Not only is this extremely expensive but in most cases not needed at the initial stage. Sometimes even the most basic and cursory review could throw up enough information about the target so as to dissuade you from not going any further. Certainly if the initial findings are positive, there must be a second round of detailed due diligence.

Why should you care about due diligence?

In 100% cases (yes without exception), companies, their managements and their advisors would make untrue statements or will omit to state material facts about the business irrespective of how good or bad things are at their end.

This is particularly true in case of distressed sales and when a management is planning to come on board your company. There is no rocket science to understanding why this happens. People, without exception want to get the best price for their assets, be it a car, a business or their human skill. There is nothing wrong with that but I think it would be absolutely criminal to not do your own diligence before believing counterpart’s claims.

How can you conduct basic due diligence about a company?

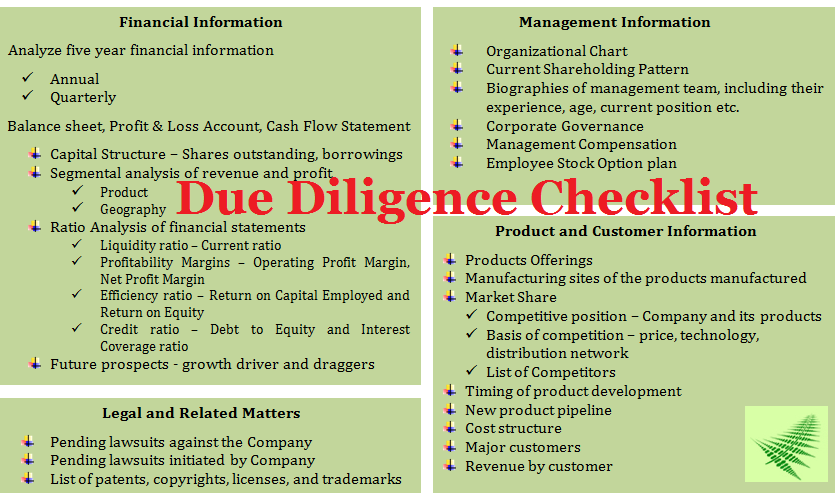

There is no dearth of elaborate checklists on conducting due diligence. Most firms put out their due diligence checklists on their websites, mostly to convince about the fine job they are capable of doing. In reality, they miss out on the most basic details relevant to a transaction. This happens over and over and over again, mainly because of the prevailing culture of mindlessly following systems and ticking off checklists without paying any attention to prioritizing. Mostly the executives who discuss your plans have nothing to do with the juniors who conduct the diligence. Believe me when I say this . . . I have vast experience in this area, both as an executive, and previously as someone much junior.

So before you get to the point of engaging a legal professional or hiring an external firm, perform some of these checks yourself, and you will find that most of these opportunities are not worth your time and that you do not need an expert to tell you that:

- Website of the Ministry of Corporate Affairs (MCA) – On www.mca.gov.in , you can find almost anything about both private and public companies including:

i. Financial statements;

ii. Annual reports;

iii. Legal proceedings against the directors or the company;

iv. Charge or lien on any of their assets;

v. Any pending corporate non-compliance action.

Start your due diligence by checking that the company is validly incorporated, its stated main clause i.e. what according to its parent document is the main business of the company and what are the other areas in which it operates.

- Website of the Credit Information Bureau (India) Limited (CIBIL) – On this website you can check the credit history of any person, company, partnership venture or any other business. You can check any litigation / cases pending against them as also whether they have in past ever been declared a willful defaulter.

- Most Basic Financial due diligence – Once you know how to get the financial statements and other corporate documents from MCA’s, you can perform basic checks such as:

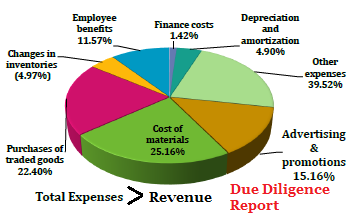

a) Past performance – a cursory look at the cash flow statement will throw light on the condition of the running business of the company. Check for the outstanding loans against the company in the balance sheet (you could also match these with the charges created against the company).

b) Financial irregularities and conduct of management – Sometime back I had written a detailed article on this aspect, you can visit that post on here on – the role of corporate governance in investing.

c) Finally, make a list of things which the company did not do correctly, how you could turn things around and focus on this one question – why is this company or asset up for sale?

d) For listed companies – in a way the task is easier for companies listed on the stock exchange given that most information about these companies could be sourced from their periodic filings. You could safely avoid getting into these aspects when conducting a basic diligence exercise.

If you have the time to get familiar with these sites, you could do most of this yourself. An easier way however is to engage someone who has prior experience in his area, and would be happy to conduct a basic due diligence exercise. You could write in to me at – rajat@sanasecurities.com, to discuss what you would like for me to carry out for you.