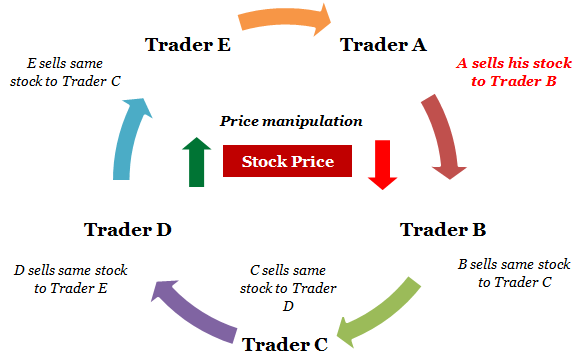

Circular trading in stock market refers to a fraudulent trading scheme where buy/sell orders are entered by a person or by persons acting in collusion with each other to operate the price of the underlying security. The person(s) buying or selling knows that the same number of shares at the same time and for the same price will be entered to neutralize the transaction. Hence, these trades do not represent a real change in beneficial ownership of the security.

The only intention behind such buying or selling is raising or depressing prices of the underlying securities by increasing trading volumes.

The participants involved in such trades make use of their prior knowledge and enter orders knowing that those orders will be covered by reverse orders of the same size, at the same time and price. This increases the trading volumes in the underlying security and generates interest from other investors. When trading volume in a particular script increases, it leads other investors to believe that something big is afoot (such as a merger or an acquisition) and that the interest in the underlying security is genuine.

In short – the intention of those who initiate circular trading is to con investors and traders into buying or a selling the operated script.

For example, if there is any news on the issuance of bonus share by a company, the traders involved in circular trading may enter into matching deals among themselves (i.e. buy and sell order) at a price similar to or higher than the prevailing market price. As the trading volume increases, other investors will start buying the stock at which point those who initiated the circular trades will slowly start booking profits and exit from the transactions while other investors are caught unaware of the real situation.

Some Cases of Circular Trading in India

- Ketan Parekh is alleged to have been involved in one of India’s biggest stock market scams dating back to 1999-2001. Currently he is debarred from trading in the Indian stock exchanges till 2017. He was accused of inflating share prices of the firms like Zee Telefilms, Ranbaxy, Global Telesystems, Himachal Futuristic Communication (HFCL), Silverline, Satyam Computers, among others, using circular trading.

- SEBI discovered another incidence of circular trading by two brokers over the stock of Videocon Industries Ltd. in 2004. The involved brokers were Mansukh Securities and Finance Ltd. (MSFL) and Intec Shares and Stock Brokers Ltd. (ISSL). Together, they deflated the share price from Rs. 36.15 to Rs. 28.19 i.e. a 20% fall. In 2012, Sebi imposed penalties of Rs 2 lakh each on the two brokerage firms.

- SEBI accused Angel Broking of working with the three other brokerages to create artificial volumes in shares of Sun Infoways Ltd from February 5 to March 2 in 2001. Shares of Sun traded in the range of Rs 342 to Rs 296 during that period, after which shares slumped to as low as 60.75 rupees on April 30, 2001, while trading volumes reduced drastically.

- In 2009, SEBI barred Shankar Sharma, the Joint Managing Director of First Global Stock Broking Limited, Shankar Sharma for 1 year, for circular trading.

To prevent circular trading in the stock market, SEBI has introduced price filters:

- Intraday price bands permits the stock to be traded within a range during a trading session. It aims at preventing intraday price swings.

- Inter week price band has a wide range within which stocks are permitted to be traded in a week. It prevents huge swings in prices rippling into the next settlement cycle. SEBI imposed a uniform intraday price band of 10 % for all securities on all stock exchanges, in addition to 25 % weekly price cap being followed by all exchanges.

- Margins are additional filters applied by the stock exchanges to curb the price volatility. For every transaction undertaken by the broker he has to deposit a margin amount to the stock exchange. The margin amount paid is used as a tool to discourage speculative and circular trading.

I have often observed that when I make a speculative sale of my shares (deliverable) the price goes up sharply. I surmise this is the circular traders piggybacking on my sale as a substitute for their initial investment, to show that it is not a closed loop (in case of investigation).

I also observed how the Indian Bank stock went from above Rs 200 to below Rs 60 and is up to 240 levels again. Is this a fit case for investigation? I had read that those who are involved in money laundering will introduce a bearish trend in selected stocks, but recompense any loss to those who sell down in black money. After the cooling off period, they then manipulate the value up to the level required to legitimize their black money assets, some of which they have invested to achieve this result (I am sure they keep a stash even after laundering!)

Really clear site , regards for this post.