A few days back, I wrote an article on various debt mutual funds and what investors must consider before investing. Some of the questions I received gave me the idea of writing this part 2. I will try to explain basic debt fund terminology here.

What is Yield to Maturity (YTM)?

Debt mutual funds, being market linked, do not declare the rate of return, like in case of bank deposits. They instead declare yield to maturity (YTM).

YTM is the total rate of return an investor earns if he/she holds the bond until maturity. While calculating, it is assumed that the bond is held till maturity, and all the coupon/interest payments are made on time and reinvested at the same rate as the bond’s current yield.

A higher YTM indicates higher returns, but it is also associated with higher risk, as the fund may be holding risky papers offering higher yields. Since price and yield are inversely related, the fall in price on account of the higher risk will push up the yield of the bond.

YTM and Actual Returns?

Except for close-ended debt mutual funds such as fixed maturity plans (FMPs) and interval funds, the YTMs and actual returns of open-ended debt mutual funds don’t match. Why is that the case?

There are two reasons why you can never be absolutely sure about how much you will make in an open ended debt fund:

[1] Portfolio churn due to inflows and outflows;

[2] Changes in bond prices caused by movement in the underlying market due to interest rate, valuation and rating changes have an important impact on the YTM and portfolio returns. Similarly, a rating change also has its impact on the portfolio YTM.

Think of it this way – you are holding a bond which pays 8% p.a. for the next 5 years. The face value of the bond is Rs. 100. The RBI then reduces the base interest rate by 0.5%. This means that newer bonds of the same credit rating will now pay 7.5% p.a. This will make the face value of the old bond jump as the old bond’s yield is higher (i.e. more cash flow will accrue by holding the old bonds). Investors will obviously jump to buy the old bonds. This will appreciate the value of old bonds (and a fund holding old bonds). Similarly when interest rates are raised, old bonds will become cheaper (i.e. they will start trading below the face value). For this reason open ended debt funds are always impacted by interest rate changes in the short term.

Should YTM be a Criteria to Decide While Investing in Debt Fund?

Ideally No.

YTM of a debt fund can give a fair idea about the interest income that will accrue in a stable interest rate scenario if all its portfolio constituents are held till their respective maturity dates. But it should not be considered as the sole indicator of the possible gains from a debt fund as the actual return would also depend on the mark-to-market valuations and changes in the portfolio.

On the contrary, a high YTM may mean that the face value of bonds has fallen, this may be because of bad quality of paper more than changes in interest rates. Consider this as a red flag.

Average Maturity

A debt fund portfolio comprises several bonds with varying maturity dates. Average maturity is the weighted average of maturity for all bonds in the fund portfolio.

Consider a debt fund which has invested in 4 bonds, with the below maturity profile:

1 year maturity (Rs. 1,000/-),

2 year maturity (Rs. 2,000/-),

3 year maturity (Rs. 1,000/-)

5 year maturity bonds (Rs. 5,000/-)

This fund will have an average maturity of 3.67 years, which is the weighted average of the maturity of the fund’s four bond holdings.

Total investment in debt portfolio = Rs 9,000

Weighted Average Maturity = (1000/9000) *1+(2000/9000) *2+(1000/9000) *3+(5000/9000) *5

= 3.67 years

Higher average maturity implies that a debt fund has invested more in long term papers while lower average maturity indicates that a debt fund has higher exposure in short term papers. This, in turn, explains the debt funds’ sensitivity to change in interest rates. Longer average maturity period will indicate a higher impact of interest rate changes.

Modified Duration

Modified duration refers to the sensitivity of a debt fund’s portfolio to changes in interest rate. So, if the modified duration of bond is 4.50 years. This indicates that the price of the bond will decrease by 4.50% with a 1% (100 basis point, or bps) increase in interest rates.

Higher the modified duration, more volatility the bond exhibits with a change in interest rates. Thus, bonds with higher modified duration do massively well in falling interest rates.

Macaulay Duration

Macaulay duration basically measures how long does it take for the price of a bond to be repaid by the cash flows from it. Macaulay duration tells us how much time it would take for the investor to to get back all his invested money in the bond by way of periodic interest as well as principal repayments.

The Macaulay duration for a portfolio is calculated as the weighted average time period over which the cash flows on its bond holdings are received.

Suppose a bond fund closes shop and stops trading its bonds. In such a scenario, Macaulay duration becomes extremely important as it tells you exactly how much time it will take for you as an investor to receive the NAV of the fund.

As an investor, when you are planning to invest in debt funds, keep 3 main things in mind:

First, Debt funds are not FD replacements. Thought they can generate much higher return and are more tax efficient.

Second, like equity funds, choose debt funds with good quality paper, particularly in unstable economic environment.

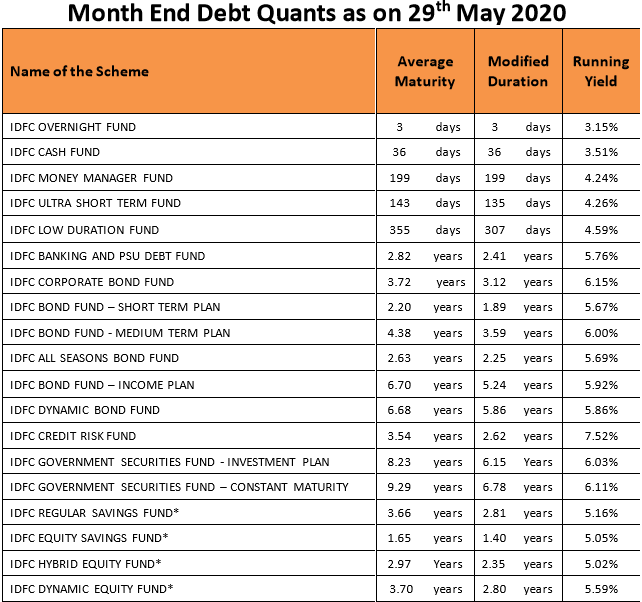

Third, if you are choosing funds with higher modified duration, be prepared to hold it for longer duration. Otherwise stick to shorter modified duration funds for certainty of returns. Look at the below table for modified duration of various debt funds of IDFC Mutual Funds as a sample. This will give you a good idea on how to select a fund based on your time horizon and return expectation.