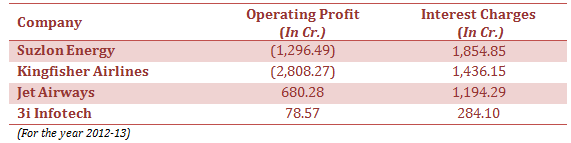

There are increasing numbers of Indian companies which are finding themselves in a debt trap, with their entire operating profits not sufficient to meet their finance charges. Worst still, a lot of these companies have negative operating profits and a huge interest burden on top of that. Look at the examples below:

Personally, for most part, I like businesses that run on cash (i.e. companies which have running businesses and which do not require additional capital). More so in the current market environment which is why I always emphasize on looking for debt free companies in India.

In addition to bringing in their own equity, promoters regularly raise debt capital in the form of loans to finance the business plans and projects of the company (i.e. product development, capacity expansion etc). This borrowing comes with a cost in the form of finance charges. In other words, the company becomes obligated to not only pay back the amount of borrowings but also the constant interest charges on the borrowed sum. For this reason, a company which operates with a substantial amount of debt must always be scrutinized carefully by investors to check such company’s ability to meet its finance obligations.

An ideal capital structure should be such that the finance costs stay manageable and do not put ‘a lot of pressure’ on the profitability of the company. An extremely helpful metric to assess a company’s solvency and its ability to run a profitable business is the interest cover ratio.

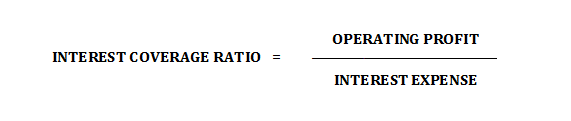

Interest Coverage Ratio: indicates the extent to which a company’s earnings are available to meet its finance costs. It measures a company’s operating profit (i.e. earnings before other income, interest, tax, depreciation and amortization) relative to the amount of interest charges which the company pays. Debt free companies in India and companies which maintain their earnings well above their interest obligations are in a good position to endure economic slowdowns and business setbacks. On the contrary, a company which is not generating enough will find it difficult to service its interest obligations and will have nothing left for distribution amongst the shareholders. For a list of low debt / debt free companies in India, we highly recommend that you subscribe to blue chip stock reports.

Calculation:

Interest-cover ratio below 1 is an indication that the company, regardless of the sector or the industry in which it operates, is not generating sufficient income to cover its interest obligations. A ratio of at least 1.5 or higher is the minimum level of comfort for any company in any industry.

Beyond these minimum levels, determining acceptable finance obligations for an industry depends on the stability or consistency of its earnings. It should be noted that a company’s earnings and operating profit fluctuates more than its finance expenses on a y-o-y or q-o-q basis, therefore it is advisable to look at previous year’s trends (3-5 years).