In a country like India with a shadow economy the size of ~ 25% of GDP (total unaccounted money within India is estimated between Rs. 10 – 15 lakh crore by various accounts), it is not surprising that newer methods are constantly being evolved to make use of black money in the real economy. Not only are they evolving, they are in fact thriving. There is almost a full scale industry where innovative ideas continue to reward tax evaders.

How exactly is black money used to invest in shares?

Before I start a discussion about how black money is channelized in the financial system, let me assure you that with some wise thinking and tax planning, it is in fact easier to invest in a channelized and proper way. Somehow, either due to a fear of the tax authorities and more because of an ignorance of the tax system a lot of investors stay away from paying taxes and legalizing their unaccounted money.

In any event there are two popular ways in which black money is used to invest in shares of listed companies.

[I] Trading in a third party account

Typically an intermediary (typically a stock broker or an authorized person) opens an account for the investor in a third person’s name. Usually a company or for smaller accounts – in another individuals name, who falls below the taxable limit for income. This account is then funded with the investor’s money. The investor can trade in this account via call and trade facility or even using online banking and trading facility. Basically, it is no different than giving the investor access to another person’s trading /bank account which is funded 100% by the investor’s money.

When the investor wishes to withdraw his investments, he instructs the intermediary who gets a small percentage of commission to facilitate the whole system. In a lot of cases, the intermediaries end up even managing such money, this could at best be described as a ‘black portfolio management service’. It’s rampant to say the least.

[II] Converting black money into white – Incorporating the so called ‘capital gains company’

I am not sure if this is plain ignorance on the part of our enforcement agencies or is the greatest story ever told, but this cannot be go under the radar for so long. The mechanism takes advantage of the fact that long term capital gains on share purchase transactions (gains on shares held for over year) are tax exempt.

To explain the mechanism, with an example:

Pool A: many investors pool in their unaccounted money;

- Pool B: at the same time, a group of investors with white (tax paid) money come together (or rather, they are arranged together by an intermediary);

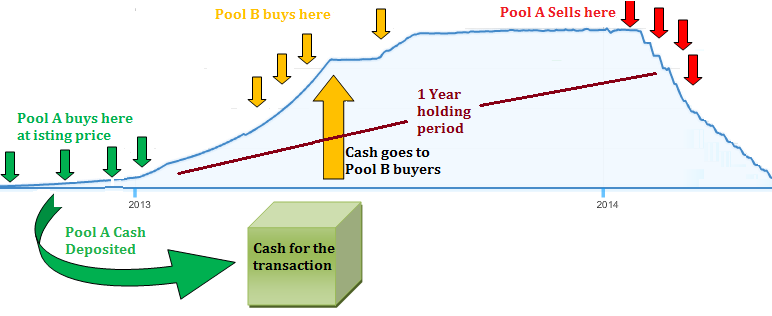

- Once the company is listed, the first group of people to buy stocks are those who want to convert black money into white. The money they use does not come from pool A. In fact, they use a small portion of their white money to buy shares at the listing price (say Rs. 10 for each share).

- Once, investors from Pool A take positions (i.e. buy shares at the listing price), investors from pool B start buying thus inflating the stock price. At the same time they receive the unaccounted money from Pool A. While in practice they buy with the pool A cash, in accounts, they take a loss in their books and their (tax paid) white money disappears. Effectively they are buying with their white money to inflate the price of a listed stock and are receiving black money in return. To do this they are compensated a few percentage points of premium. For example, if they convert their white money worth Rs. 1 Cr., they will get black money to the tune of Rs. 1.05 Cr.

- After 1 year from the date of initial purchase made by Pool A investors (to ensure the benefit of tax free long term capital gain) – as the stock price rises investors from Pool A start selling their holdings and investors from Pool B suffer huge losses (only on the screen). In return they have received the Pool A money, greater than the loss they suffer on the screen.

- Eventually, the entire lot of Pool A investors cash out and the stock price collapses.

So when you see unheard of companies which show extraordinary performance without any improvement in fundamentals, or companies that continuously hit upper (or lower) circuits, chances are that you are looking at a manipulated stock.

BEWARE: NOT ONLY ARE SUCH COMPANIES WITHOUT ANY FUNDAMENTAL MERIT, THEY ARE ALSO ILLEGAL. DO NOT JUMP INTO BUYING SHARES IN THEM BECAUSE THEY HAVE SHOWN UNBELIEVABLE OUT-PERFORMANCE, YOU WILL GET STUCK IN THEM ONCE THEY START HITTING LOWER CIRCUITS.

Very informative post.

PLEASE SEND MORE ARTICLES

I try Bhupinder 🙂

So far the best post i have read on any site.very informative..Nicely explained

Thanks Sachin