Of course you can get insured for as much as you want. Higher the insurance amount, higher will be your insurance premium. Higher the premium; better it is for the insurance company. In any event you must draw a line somewhere, right? How much annual premium would you like to pay?

Read: Insurance Planning – 5 Basic Factors to Think About

The above article will help you understand the type of insurance policies which you should keep at all times. The next most important thing to decide is ‘The Correct Amount of Life Insurance’ which you need. Unlike other types of insurances like medical, motor vehicle etc. life insurance amount can be calculated based on the amount which your family or dependants will need on monthly basis if you stopped working or worst still, if you die.

The correct amount of life Insurance should be calculated based on the Human Life Value.

Human Life Value (HLV)

Human life value or HLV is the amount of insurance that will be required to attain all future earnings in case the person stops working today. In other words it is the present value of all future earnings. There are 2 popular ways of calculating this value:

[1] Income Replacement Method

As the name suggests, under this method, calculation is based on the amount of income which the dependents of the insured person will have to live without. In other words the calculation tells you the amount of insurance needed today to replace the future income on a monthly basis. A few important factors must be considered in making this calculation including –

- Number of working years left (for which income is to be replaced);

- Average income in each year;

- Expected growth rate of income on a yearly basis;

- Rate of return expected to be earned on the accumulated sum of money;

This can be best explained with an EXAMPLE.

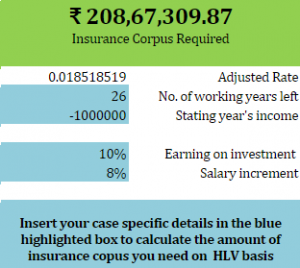

Raju earns Rs 10, 00,000/- p.a. He is 34 year old and would like to retire at the age of 60. Assuming that on average his salary will increase by 8% per year and that his investments would earn 10% per year, how much insurance should he need to replace his income over the next 26 years (i.e. till he attains the age of 60).

The Formula

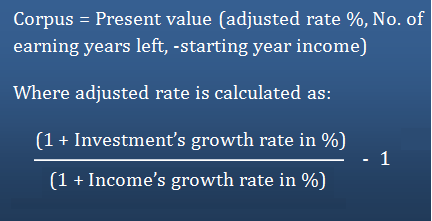

The formula to calculate the insurance amount or the corpus that is required to replicate Raju’s income in case he stops working is:

In our case, Raju’s insurance need = 1,53,39,470/-

You can use the excel calculator below to do this calculation for your individual case.

[2] Need Based Method

The big difference in this method is that here we take into account the current investments, assets, expenses etc. and also factor in future needs when calculating the corpus required. In other words, insurance is taken for what is not already covered by the current investments and assets.

Factors to be considered when making this calculation –

- Current Insurance;

- Current investments;

- Rate at which investments will grow;

- Inflation rate;

- Number of years for which insurance protection is needed;

Example

Mr. Bubna’s monthly income is Rs. 3,00,000/-. He pays an insurance premium of Rs. 20,000 p.a., car EMI of Rs. 35,000 on a car loan of Rs. 10,00,000/-. His personal expenses per month are approximately Rs. 15,000/- How much insurance should he get today to safeguard the future of his wife who is currently 35 years old and is expected to live till the age of 80. He owns a house which is valued at Rs. 3 Cr. and has liquid investments of Rs. 25,00,000/-.

We assume that investments will appreciate at a rate of 10% and inflation to be at an average of 7%.

The Formula then remains the same. You can use the calculator above to arrive at the required amount. The only difference in this approach is that existing investments and expenses are to be factored in, in order to reach the amount of insurance cover required.

Calculation

| Adjusted Rate | = ((1+7%)/(1+10%))-1 = 2.80% |

| Period for which insurance needed | = 45 years (80-35) |

| Present income to be replaced | = (3,00,000-20,000-35,000-15,000)*12 =2,70,000*12 = 32,40,000/- i.e. yearly income |

| Corpus required | = 8,45,69,313/- |

| ADDITIONAL STEPS | |

| Add the value of outstanding loan | = 8,45,69,313 + 10,00,000 = 8,55,69,313/- |

| Minus the value of current investments and house. | = 8,55,69,313 – 3,00,00,000 – 25,00,000 |

| Insurance cover needed | = Rs. 5,30,69,313/- |

The above amount is the total insurance cover which Mr. Bubna should get to achieve his goals. In case he has a current insurance cover, that cover amount should be subtracted from the amount above.

Thanks for the information it’s really helpful. Learnt many things.