“Credit rating agency Moody’s has assigned a ‘Baa3’ rating to India, with a stable outlook”.

You must have read/heard this news. Do these AAAs, Baa3s, Cas, CCCs make any sense to you?

Just like a school report card, these grades serve as a marking system /score card designed to inform interested parties about the creditworthiness of countries, companies and individuals. How do credit rating agencies assign these scores/ ratings?

Role of Credit rating agencies

Credit Rating Agencies in India

- Crisil Limited

- Credit Analysis & Research Ltd. (CARE)

- ICRA Limited

- ONICRA

- Fitch Ratings India Private Ltd.

- Brickwork Ratings India Private Limited

- SME Rating Agency of India Ltd. (SMERA)

The credit rating indicates the rating agency’s opinion on the likelihood of default by the issuer. Credit ratings establish a link between risk and return. It is arrived at by evaluating various quantitative as well as qualitative parameters of the issuer.Lower credit ratings result in higher borrowing costs because the borrower is believed to carry a higher risk of default. In other words, when you invest in an instrument issued by someone with a weak credit score, you are hoping for a higher rate of return.

Broad parameters used for evaluation by credit rating agencies:

- Background and history of the company

- Industry/sector trends

- Political and regulatory environment

- Management quality, experience, track record, and attitude toward risk-taking

- Management structure

- Competitive position

- Debt structure

- Financial and liquidity position, including cash flow position, operating margin and balance sheet analysis (debt burden)

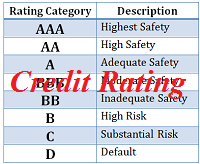

Credit rating agencies use simple alphabetical or alphanumeric symbols which help the investor differentiate between debt instruments on the basis of their underlying credit quality. Rating companies also publish explanations for their symbols to facilitate deeper understanding. Look below at Crisil’s credit rating scale and the description associated with each category on the rating scale:

| Rating Category | Description |

| AAA | Highest Safety |

| AA | High Safety |

| A | Adequate Safety |

| BBB | Moderate Safety |

| BB | Inadequate Safety |

| B | High Risk |

| C | Substantial Risk |

| D | Default |

Credit rating gives the investor an idea about the degree of financial strength of the issuer company thus enabling him to make an educated investment decision. Any upgrade/ downgrade in credit rating leads to high volatility in the stock market. For example, if Moody downgrades India’s rating, this will shake the confidence of investors and other market participants which will lead to fall in stock prices.

Upgrade: A positive change in the rating of a security. An upgrade is usually because of steady improvement in the fundamentals and financials of the company that has issued the security. An example of an equity upgrade would be an analyst raising the investment rating for a particular stock (or sector) to “buy” from “hold.”

Downgrade: A negative change in the rating of a security. This situation occurs when analysts feel that the future prospects for the security have weakened from the original recommendation, usually due to a material and fundamental change in the company’s operations, outlook or industry

The rating symbols provided by the agencies indicate both the returns expected and the risk attached to the instrument. Hence it becomes easier for the investors to base their decision by looking at the symbol assigned by the rating agencies.

Is it Mandatory for all security instruments to have a credit rating assigned to them?

While some instruments mandatorily require a credit rating grade to be assigned to them, it is not mandatory for all security instruments to be rated. For example, all companies (i.e. issuers) coming out with an Initial Public Offering (IPO) are required to obtain a grade for the IPO from at least one credit rating agency. Similarly, for all debt issuances, it is mandatory to obtain a grading.

While it is not mandatory for banks to get a credit rating grade on the corporate before giving out a loan to them, it has become a market practice and banks usually engage an external credit rating agency to get a corporate grade before extending loans.