How many times have you heard something like this – The company plans to expand its operations by debt securitization or by securitization of (proceeds of) certain of its assets, or simply by securitization.

In this write up, I will try to explain very briefly about what this means and how it works in practice.

Debt Securitization – Meaning

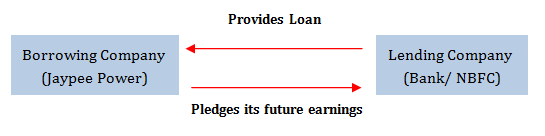

In the simplest language, debt securitization is a process where companies raise money by pledging the cash-flows from their current and/ or future assets. Unlike a traditional loan, in this case, what is given as collateral to secure the debt is the very present and future receipts/ income to be generated from the project (or from any other project) for which the loan is being taken.

The enactment of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act) in December 2002 paved the way for securitization in India. On the upside, this allows the company to get cash up front, which can be put to use in the business or be used in order to pay off existing debt.

Types of Debt Securitization

There are 3 types of securitization methods which a company can choose from:

- Asset Backed Securitization: In this method, companies pledge their existing assets with the lending institution to secure the loan.

- Mortgage Backed Securitization: In this method, loans are secured by real estate, wherein the lender has the right to sell the property, if the borrower defaults.

- Future Revenue Flow Securitization: In this, future/ prospective cash flows of the company is pledged as security to raise funds, for example – sale of power, toll revenue, rental income etc.

In a lot of industries, particularly infrastructure and power companies, it is common to securitize future earnings (cash flows), to receive loans for current and future expansion. In other words, future cash flows are assigned as collateral against the loan given by the bank or any other financial institutions.

Example

Suppose Company ABC wants to open a multiplex and is in need of funds for the same. To raise funds, Company ABC will securitize its future cash flows (cash flows arising from sale of movie tickets and food items in the future) in the form of securities to raise money.

This will benefit lenders as they will have a claim over the future cash flows generated from the multiplex. Company ABC will also benefit as loan obligations will be met from cash flows generated from the multiplex itself.

A typical future flow structure involves the borrowing company selling its future product (receivable) to the financial institution (bank, NBFC etc.)

Future Flow Securitization – Gaining Importance in Infra Projects

This type of securitization provides a new way of financing for many developing countries like India. Sectors like power, infrastructure which require huge capital outlay and where the projects have long gestation periods are increasingly adopting this method of financing.

Infrastructure companies have increasingly started securitizing receivables from their existing projects to arrange funds for setting up new projects. The following table provides a list of future flow securitization opportunities in various sectors:

| Sector | Future Flow to be Securitized |

| Power | Meter rentals |

| Receivables from bulk consumers | |

| Telecom | Phone rentals |

| Lease receipt from optical fibers | |

| Rentals/user charges | |

| Transport Infrastructure | Toll collection from commercial vehicles |

| Airline ticket receivables | |

| Landing and parking fees for airports | |

| Coal, Oil & Gas | Revenue from sale of coal, oil, and gas |

| Royalty from mining and exploration | |

| Urban Infrastructure | Property tax collection |

Some key features of Future Flow Securitization

- Low interest cost: Securitization provides a low cost financing option to companies.

- Diversification: Securitization helps the company in diversifying its funding sources.

- Uncertain Receivables: by its very nature, future cash flows are uncertain and depend on various factors like performance of the company, economic conditions, government policies etc.

- Credit Risk/default risk: Since future cash flow transactions involves the transfer of receivables that do not exist at the time of granting of the loan, it is necessary for the lending companies to have a thorough understanding about the borrowing company’s operational record. The lending company always faces a risk as to whether the future cash flows will in fact be generated as per expectations, or at all.

Examples of debt securitization against future receivables

- Jaypee Power has securitized its future receivables from Vishnuprayag Project for Rs. 1,650 Cr. and also the Company has securitized receivables from Baspa – II HEP for Rs. 1,100 Cr.

- Superconnectivity Ltd’s access controlled 8/6 lane rack of length 27.7 kms on NH8 – Securitization of the toll receivables for Delhi-Gurgaon.

- DLF also securitized its future rents to pay off its short-term debt obligations. Rent securitization is the securitization of future rent receivables, under which a developer pledges, its future rentals from a commercial space to a bank that disburses a loan against the rent receivables.

Are home loans allowed to be securitized in India?

If yes, then what are the Securities sold as, and to whom?

Will the appear in any Debt Mutual Fund that I may be investing in as a retail investor?

And how do I check if I am exposed to such Home loan based / Mortgaged Backed securities?

with sincere regards,

Rahul

Simple answer – No.

In past receipts from power projects were securitized which dint work well for many banks.

Could you brief on securitization case in which 3 state electricity board(UP, Bihar and Rajasthan) owes Rs 15000 crores to NTPC but are unable to pay, so NTPC ask SEB to sell them bond worth Rs 15000 crores @12% interest.So now NTPC will get Rs 1800 crores from all 3 SEB as interest. These bonds worth 15000 crores NTPC sells in market at lower interest rate sy at 10%. Thus in all NTPC is getting 2.5% as profit as well .

So how securitization comes in this play and ensuring or mitigating the risk factor??

It would be so kind of you, if you could explain this fact in detail.

Thanks & Regards,

Will try Vipul but you have done a good job in putting these facts up for us here. Thanks.

(A) Can you suggest leading investment bankers for a medium sized securitised debt issue by a NBFC?

(B) Do you advise on structuring of SPV / Trust and related documentation and legal aspects?

Thanks.

Yes & Yes

Please write in to me at rajat@sanasecurities.com

Hi U got an answer to an question of Vipul Jain dated March 16, 2016 at 1:33 am ?

Why dont you call me about whatever this is – 9833905054