Deep Industries Limited is a company specializing in providing Air & Gas Compression Services, Drilling and Workover Services, Gas Dehydration Services, and also having expertise in Integrated Project Management Services. Deep Industries’ stock has given an aggregate return of around 50% in the last 6 months, and recently it posted a 44% growth in net profit in Q3 FY2022.

With the Government announcing a push for a gas-based economy in the recent Union Budget of 2023 and also allocating around Rs. 10,000 crores for setting up biogas plants, let’s have a look at how the government is helping to push the growth in this niche industry and how Deep Industries can benefit immensely in the coming years from this.

DEEP INDUSTRIES SERVICES PORTFOLIO

Deep industries majorly operates and generates its revenue from three divisions of services which are:

- Gas Dehydration plants

- Gas Compression plants

- Workover and drilling rigs

- Deep Industries gets the majority of its revenue from the Gas Compression business, followed by the Gas Dehydration and the Drilling rigs business.

- It’s Natural Gas Compressors packages range from 180 HP to 1,680 HP Compression capability with a total capacity of ~87,000 HP.

- The Company is the market leader in the gas compression business in India with an estimated market share of ~75%.

- Deep Industries is one of the first companies in India that qualifies to provide Gas Dehydration on a charter hire basis.

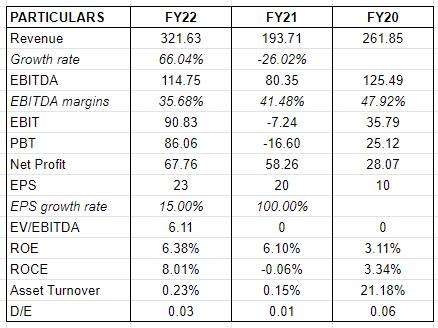

KEY FINANCIALS OF DEEP INDUSTRIES

Figures in Crores(Crs)

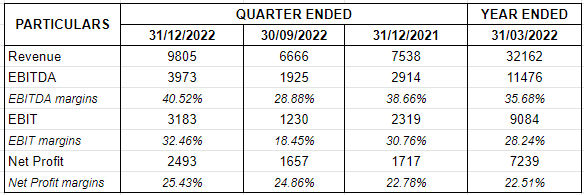

LATEST QUARTERLY RESULTS

Figures in Lakhs

Q3 FY2022 Highlights

- In Q3FY23, the company posted revenue from operations of ₹98.06 Cr on a consolidated basis, up by 30% from ₹75.38 Cr in Q3FY22. This rise in revenue could be attributed to the increasing usage and setting up of natural gas plants by India, to fulfill the energy demands of the country domestically without relying on foreign countries. This increase further fuels the need for natural gas compression, to avoid loss due to leakage and harming of pipelines, which in turn increases the sales of companies like Deep Industries.

- The company said its EBITDA reached ₹39.73 Cr in the quarter that ended December 2022 compared to ₹29.44 Cr in the quarter that ended December 2021 whereas the EBITDA margin stood at 40.52% from 38.90% in the year-ago quarter.

- The net profit of Deep Industries reached ₹24.93 Cr in Q3FY23 compared to ₹17.17 Cr in Q3FY22, representing a growth of 44% whereas the PAT margin stood at 24.93% in Q3FY23 against 22.69% in the same quarter last year.

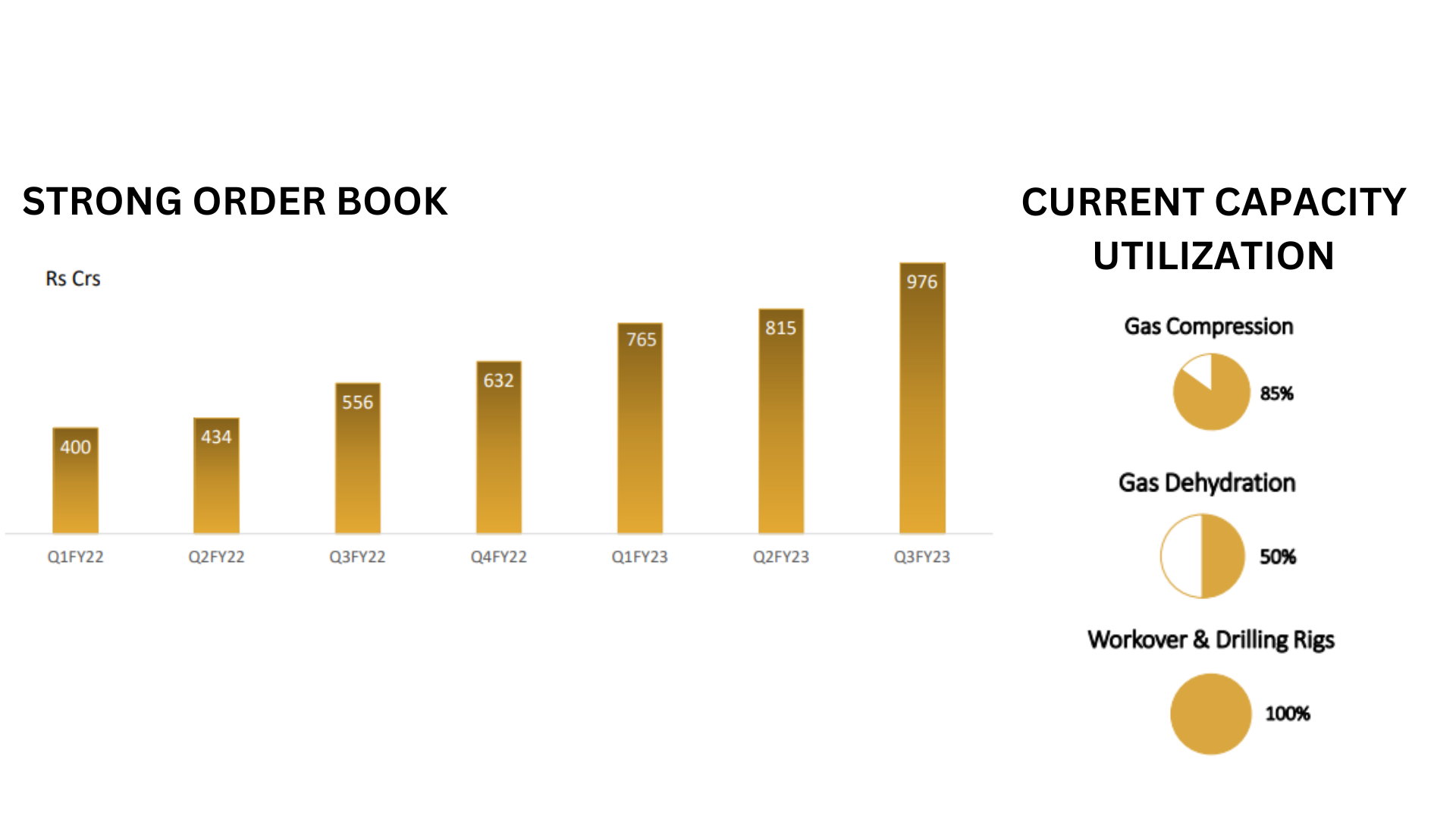

- The Company’s order book value has risen significantly over the year suggesting the future potential of sales and clients that the company holds.

INVESTMENT RATIONALE

Robust and Improving financials

- Deep Industries’s financials certainly indicate the fundamental strength hold of the company, with Revenue, Operating profit, and Net profit increasing these past years, the company sure shows signs of gradual improvement and growth.

- The company has had declining revenue for almost 5 years, from ₹300 crores in 2017, to ₹259 crores in 2018, to ₹251 crores in 2019, to finally posting a significant increase in revenue in 2022 of around ₹321 cr. This resulted in an Average Annual growth rate of almost 5.5% over the past 5 years for the Company.

- The company also posted an increase of around 44% in its net profit in Q3 FY2022, indicating the steady improvement and growth in the company’s operations and business.

- Deep Industries is trading at a P/E of 11.93 and an EV/EBITDA of 6.11, both of which are extremely below the industry average, indicating that the company is relatively well undervalued.

- The Company’s order book value has risen significantly over the year suggesting the future potential of sales and clients that the company holds, from 765 crores to 976 crores in just a couple of years. The company is witnessing high EOIs & bids submission which could further enhance the order book going forward.

Market Leaders in their segments

- Even though the company operates in a very small and niche market and industry, it still is the market leader in its segment, as Deep Industries is a market leaders in gas compression business in India with an estimated market share

of ~75%. - The company consists of Natural Gas Compressors packages ranging from 180 HP to 1,680 HP Compression capability with total capacity of ~87,000 HP, and is investing consistently in capex to increase its plant, and machinery size to cater to an even bigger market of services.

- It has long-established vendor relationships with reputed and experienced compressor package suppliers in the USA for the supply of Natural Gas Compression Packages, hence strengthening its supply chain. The company also has plans to expand in Onshore Drilling Business as there is a significant opportunity in the Industry.

- Deep Industries owns & operates 8 Workover Rigs with capacities ranging from 30T to 100T, and 3 Drilling Rigs with a capacity of 1000Hp. It also possesses a Total Dehydration capacity of ~ 4.35 MMSCMD. Well-poised to tap potential dehydration demand which is expected to be ~ 10 MMSCMD.

- It also is one of the first companies in India which qualify to provide Gas Dehydration on charter hire

basis.

Increasing Industry and Government aides to throttle growth

- With the Government announcing a push for a gas-based economy in the recent Union Budget of 2023 and also allocating around Rs. 10,000 crores for setting up biogas plants, let’s have a look at how Deep Industries can benefit immensely in the coming years from this.

- India’s economic growth is closely related to its energy demand, therefore, the need for oil and gas is projected to increase, thereby making the sector quite conducive for investment. India retained its spot as the third-largest consumer of oil in the world as of 2021.

- The Indian government has recently acknowledged this growing sector of India, and plans to optimize the capacity of the sector by increasing Capex and investments in the Industry. In the Union Budget of 2023, an announcement of 200 compressed biogas plants, including 75 in urban areas, and 300 cluster-based plants was proposed to be set up.

- The Indian government is focused on increasing gas usage in the energy basket from the current 6% to 15% by 2030. At the same time, the focus has been brought to revive the domestic production of gas which was in decline since 2012. All these efforts are yielding results and gas production in India is slated to increase by 18% CAGR till FY25E.\

- The Government also announced the availability of 26 exploration and development blocks totaling around 2.23 lakh sq km under the HELP Policy. Furthermore, 75 discovered oil and gas fields across multiple onshore and offshore basins were offered under DSF-3 bidding. These policies have interested many new players forming a base for the potential expansion of the company’s clientele.