Buy shares and sell a call option of an equal number of shares. The covered call option strategy is also called “Buy write” strategy.

When to use the covered call option strategy: When you are neutral (or moderately bullish) on the short term direction of the underlying stock and you want to earn some fixed income from your investment in the underlying stock.

How it works: You buy HDFC Bank share on 3rd September 2013, when the share trades at Rs. 570. You expect the share to do well in the long term but you are neutral about its performance in the short term. You sell a call option at a premium of Rs. 23, expiring 26th September 2013 with a Strike Price of Rs. 580.

If the price of HDFC Bank stock rises above Rs. 580 (i.e. the strike price), the buyer of the option can exercise his option, but the price of the stock must rise above Rs. 603 (i.e. the strike price + the amount of premium you received) for the option buyer to exercise the option and make profit from the same. In other words, so long as the price stays below Rs. 603, you will be making some profit in the form of option premium and also as appreciation in share price (if that happens).

Scenario 1

If the price rises above Rs. 603, the buyer of call option will exercise his option and make a profit based on how far above Rs. 603 does the stock price rise. Unlike writing a naked call option where you do not hold the underlying shares, in case of a covered call, you hold the actual shares of the underlying script and hence your loss on the call option will be set off when you sell the underlying share which has also appreciated.

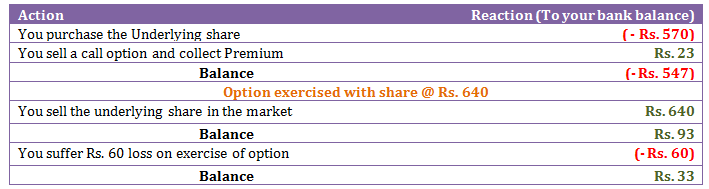

So let’s say in the above example, the price of HDFC Bank share rises to Rs. 640. The call buyer exercises his option. You will have to pay Rs. 60 (i.e. share price – strike price) when the option is exercised. But overall you still make a profit. Let’s see how the entire trade unfolds.

(click to enlarge)

Scenario 2

If the stock price does not rise above Rs. 580, the option will not be exercised and you will make a profit equal to the amount of premium (i.e. Rs 23).

Note: Based on where the stock price ends upon expiry you will make a notional profit or loss on the underlying share purchase. So if the price reaches Rs. 575 upon expiry, then in addition to the premium, you also make an additional profit (notional) of Rs. 5 (Rs. 575 – Rs. 570). Similarly if the price falls below your purchase price of Rs. 570, let’s say to Rs. 555, you suffer a loss (notional) of Rs. 15.

Risk / Reward: Even though you write / sell a call option, your risk is from a downside in the stock price and your total loss will depend on how much the price of the underlying stock falls. This is because while you retain the premium received from selling the call, the principal amount spent on buying the underlying shares gets eroded as the stock price falls. So your maximum risk will be, stock price paid – premium received (i.e. in our example Rs. 547).

The maximum reward (i.e. profit) you stand to make will be limited to the premium received + (strike price – price paid for buying the stock) (i.e. in our example Rs. 23 + (Rs. 580 – Rs. 570) = Rs. 33.

How to use the Covered Call Option Strategy Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the Covered Call Option Strategy.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example HDFC Bank Limited call option contract is for 500 shares. Accordingly the premium you receive will be Rs. 11, 500 for a single lot (i.e. 23 *500) in our example.

Also Note: Unlike the buyer of an option who only pays the premium to buy the option, the seller of an option must deposit a margin amount with the exchange. This is because he takes an unlimited risk as the stock price may rise to any level. In case the price rises sharply above the strike price, the exchange utilises the margin amount to make good the profit which the option buyer makes. The amount of margin is decided by the exchange and it typically ranges from 15 % to 60 % based on the volatility in the underlying stock and market conditions. In the above example, as a seller of call option, you will have to deposit a margin of Rs. 36,250 (i.e. Strike price * Lot size * 12.50%) for selling/writing a single lot of HDFC Bank Limited call option. Note that the total value of your outstanding position in this case will be Rs. 2,90,000 (i.e. strike price * lot size).

Rajat,

Very well explained – good illustrations. Being a beginner, I’m quite happy to have stumbled on this blog.

Quick question though.

In a buy-write strategy, as you mentioned, the lot sizes vary. So when you sell a lot of say RIL (250 lot size), shouldn’t I first buy 250 RIL shares in cash market? Is my understanding correct?

Thanks.

That is correct.

What will be the adjustment when market is going down unexpected…

What will b the best adjustment in covered calls….

Please reply…

Thanks…

Not sure if I understand your question.

can sombody do buying by call option ? instead of total number. that in that case cost would be premium paid to buy call option.

show upper and lower break even in this example

Of course. There’s a saying – an apple is an apple no matter how you slice it.

Hi, is it mandatory to sell the stock under covered call if the price of the stock rises above the strike price+premium received? even if the loss arising out of writing the call is taken from the margin.

how this covered call practically works in Indian markets? does actually a writer of covered call, needs to sell his stock if price rises?

Answer to all your questions – NO

In India – the margin, if maintained will be deducted until expiry on MTM

Sir, what if the price of the stock rises beyond the margin amount deposited with the exchange? In that case, the seller has to pay the whole amount or it is limited to the amount deposited with the exchange? Please let me know.

It is limited to your margin which you will lose unless you top it up before it is wiped out.