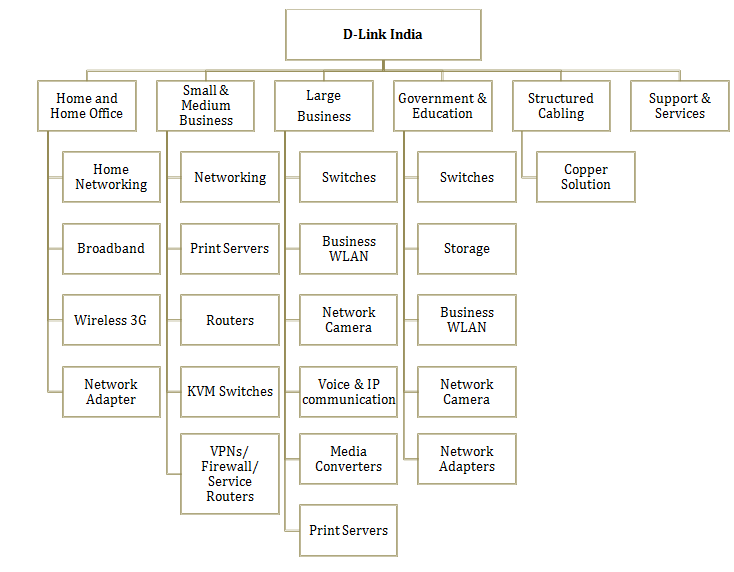

D-Link India is engaged in the marketing and distribution of networking products in India and SAARC region. The Company’s product offerings extend across all areas of network infrastructure including switches, security cameras, wireless routers, IP surveillance, and structured cabling.

D-Link India is a subsidiary of D-Link Corporation (Parent), a Taiwanese company which (indirectly) holds 51.02% stake in D-Link India and operates in over 80+ countries.

Caveat: The Parent is listed on the Taiwan Stock Exchange and has lost 2/3rd of its market capitalization over the past 5 years.

CMP: Rs. 159 | BUY

View: I remain extremely negative on telecom sector which is going through a shift from voice calling revenue to earning a higher share from data services (i.e. broadband, 3G/ 4G). Over the next few years, I expect internet enabled calls to completely replace voice calling. The fact that homes, offices and most public places provide wi-fi (internet) is likely to negatively affect telecom companies. Further, with time more and more people are going to opt for broadband/ wi-fi connections at homes and offices. D-link also provides security and surveillance equipment including cameras and home automation equipment. I am bullish on security and surveillance related themes as I doubt that the world could be any safer in future.

Also Read: Are telecom Stocks Heading for a Crash

D-Link India Products and Services

WHAT’S DRIVING THE STOCK

Growth Potential: Increasing Mobile Connectivity & Broadband Penetration

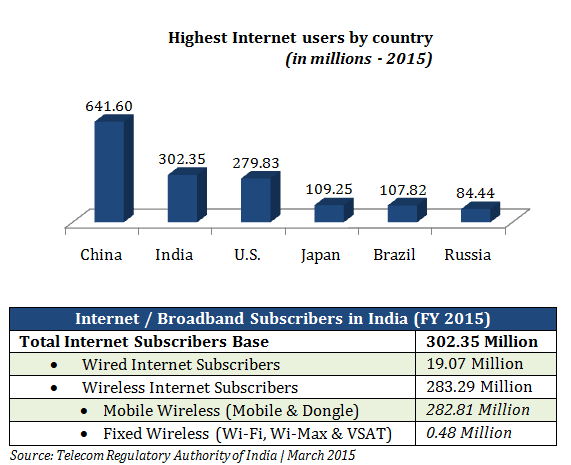

Internet Penetration in India

India’s population is four (4) times that of the United States and less than 20% of India’s population uses the internet compared to 46% in China and 87% in the United States. The total number of internet connections is expected to reach 463 million by FY 2018 (as per FICCI KPMG).

Since March 2015, the date of the above report, India’s internet population has grown ~ 17% to 354 million (Source: dazeinfo. com).

Increasing penetration of internet in India both wireless and broadband has led to increased demand for networking products such as routers, switches and wireless products. Emergence of affluent middle class and young population (large users of smart phones) has led to increase demand for mobile and internet segments.

Drivers of Wi-Fi Data Consumption

- Young and tech savvy population of India;

- Easy affordability of smart phones.

- High mobile data cost (for 3G/4G Plans);

- Faster data networks available through Wi-Fi in comparison to 3G/4G Plans;

- Less radiation (approx 36%) than telecom towers.

D-Link is well placed to take advantage from the internet boom in India (especially through Wi-Fi) with its portfolio of innovative product offerings. Rapid expansion of broadband spectrum has given the Company a new opportunity to look at Tier II/Tier III cities.

Government Initiatives

Significant government initiatives like ‘Digital India’ and ‘Smart Cities Project’ are aggressively promoting broadband usage in the country and driving the demand of networking products.

The government is focusing on making the Internet a reality for the rural population and providing access to e-governance, e-education, e-medicine, e-banking, using new technology. These efforts of the government will boost the demand and production of routers, switches, wireless broadband (WiFi and LTE).

Some of the initiatives are:

- High-speed public Wi-Fi in 400 Indian railway stations;

- Expansion of the National Optical Fibre Network (NFON) to take broadband to 600,000 villages.

Growing Enterprise Spending

Indian enterprise IT spending has grown from U.S. $28.5 billion in CY 2010 to U.S. $39.7 billion in CY 2015 at a CAGR of 12%, which has resulted in strong demand for networking products like routers, switches and access points to storage and surveillance products across all verticals. It is further estimated that enterprise IT spending will further grow at a CAGR of 12% and reach U.S. $50 billion by the end of CY 2016. (Source: D-Link India Annual Report)

Large and small organizations in all areas including telecom, retail, aviation, hospitality, government, manufacturing and education have been investing towards setting up a strong networking infrastructure to deliver end-to-end solutions. In FY 2015, switches and router market in India witnessed a 20 % year-on-year growth, according to the International Data Corporation (IDC). The upcoming verticals like e-commerce along with traditional ones are expected to drive future investments in the networking infrastructure.

D-Link being a market leader in providing networking and IT products and solutions has a huge advantage from increased spending in networking infrastructure.

Strong Financial Position

The Company operates with ZERO DEBT and has consistently paid dividend for the last five years. For FY 2015, the Company paid 35 % dividend (Rs. 0.70 per share).

Market leader in Product Categories

In India, D-Link has sustained its growth momentum in various categories. In the switches segment, D-Link’s market share continues to grow and has reached the leadership position at nearly 37%. In the routers segment, D-Link ranked second with 31% market share. In the wireless domain, D-Link retained its leadership position with 40% of the market. (Source: D-Link India Annual Report)

The growth potential of the internet industry, a strong product portfolio and distributor network will help the Company to increase its market share in the coming years.

Strong Distribution Network

D-Link distributes its products in India largely through two pan-India distributors, Redington and Ingram Micro. In addition, the Company operates through a strong distribution network with 17 branch offices of its own, 22 Return Merchandise Authorisation (RMA) centres, 85 business distributors and over 200 selling partners.

WHAT’S DRAGGING THE STOCK

Poor Performance of Parent

D-Link India’s parent company (Parent) is listed on the Taiwan Stock Exchange and has lost 2/3rd of its market capitalization over the past 5 years. The Parent’s profitability is on a declining trajectory and on TTM basis the Parent has reported a loss. In case the Parent suffers more losses, it may liquidate its holding in the Company which will have a negative impact on share price.

Increasing Competition

D-Link faces competition not only from domestic firms but also from multinational IT vendors. New competitors are emerging from adjacent markets and distant geographies. Netgear, Cisco, Linksys etc are some popular manufacturers of Wi-Fi routers.

Technological Obsolescence

The Company operates in dynamic, fast changing and constantly evolving technology business. The Company needs to spend huge amount of money and focus on research and development to upgrade its products and solutions. Also, the Company needs to continuously invest to keep launching new products to enhance reach and reputation amongst customers and channel partners.

Thanks Sir for such good explanation.

Glad you found it helpful.

Thanks for the post.complete analysis.How is the present company doing now after 5 mths of this post ?