Over the past few weeks, I have made some major changes to client portfolios. The ongoing credit crisis perhaps has changed my general tone on stocks, and other financial assets. I am not trying to rein in on anyone, nor suggest that a Multicap approach is astute right now, yet some of the things I have heard this past week, have been:

- Since when did you become a bull?

- Don’t you only suggest large caps?

- Markets will fall a lot more

I have very openly expressed my belief that bulls and bears should be left out in the animal kingdom.

That, no law/ regulation binds me to buy only large cap stocks. There was a time when I saw a lot more value in large caps over small/mid-market stocks. At this point, I believe, that small and mid-caps are available at a better Price Entry Point. I like to call this my – PEP. It is simple to see this.

Yes, I also believe that markets will fall. I however remain convinced that some of the stocks that I have bought over the last 2 weeks will not be available at a price much below where I purchased these.

Broadly however I believe this to be a good time to accumulate stocks. Stocks have a higher potential to beat fixed income returns by a big margin over the next 3 years. In the short term however, a 10-20% correction over the rest of this year is a very real possibility.

The Big Worry – Credit Crisis

We will go through a phase where production would have come to a standstill. Buying capacity of the world would have eroded significantly. Travel and business would be curtailed by 80-90% for at least another year from a resolution to the Covid problem. The world will need to restart.

While this happens, a lot of companies will go through an extended period of pain. Some will not revive. Once that starts happening, the repercussions will be felt across financial sector. Consider what’s happening in the mutual fund industry. A large fund house abruptly wound up 6 of its debt schemes and with it, locked up 30,000 Crores of investor money.

The reason?

Not enough liquidity to redeem the funds.

Typically, a debt fund buys bonds and other debt instruments of corporate and Government companies. The reason why such a fund is preferred over let’s say a bank deposit is that it pays upto 2-3% higher return. What’s happened here is that a lot of the debt paper which Franklin is holding is not liquid (i.e. is not actively trading). When an existing investor places a redemption request, typically the fund house redeems the paper that it is able to sell.

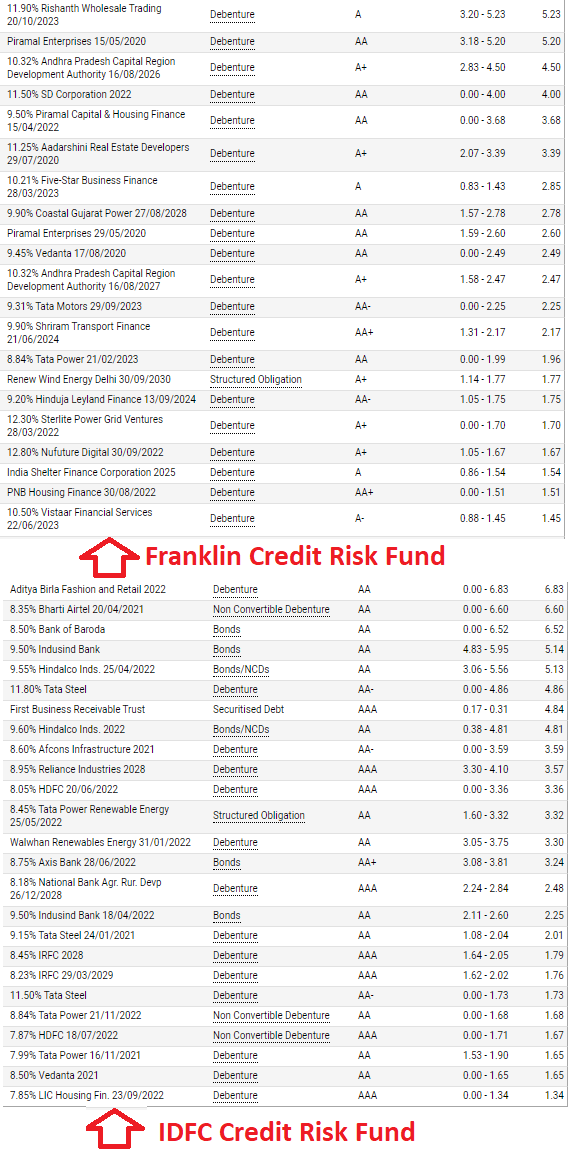

If you look at the profile of one of the Franklin funds (image 1 below), you will notice that it is now largely a bunch of A and AA rated bonds. The fund house has already redeemed a lot of its AAA rated instruments and other instruments which had an active trading market. The result of redeeming higher quality papers is that investors who do not redeem are left holding, well… in this case pretty crappy paper. Compare this with a healthy debt fund – IDFC Credit Risk (image 2 below) which can meet redemption pressure with ease. That said, if everyone starts selling all over, then things can turn pretty ugly, pretty quickly.

To be fair, this problem has been going on for years. I had written about it long before defaults peaked out (they still haven’t peaked out). Read here – Debt Mutual Funds: Yes Bonds are Cheap, But for a Reason (13 February 2019)

But How Big is This Worry?

It is big, pretty damn big!

A lot NBFCs, the paper of which these debt funds are holding have been rolling over money literally as a business model. In that, they come out with a bond issue, use that money to extend loans where they earn a higher interest from Borrowers than they have to service in the bond issue. This goes on well until one of the two happens:

- Borrowers stop servicing (interest) on loans

- Borrowers default

At this point, RBI’s, moratorium allows Borrowers to not service interest on these loans for until the lockdown lasts. The issuing companies however have to service the interest that they in turn pay on these bonds.

To deal with a potential credit crisis, RBI came out with Targeted Long Term Repo Operations (TLTROs) where they allowed (rather encouraged) banks to lend to NBFCs. To do so, banks will receive cheaper credit from the RBI (i.e. at Repo rate of 4.4%). Of course, banks actually stand to make a lot more net interest margin since they will be buying fresh or secondary market bonds yielding a lot more than 4.4%. The total TLTRO operation size is Rs. 1 lakh Crore with detailed guidelines on the size and type of bonds, and the size and type of NBFC of which the bonds should be purchased. There is an allocation for medium, small and large sized NBFCs.

Yet, there has not been much offtake from banks under RBIs TLTRO. One would think that with so many companies facing redemption pressures over the next few months, many of which are sold large corporations, it is a great opportunity for banks to earn a higher interest differential. Why then are banks shying away?

This is where the worry is!

No bank can put their hand out and be certain that the company to which it extends a line of credit or buy bonds off will service their obligation. This is where the second of the 2 fears above plays out. What if borrowers of the issuing company default?

No matter how big a company (in fact to me, the larger companies tend to be more mismanaged in this regard), when economic tide turns, their borrowers default in large numbers. In case this happens, it can shake up the whole system and ultimately the banks which extended these credit lies by buying new or secondary bonds of theses companies will suffer. Banks in India have already absorbed a lot of NPAs over the past few years. Will they be able to sustain more defaults?

It is time to be very careful of buying into NBFCs. People are likely to lose jobs. Retail, consumer, agriculture, car, home all sorts of loans could default after the lockdown is over. It is not the time to be bullish or bearish. It is time to be a realist. Look around, the turmoil presents tons of opportunity, just not in this space. As for banks, the TLTRO money is most likely getting deployed to companies with a healthier book, irrespective of their size, and so it should.