr. (~55%) | |

| [3] General corporate purposes – The amount not to exceed 25% of the Gross Proceeds. | |

Important Points about Cafe Coffee Day IPO

[1] Leadership Position – Cafe Coffee Day enjoys a leadership position in the organized Cafe chain outlet business with 46 % share (based on number of outlets). As of December 31, 2014, the Company operates through 1,472 outlets across 209 cities followed by Barista with 169 outlets. The Compay has been very aggressive in expanding and has approximately four times the number of stores as compared to the next top four brands put together as on December 31, 2014. In addition, the Company also has 590 Coffee Day Xpress kiosks across 12 cities, 42 CCD Lounges across 7 cities, and 7 CCD Square outlet across 7 cities.

[2] Low Price Strategy – Cafe Coffee Day with the highest number of outlets and competitive pricing has been able to achieve better consumer penetration and strong connection with the young consumers and has consciously kept its pricing on the lower side of the pricing scale.

[3] Financial Performance: Coffee Day’s recent financial performance has not been so impressive. The Company has reported losses consecutively for 3 years. Financial numbers for FY2015 are available for 9 months only. However, it is unlikely that the Company posted profit for full year since nine months losses stood at Rs. 75.20 Cr.

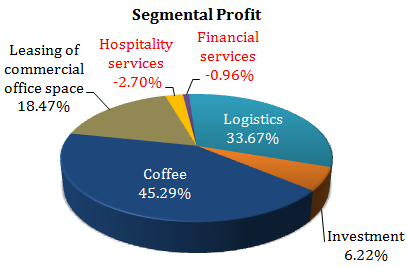

The Company derives 80 % of its revenue from its 2 businesses – Coffee (45.29%) and Logistics (33.67%) (See breakup above). The Company’s non coffee businesses particularly – hospitality and financial services have posted losses consecutively for last 5 years. Yet the Company in its DRHP has mentioned its intention to invest in the development of its financial services and hospitality services segment to drive better financial and operational performance.

The Company has not declared any dividends during the last five financial years and is most likely to use its future earnings for expansion and repayment of debts.

[4] Exiting Investors/Shareholders: Coffee Day can boast of some reputed names in its list of existing shareholders. Currently, the total number of shareholders is at 22. Promoter of the Company, V.G. Siddhartha, hold 54.78%. Some of the other investors include: Infosys co-founder Nandan Nilekani (1.77%), private equity firm KKR (3.43%) and Rakesh Jhunjhunwala (0.24%).

Top 10 Shareholders as on the date of filing of DRHP

| Name of the Shareholder | Percentage (%) |

| V.G. Siddhartha | 54.78 |

| Devadarshini Info Technologies Private Limited | 10.63 |

| Coffee Day Consolidations Private Limited | 10.51 |

| Gonibedu Coffee Estates Private Limited | 9.48 |

| KKR Mauritius PE Investments II Limited | 3.43 |

| Malavika Hegde | 2.50 |

| Vasanthi Hegde | 2.24 |

| S. V. Gangaiah Hegde | 2.22 |

| Nandan Nilekani | 1.77 |

| Bennett Coleman & Company Limited | 1.17 |

| Total | 98.74 |

Our View

The Company could be an interesting story purely on the basis of business outlook for coffee business of Cafe Coffee Day chain. Will update once there is clarity on valuation and pricing details.

Hi rajat, thanks for the article, its informative & useful. With pricing of INR 325 published by article in routers, how is your analysis on IPO pricing ?

Great info, exactly what I was looking for. I guess investors are currently buying into their debt with the hope of some share in future profits. CCD has many outlets, I wonder what is the book value of this stock, do they own their outlets or do they rent?

Personally, I think this name is too generic and does not command a premium, the way Starbucks does.

Avoid, until it becomes clear how many outlets they own (versus renting). This business depends on real estate, the strategic location of their outlet will be a deciding factor in earnings.