Asian Paints and Kansai Nerolac – Business Description

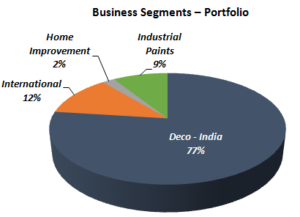

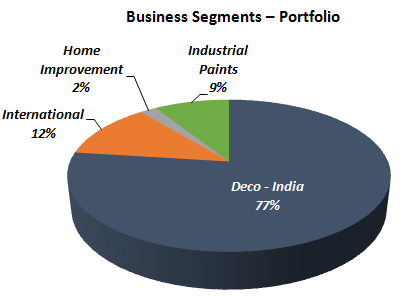

Asian Paints – Asian Paints is the industry leader in the decorative paint segment with 53% market share and a dealer network of over 55,000 across India. It derives 77% of its topline from the decorative segment.

Asian Paints along with its subsidiaries have operations in 16 countries across the world with 26 paint manufacturing facilities, servicing consumers in over 65 countries through Berger International, SCIB Paints – Egypt, Asian Paints, Apco Coatings, Taubmans and Kadisco.

Asian Paints is also present in the Home Improvement and Decor space in India through Sleek (Kitchens) and Ess Ess (Bath Fittings).

- Deco India : Paints, Water Proofing, Wall Coverings & Adhesives

- International – Operations outside India (Asia, Africa, Middle East and South Pacific)

- Industrial – Two 50:50 JVs with PPG Inc, USA for automotive & Industrial paints in India

- Home Improvement – Bath & Kitchen business in India

____________________________________________________________________________

Kansai Nerolac – Kansai Nerolac is India’s largest industrial paint company with ~35% market share in industrial paints and third largest player with overall ~14% market share. The Company has coating solutions across the decorative, wood coatings, general industrial, high performance coatings, powder coatings, automotive, and auto refinish market segments.

Kansai Nerolac has four manufacturing facilities situated at Lote in Maharashtra, Bawal at Haryana, Jainpur in UP and Hosur in Tamil Nadu with an Installed capacity of nearly 431,000 tonnes.

Revenue Contribution – 55% from Decorative business and 45% from Industrial segment. Automotive segment contributing 75% of the industrial segment revenues.

- Major Clients in Automotive Coatings – Maruti, Toyota, TVS Motors, Bajaj Auto, Tata Motors, Honda, Mahindra & Mahindra, Volvo, Ashok Leyland, Renault, Fiat, Tafe, Eicher, Hero, Yamaha and Nissan.

- Major Clients in General Industrial Coating – Godrej, Whirlpool, Samsung, Blue Star, Daikin, Voltas, Haier, Videocon, Siemens, Havells, Panasonic, Orient Fans and Hitachi.

- Major Clients in High Performance Coating – Adani, Ambuja Cements, Hindalco, Larsen & Toubro, NTPC, BPCL, JSW, Thermax.

IN A NUTSHELL, THE FOCUS OF ASIAN PAINTS IS MORE ON THE DECORATIVE SEGMENT WHILE THAT OF KANSAI NEROLAC IS ON THE AUTOMOTIVE SEGMENT.

*ASIAN PAINTS – 11.93% OF PROMOTER HOLDING IS PLEDGED.

Asian Paints and Kansai Nerolac – Financial Position

| Particulars – | FY17 | FY18 | FY17 | FY18 |

| ASIAN PAINTS | KANSAI NEROLAC | |||

| Revenue (In Rs. Cr.) | 15,061.99 | 16,824.55 | 4,052.55 | 4,658.08 |

| Growth | 5.54% | 11.70% | 7.58% | 14.94% |

| EBITDA (In Rs. Cr.) | 2,986.42 | 3,197.61 | 737.40 | 793.12 |

| EBITDA Margin | 19.83% | 19.01% | 18.20% | 17.03% |

| EBIT (In Rs. Cr.) | 2,651.63 | 2,837.14 | 667.31 | 716.05 |

| EBIT Margin | 17.60% | 16.86% | 16.47% | 15.37% |

| PBT (In Rs. Cr.) | 2,884.07 | 3,022.69 | 765.31 | 786.96 |

| PAT (In Rs. Cr.) | 1,939.43 | 2,038.93 | 508.84 | 514.40 |

| PAT Margin | 12.88% | 12.12% | 12.56% | 11.04% |

| EPS (In Rs.) | 20.22 | 21.26 | 9.44 | 9.55 |

| EPS Growth Rate | 11% | 5.1% | -44% | 1.1% |

| Historic P/E (Closing Price of 31st March) | 53.09 | 52.71 | 40.10 | 52.99 |

| CURRENT P/E | 66.50 | 51.87 | ||

- Revenue of Asian Paints was Rs 16,824.55 Cr. in FY18 while that of Kansai Nerolac were Rs 4,658.08 Cr. Thus, in terms of size, Asian Paints is almost 3.6 times Kansai Nerolac.

- Over the last 5 years Asian Paints’ revenues have grown at a CAGR of 7.25% while those of Kansai Nerolac have grown at a CAGR of 9.99%.

- Over the last five years average EBITDA margins of Asian Paints were 17.94%. For Kansai Nerolac the same stood at 14.97%.

- ROE of Asian Paints is higher than that of Kansai Nerolac. Over the last five years average ROE of Asian Paints were 37.98%. For Kansai Nerolac the same stood at 24.66%.

Comparative Valuation – Asian Paints and Kansai Nerolac

| Particulars | Asian Paints | Kansai Nerolac |

| No. of shares (31st Dec 2018) | 95.92 Cr. | 53.89 Cr. |

| Price (3rd April, 2019) | Rs. 1,503.00 | Rs. 461.65 |

| Market Cap (In Rs. Cr.) | 144,167.43 | 24,879.23 |

| Shareholder funds (In Rs. Cr.) | 8,410.23 | 3,132.32 |

| Minority Interest (In Rs. Cr.) | 327.65 | 16.38 |

| Debt (In Rs. Cr.) | 520.75 | 26.54 |

| Cash (In Rs. Cr.) | 404.65 | 363.61 |

| Enterprise Value (In Rs. Cr.) | 144,611.18 | 24,558.54 |

| Revenue (In Rs. Cr.) TTM | 18,806.89 | 5,124.02 |

| EBITDA (In Rs. Cr.) TTM | 3,541.50 | 761.30 |

| EBITDA Margin % | 18.83% | 14.86% |

| Net Profit (In Rs. Cr.) TTM | 2,182.29 | 480.34 |

| Net Profit Margin % | 11.60% | 9.37% |

| EPS (In Rs.) TTM | 22.60 | 8.90 |

| EV/EBITDA (x) | 45.22 | 30.96 |

| P/E (x) | 66.50 | 51.87 |

Asian Paints is more expensive than Kansai Nerolac on both valuation metrics. Superior performance in the past and leadership position in the paint industry has led Asian Paints to trade at a premium valuation to Kansai Nerolac.